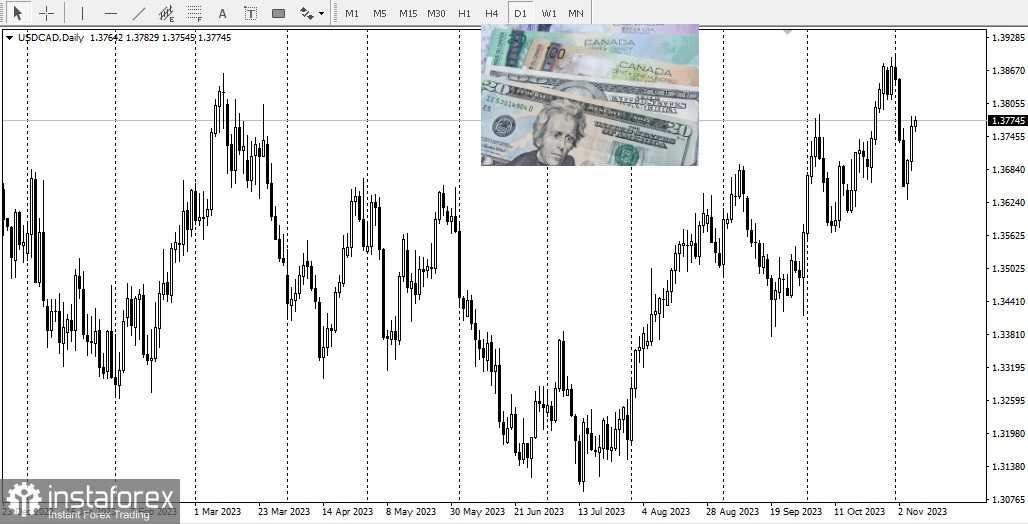

The drop in crude oil prices fueled the decline of the Canadian dollar. At the same time, dollar continues to recover after the negative news released last Friday.

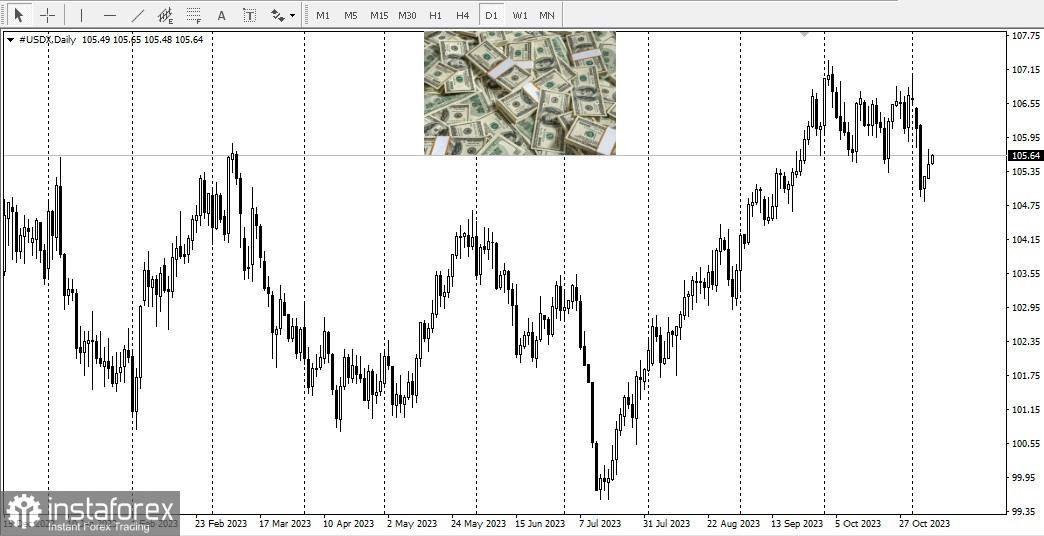

Recent sharp declines in US Treasury bond yields and the prolonged rally in the stock markets have been key factors acting as hurdles for dollar. In fact, the released October data on US employment, which turned out weaker than expected, confirmed the market's view that the rate hike cycle will come to an end.

However, a greater number of FOMC members acknowledged the economic resilience of the region, hinting at further rate increases. Accordingly, many await the speech of Fed Chairman Jerome Powell, particularly on what he will say about the monetary policy. A cautious tone will stimulate dollar demand, providing new impetus to the USD/CAD pair

In the absence of any significant market-moving economic news from either the US or Canada, traders could rely on the dynamics of oil prices to seize short-term opportunities. However, recent news seems to favor the bulls and support the prospects of positive momentum.