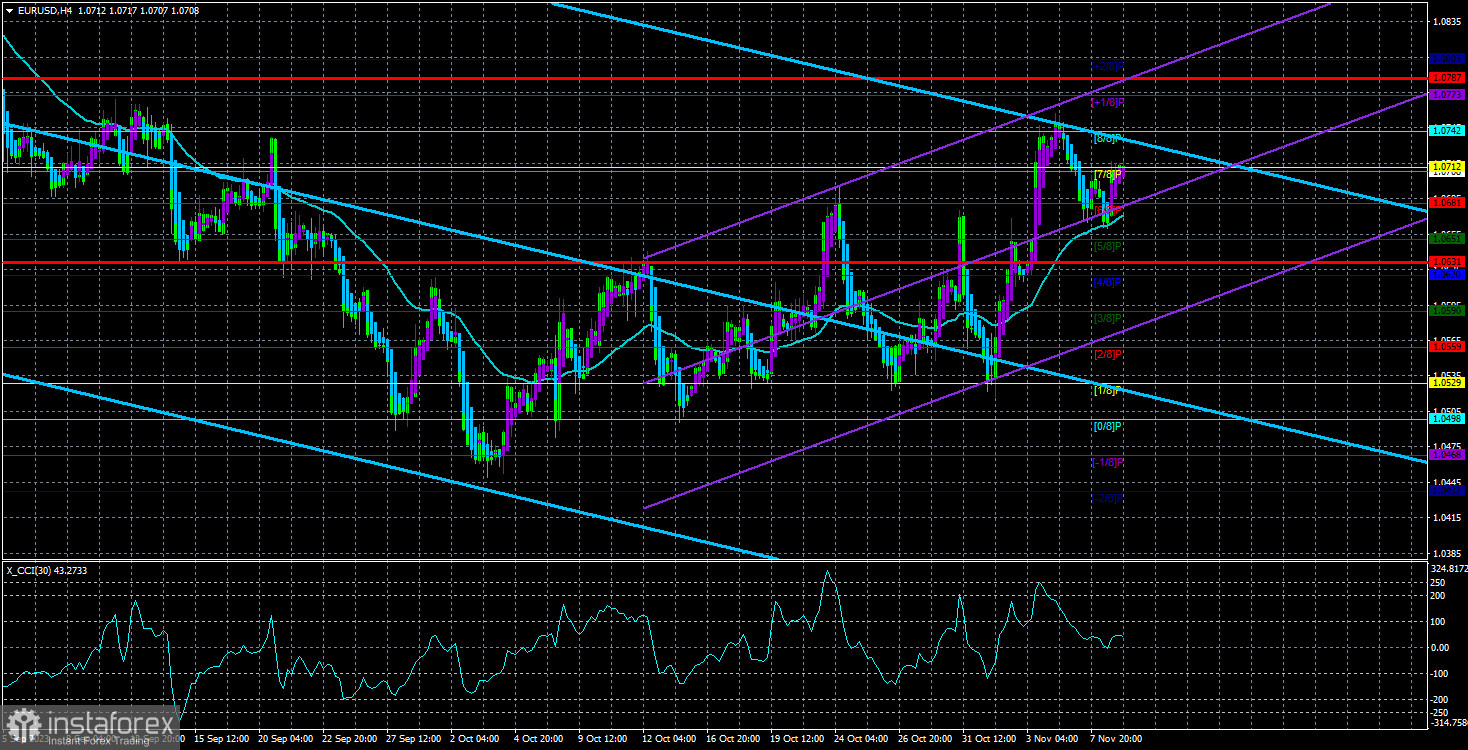

Throughout Wednesday, the EUR/USD currency pair worked with the moving average line but failed to overcome it. It bounced off and is maintaining a corrective trend. In principle, we did not see any interesting or strong movements yesterday. Volatility was weak again, the macroeconomic background was weak, and the fundamental background was completely absent. From the reports, only retail sales in the European Union stood out, which predictably turned out to be below forecasts, and that's about it. Also, the speech of the head of the Federal Reserve, Jerome Powell, was supposed to take place, but in his speech, Mr. Powell did not touch on the topics of inflation or monetary policy. Therefore, traders simply had nothing to react to throughout the day.

Despite the fact that the correction is ongoing while we expect a resumption of the medium-term downtrend, we do not think that anything is going awry. It should be understood that the pair may continue to correct for several months. During this time, the price may well remain in a limited price range, i.e., in a flat. Therefore, we cannot accurately say when the trend will resume. But based on the current fundamental background and technical analysis, it should resume. Remember that the CCI indicator entered the overbought zone twice. And two such entries during corrections mean that the correction will soon be completed.

On the 24-hour chart, the pair entered the Ichimoku cloud but has already worked out its upper boundary, Senkou Span B. Therefore, we can expect a rebound and a resumption of the decline. Perhaps the market will try again to push the pair a little higher, but until the price is firmly above the Ichimoku cloud, the main option remains the decline of the euro currency. It is also necessary to be cautious: if the price stays in the same area for a long time, it will sooner or later leave the Ichimoku cloud. But such a signal in a flat will not be considered a signal for further upward movement.

With the ECB, everything is clear; there are questions for the Fed. Yesterday, we already mentioned that the Federal Reserve has, in recent months, seemed unable to decide what to do next with the key rate. First, the Federal Open Market Committee expressed support for keeping the rate at the current level, although inflation began to rise in the United States three months ago. And now, when reasonable questions arise to the regulator, some of its representatives again begin to talk about raising the rate. Perhaps the American regulator did not expect a sharp rise in inflation to 3.7%, but that's why it is a regulator: it should be aware of everything happening in the economy and be able to predict specific macroeconomic indicators. In practice, however, it turns out that first, "we no longer need to raise the rate," and a little later, "it seems we still need to raise the rate once." However, we have repeatedly said that we do not consider the tightening cycle in the United States complete.

With the ECB, everything is much simpler and more prosaic. At the moment, no one expects the European regulator to raise the rate, and no one from the ECB's monetary committee talks about the need to raise it. Yes, some officials admit that there may be a situation where additional tightening is needed. But if we talk about reality in the near future, we do not see any signs that the ECB will raise the rate again. Inflation will continue to decline slowly, as even the IMF says. All central banks do not expect a quick return to 2%, even with maximum rates. Therefore, in any case, achieving the target is postponed to 2025. The only question is whether inflation around the world will start rising again.

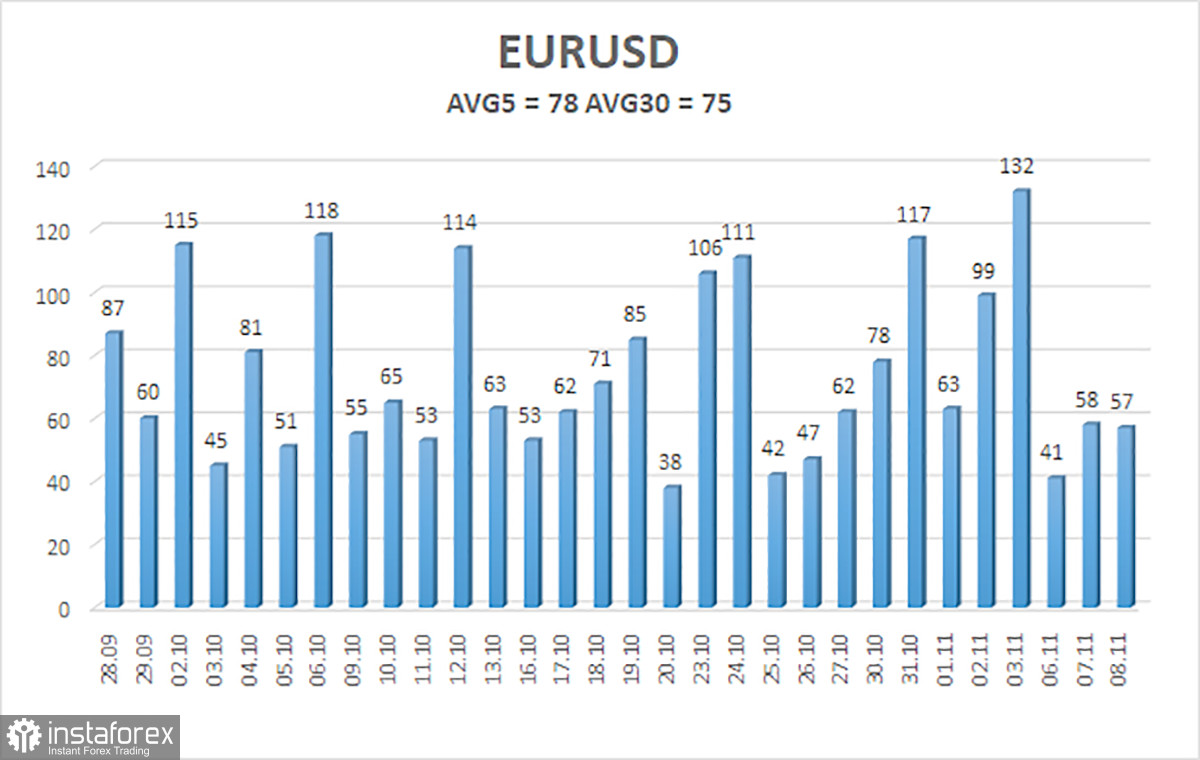

The average volatility of the euro/dollar currency pair for the last 5 trading days as of November 9 is 78 points and is characterized as "average". Thus, we expect the pair to move between the levels of 1.0631 and 1.0787 on Thursday. A reversal of the Heiken Ashi indicator will indicate a new attempt to resume the downtrend.

Nearest support levels:

S1 – 1.0681

S2 – 1.0651

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0712

R2 – 1.0742

R3 – 1.0773

Trading recommendations:

The EUR/USD pair continues to change direction almost every day. Therefore, relying on moving averages at the moment is a futile endeavor. On Friday, we saw strong growth, but it is unlikely that the upward movement will continue. The growth was shown exclusively due to a strong background, which is not often the case. We believe that from the current positions, it is advisable to consider sales, but it should be understood that the "swings" may continue. Friday did not fundamentally change the nature of the pair's movement.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are pointing in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal towards the opposite direction is approaching.