EUR/USD

Higher Timeframes

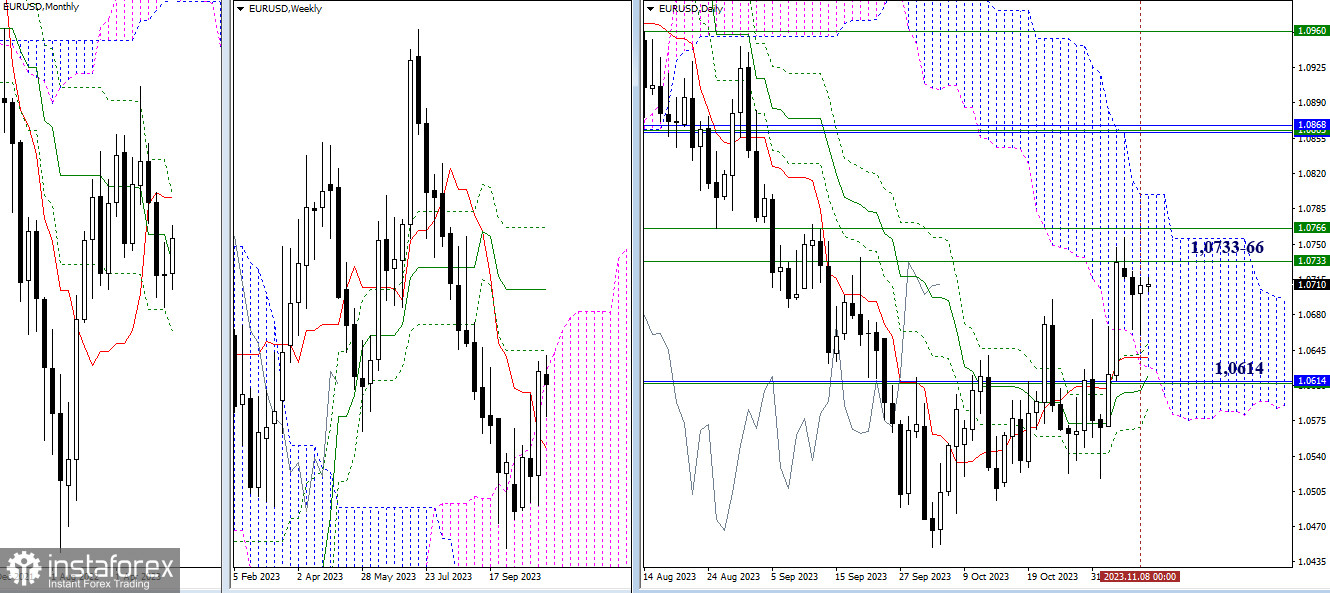

Yesterday brought no changes. The market remained within the range of the previous day, failing to achieve any significant changes or new results in its movement. Therefore, the main conclusions and expectations voiced earlier remain relevant today. For bullish traders, the weekly resistances at 1.0733 – 1.0766 are crucial in the near term. For bears, the current tasks involve testing the supports of the golden cross of the daily Ichimoku cloud (1.0638 – 1.0620 – 1.0588), reinforced by the area at 1.0614 (weekly short-term trend + monthly medium-term trend).

H4 – H1

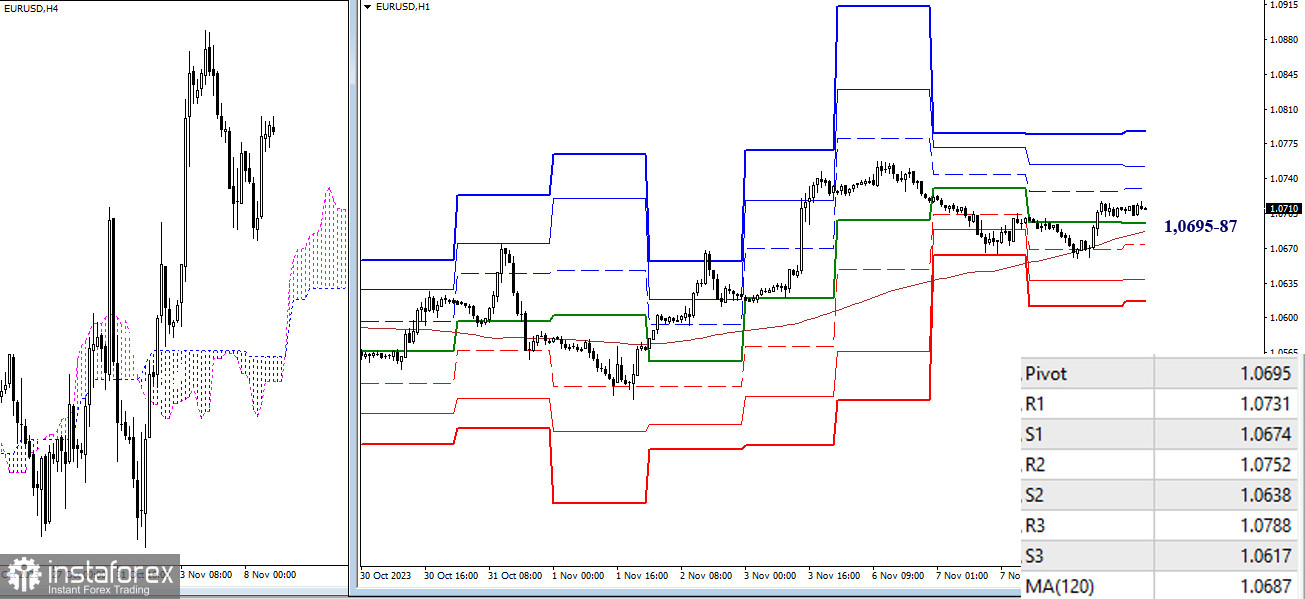

On the lower timeframes, the bulls continue to maintain an advantage, trading above key levels that are currently joining forces in a relatively narrow range of 1.0695–87 (central pivot point + weekly long-term trend). To strengthen bullish sentiments within the day, there are resistances of classic pivot points, which can now be noted at 1.0731 – 1.0752 – 1.0788, coinciding with the weekly resistances. Therefore, breaking through this area may open up new prospects not only on lower timeframes but also on higher ones. Consolidation below key levels will pave the way for supports of classic pivot points (1.0674 – 1.0638 – 1.0617).

***

GBP/USD

Higher Timeframes

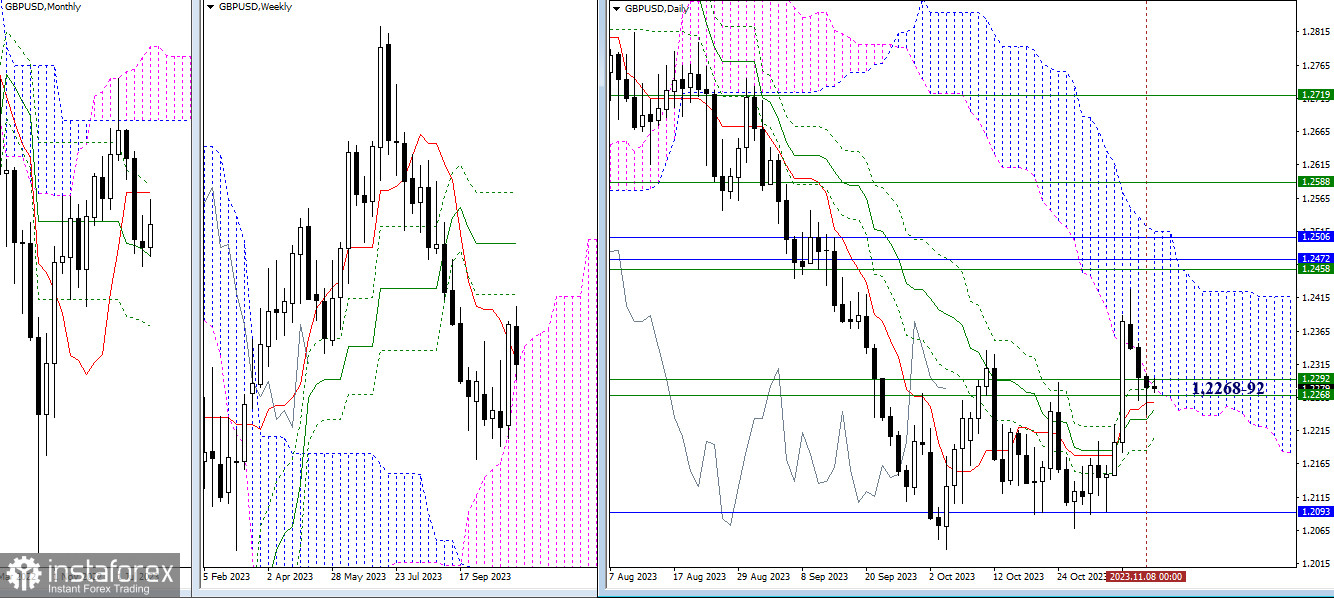

The downward trend was maintained yesterday as bears continued to test the accumulated supports. The support zone on this part of the chart combines daily (1.2277 – 1.2258 – 1.2248 – 1.2205) and weekly (1.2268 – 1.2292) levels. A breakdown and a secure consolidation below will allow bears to set new and more global targets, such as restoring the weekly downward trend (1.2036). A confirmed rebound and active recovery of positions will redirect attention to the fortified resistance zone at 1.2458 – 1.2472 – 1.2506 (monthly levels + weekly Fibonacci Kijun).

H4 – H1

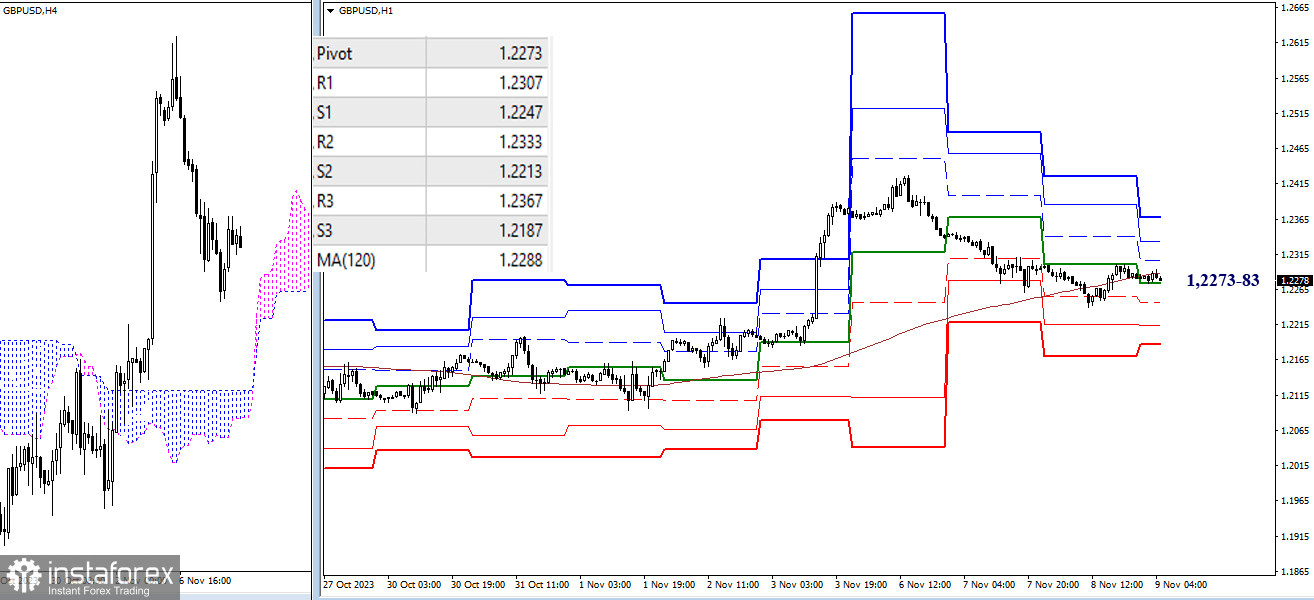

The key levels today have practically merged in the region of 1.2273 – 1.2283 (central pivot point of the day + weekly long-term trend), and the market has been in their zone of attraction and influence for quite a while, indicating uncertainty. In the case of directional movement development, the path for bulls within the day will lie through the resistances of classic pivot points (1.2307 – 1.2333 – 1.2367), while potential strengthening of bearish sentiments today may rely on the supports of classic pivot points (1.2247 – 1.2213 – 1.2187).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)