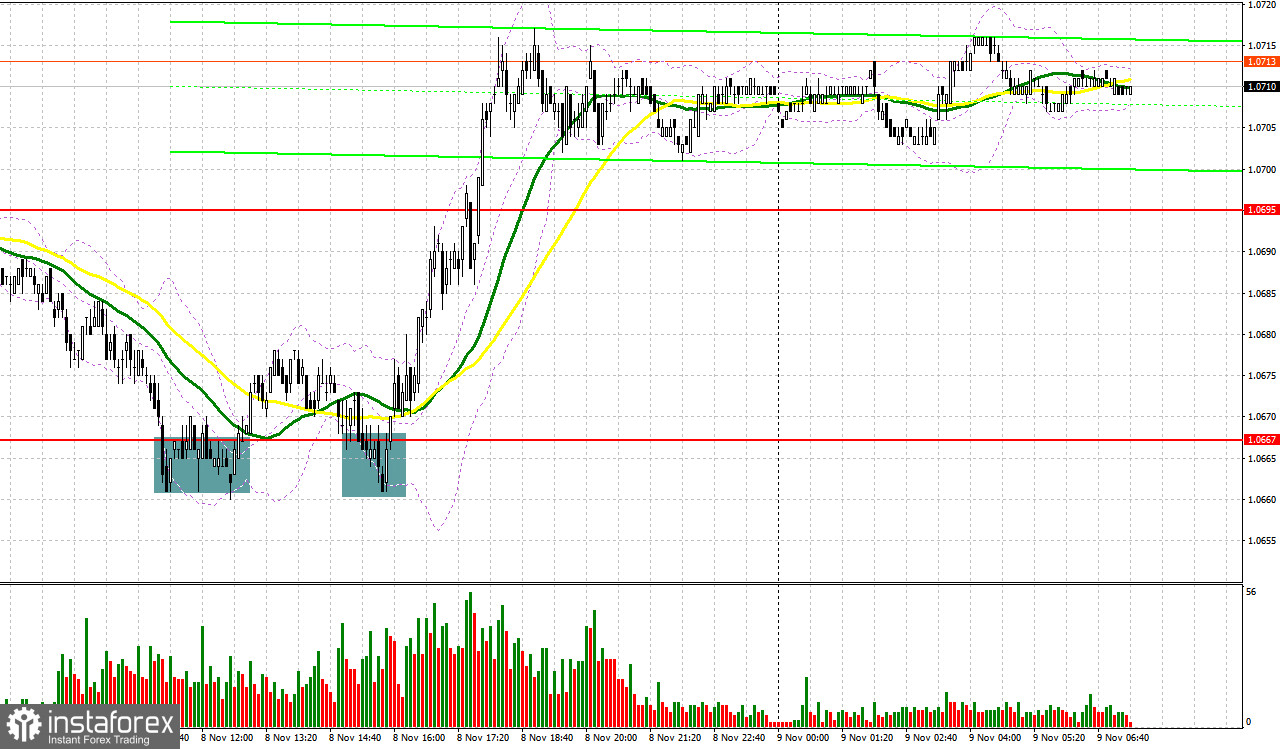

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0667 as a possible entry point. The price fell to 1.0667, but that was only worth around 10 pips. In the afternoon, a similar entry point from 1.0667 brought a profit of 30 pips.

For long positions on EUR/USD:

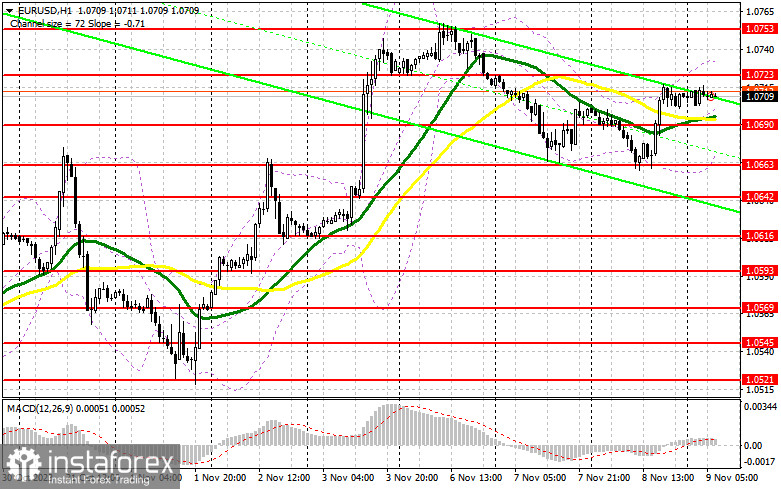

Yesterday, Federal Reserve Chairman Jerome Powell's speech boosted risk assets, including the euro, as he did not mention anything about the central bank's monetary policy, which was interpreted in favor of a softer approach that Powell took after the Fed meeting's on November 1. Today, the eurozone will not release any economic reports and only the European Central Bank's economic bulletin will be released. We don't expect the market to react to this, so traders may keep an eye on ECB President Christine Lagarde's speech, as well as other members of the Governing Council. In case the remarks exert pressure on the pair, the bulls will have to be active near the new support at 1.0690, which is in line with the bullish moving averages. A false breakout on this mark will confirm a correct entry point for long positions, in hopes of building an uptrend and testing the resistance at 1.0723, which was formed yesterday. A breakout and a downward test of this range will give the euro a chance to surge to 1.0753. The ultimate target will be the area of 1.0774 where I will be taking profits. If EUR/USD declines and there is no activity at 1.0690, the pair will be stuck in a new sideways channel, which will strengthen the bearish correction and may even push the pair down to 1.0663. In such a case, only a false breakout on this mark will provide a buy signal. I will be opening long positions on a rebound immediately from 1.0642 with the goal of an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

The sellers did their best yesterday, but despite the growth, the euro still has a chance of falling further. Now the objective is to defend the nearest resistance at 1.0723 to support the bearish movement. A false breakout at this mark, along with soft statements from the ECB officials, will give a good sell signal to continue the downward correction to the support at 1.0690, which was formed yesterday. Only after a breakout and consolidation below this range, as well as its upward retest, do I expect to receive another signal to sell the pair with a target at 1.0663. The ultimate target will be the 1.0642 low where I will be taking profits. In the event of an upward movement in EUR/USD during the European session and the absence of bears at 1.0723, bulls will return to the market and try to reach the 1.0753 high. It is also possible to sell at this point but only after a failed consolidation. I will be opening short positions immediately on a rebound from the monthly high of 1.0774 with the aim of a downward correction of 30-35 pips.

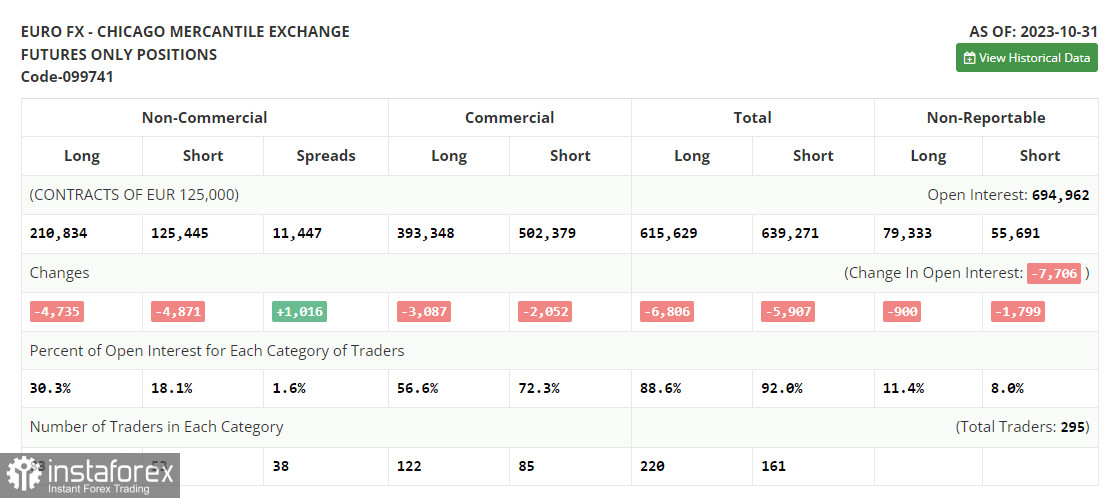

COT report:

The COT report for October 31 showed a reduction in both long and short positions. This positioning was ahead of the crucial meeting of the US Federal Reserve, where the regulator decided to maintain its policy unchanged. However, weaker US labor market data, indicating less robust growth in new jobs, likely led to a more significant realignment of forces, unfortunately not yet reflected in this report. This type of statistics reinforces the idea among investors that the Fed will no longer raise interest rates and that the aggressive policy could be concluded as early as the beginning of next summer. This will continue to put pressure on the US dollar and lead to the strengthening of risk assets. According to the latest COT report, non-commercial long positions decreased by 4,735 to 210,834, while non-commercial short positions fell by 4,871 to stand at 125,445. As a result, the spread between long and short positions increased by 1,016. The closing price went down to 1.0603 from 1.0613.

Indicator signals:

Moving averages:

Trading around the 30- and 50-day moving averages indicates market uncertainty.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0663 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.