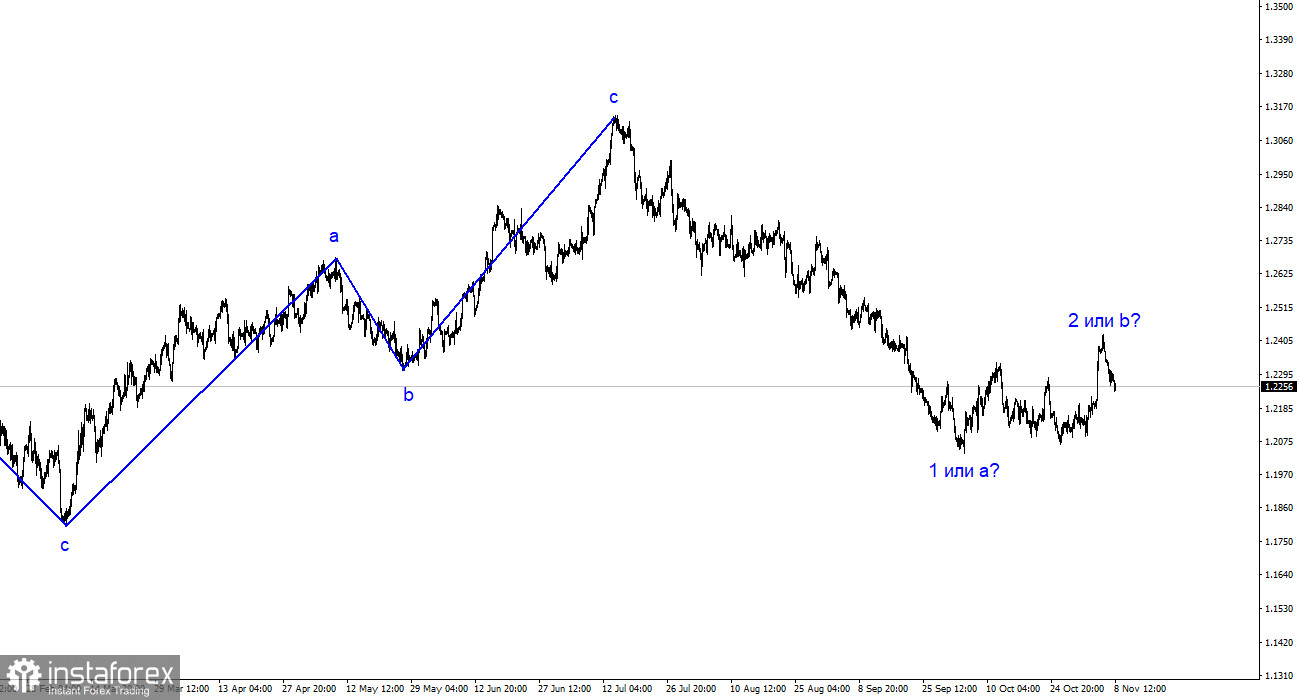

For the pound/dollar pair, the wave analysis remains fairly simple and clear. The construction of a new downward trend segment continues, with the first wave taking on a relatively extended form. In my view, there is no basis for the British currency to resume an upward trend segment, so I do not even consider such a scenario. The presumed wave 1 or a is complete. The euro wave 2 or b currently exhibits a five-wave structure, while the pound has taken on a three-wave form. Thus, both pairs' wave analysis suggests a potential resumption of the decline. This is what I have been waiting for. Regarding the pound, wave 2 or b should have taken on a minimum three-wave form.

Despite the Pound being on the verge of abandoning the scenario with the construction of wave 2 or b for two weeks, the wave pattern now looks good and convincing. Therefore, a decrease in quotes may begin in the near future, or it may have already started. The presumed wave 3 or c could be quite extensive. The 17–18 levels are its minimum target.

The Chief Economist of the Bank of England disappointed the markets.

The exchange rate of the pound/dollar pair fell by another 40 basis points on Wednesday. The current wave analysis indicates such a movement, and the weak news background fully justifies the pair's low amplitude. However, it's not just the wave analysis favoring a decrease in demand for the pound. On Tuesday, the Bank of England's Chief Economist, Hugh Pill, suggested that the interest rate may be lowered in the first half of next year. Markets probably did not receive this news with enthusiasm, as it's a bearish factor for the pound. Today, Bank of England Governor Andrew Bailey gave a speech, and he did not refute Pill's words. The market expected that monetary policy might be eased next year, as the Federal Reserve and the European Central Bank are also signaling such a scenario. In this scenario, there is nothing strange except for one small detail.

The Bank of England still expects inflation to slow down to 5% by the end of this year. What if it does not decrease to that extent? In the last two months, the consumer price index has hardly slowed down, currently standing at 6.7% YoY. Therefore, for October, November, and December, inflation should decrease by 1.7% in annual terms. And wage growth remains nearly at its maximum, which complicates the process of slowing down price growth. I doubt that the 5% target is achievable by the end of the year, but in any case, the discussion is now about a rate cut, not an increase. In the last two Bank of England meetings, it decided not to raise the rate, which could be the beginning of a dovish scenario that might last a couple of years. Based on all of the above, I believe that demand for the pound will continue to decline.

General Conclusions:

The wave pattern of the pound/dollar pair suggests a decline within the framework of the downward trend segment. The maximum the pound can hope for is a correction. At this point, I can already recommend selling the pair with targets below the 1.2068 level, as wave 2 or b has ultimately taken on a convincing form and is likely complete. Initially, sales should not be significant, as there is always a risk of complicating the existing wave.

On a larger wave scale, the picture is similar to the euro/dollar pair, but there are still some differences. The downward correctional segment of the trend continues its construction, and its first wave has already taken on an extended form and is clearly unrelated to the previous upward trend segment.