The dollar started to actively lose ground after the opening of the US session, despite the disappointing eurozone retail sales data. And there were no other reports or news. However, it is worth paying attention to the debt market. The yield on the 10-year Treasury fell from 4.610% to 4.519%. Which is quite a significant drop. And this is somewhat indicative of investor sentiment. They clearly assume that in the near future the Federal Reserve will begin to soften its monetary policy. And by the looks of it, no one believes in another interest rate hike.

The dollar could therefore weaken further. And it is not about the applications for unemployment benefits, the total number of which may increase by 7,000. The changes are quite insignificant to affect the market. It is more on how the 30-year bonds will quite cope with this task. And it is quite possible that their yields will also fall significantly. And these are much more important than any others.

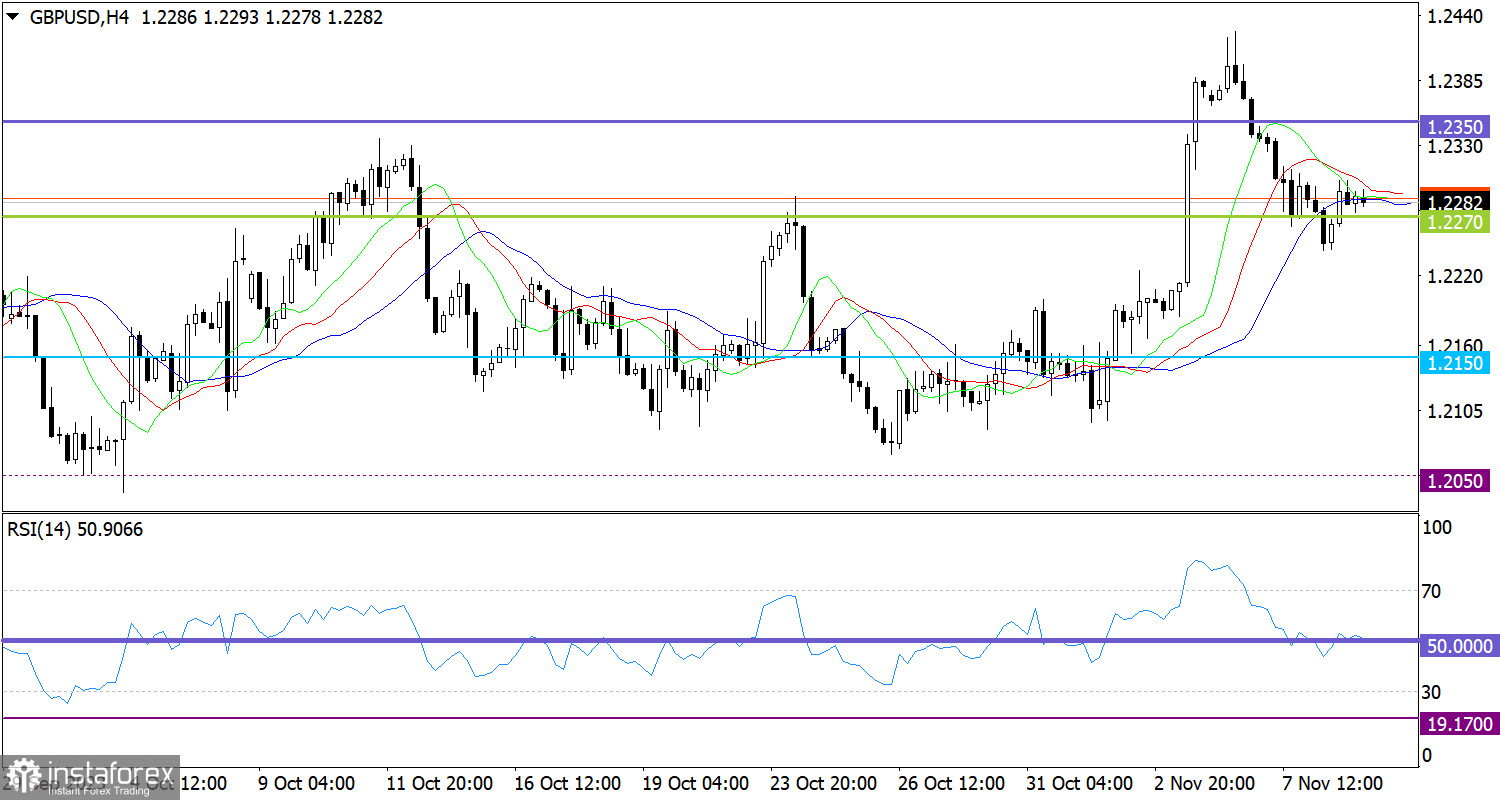

The GBP/USD pair partially recovered its positions relative to the recent decline. As a result, the quote returned above the mark 1.2270, while the general downtrend remains intact.

On the four-hour chart, the RSI is moving along the 50 middle line. This technical signal indicates stagnation, however, if the indicator settles below the midline, this will signal an increase in the volume of short positions on the pound sterling.

The Alligator Indicator on the same time frame has some intersections between the MAs, meaning that the upward cycle is slowing down. This could also indicate a change in sentiment.

Outlook

In order to fuel the downward movement, the price must stay below the level of 1.2270. In this case, it could move towards 1.2200.

The bullish scenario will come into play if the 1.2270 area acts as a support, and the quote will rise above 1.2300.

In terms of the complex indicator analysis, we see that in the short-term period, technical indicators are pointing to the recovery process in the pound. Meanwhile, in the intraday period, the indicators are providing a downward signal.