In my morning forecast, I pointed out the level of 1.0667 and recommended making entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The decline to around 1.0667 did occur, but there was no false breakout, so there were no suitable entry points. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

Everything will depend on the comments made by Federal Reserve Chairman Jerome Powell. If, for some reason, he suddenly abandons hints of ending the tight monetary policy at the end of this year and sides with those who are concerned about inflation and expect it to rise at the end of the year, all of this will lead to further selling of the European currency and a rise in the US dollar. If the rhetoric remains soft, as it was after the November 1st FOMC meeting this year, then we can expect a bullish scenario to develop. I will act according to the morning plan since I see no need to change the technical picture. In the event of a negative market reaction to Powell's speech, buyers will have to show themselves in the area of new support at 1.0667. Only the formation of a false breakout there will provide a good entry point for long positions, with the expectation of further development of an upward trend and a test of the 1.0703 resistance level, formed based on yesterday's performance, where, among other things, the moving averages are also aligned, favoring sellers. A breakthrough and update of this range from top to bottom will give a chance for a jump to 1.0729. The furthest target will be the 1.0753 area, where I will take a profit. In the case of a decline in EUR/USD and the absence of activity at 1.0667 in the second half of the day, bears can significantly gain control of the market, which will strengthen the downward correction and lead to a larger downward movement towards 1.0642. Only the formation of a false breakout will signal an entry into the market. I will open long positions only on a rebound from 1.0616, with a target of an upward correction within the day of 30-35 points.

To open short positions on EUR/USD, the following is required:

Sellers continue to attempt to take full control of the market. Unfortunately, a selling entry point from 1.0700 was not available, but bears are confidently storming 1.0667. Certainly, the euro may react well to Powell's speech today, so active defense of the nearest resistance at 1.0695, where the moving averages are located, is a priority task. A false breakout at this level will provide a good selling signal, continuing the downward correction towards the 1.0667 support formed based on yesterday's performance. A retest of this level with a close below it will provide another selling signal with an exit towards 1.0642. The furthest target will be the minimum of 1.0616, where I will take a profit. In the case of an upward movement of EUR/USD during the American session and the absence of bears at 1.0695, buyers will return to the market and attempt to reach the maximum of 1.0723. It is possible to sell there, but only after an unsuccessful consolidation. I will open short positions immediately on a rebound from the monthly maximum of 1.0753, with the target of a downward correction within the day of 30-35 points.

Indicator Signals:

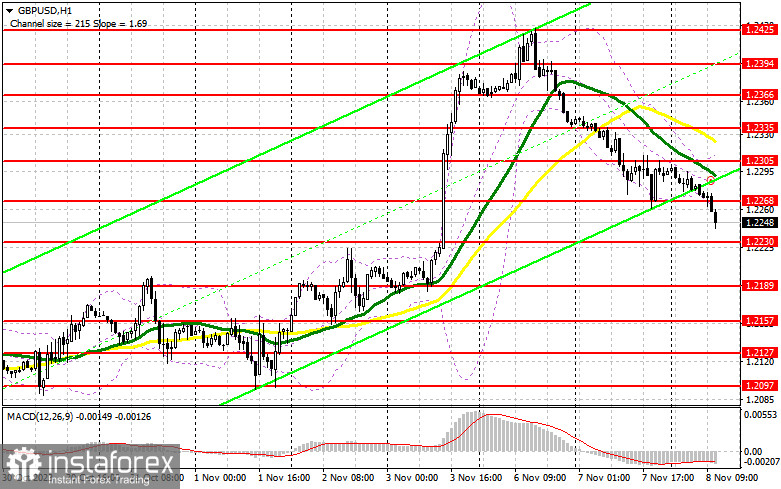

Moving Averages:

Trading is below the 30 and 50-day moving averages, which suggests the possibility of further euro decline.

Note: The author examines the period and prices of moving averages on the hourly chart H1, which differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decrease, the lower boundary of the indicator at around 1.0675 will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

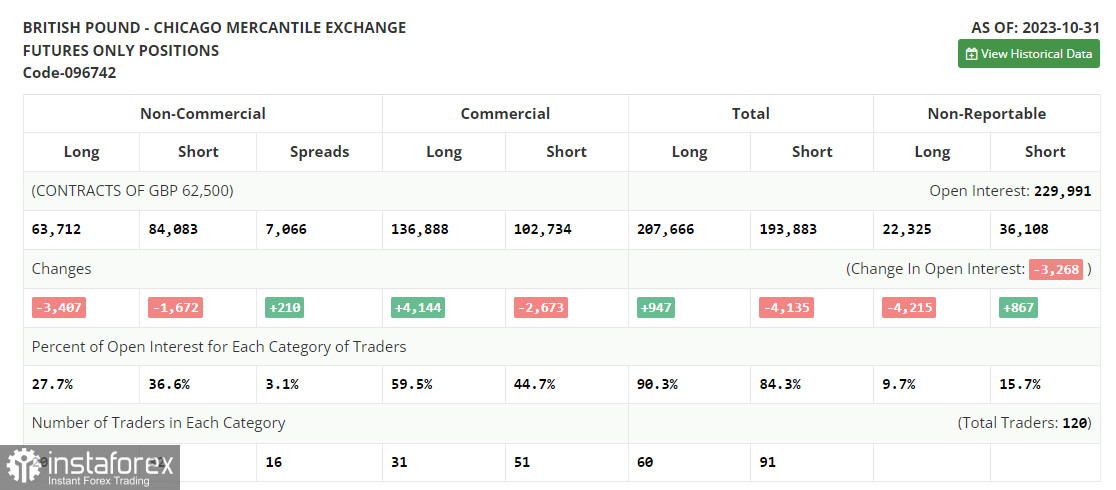

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes, subject to specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The net non-commercial position is the difference between short and long positions of non-commercial traders.