Bank of Japan Governor Kazuo Ueda slightly lowered expectations for an overnight yen reversal, stating that the central bank will stick to an accommodative policy until its inflation target can be sustainably achieved. He added that the order of the process of normalizing control over the yield curve and negative interest rate policy has not yet been determined. Consequently, we should assume that the Bank is not in a rush to resolve this matter.

Oil fell below $80 per barrel. Since there was no oil-related news, this is likely a signal that global growth is slowing, leading to a decrease in demand for oil. Typically, simultaneous declines in U.S. bond yields and oil prices lead to an increase in demand for safe-haven assets, primarily the yen. Therefore, it is possible that the USD/JPY pair will fall from its current levels, despite Ueda's cautious comment.

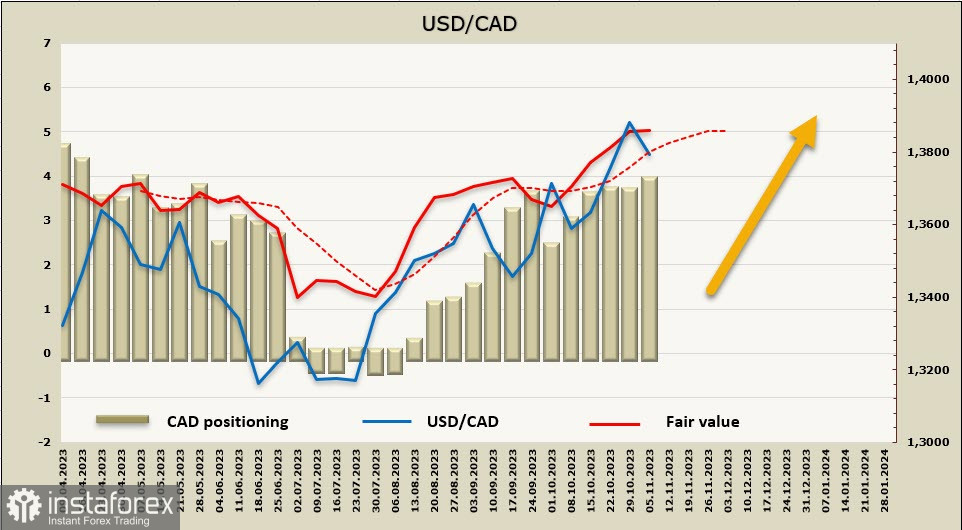

USD/CAD

After the release of the employment report, which generally met expectations, markets lean towards the Bank of Canada starting rate cuts in June. There is also an increased probability that the first quarter point rate cut could occur as early as April. The yield on 5-year Canadian government bonds recently fell by more than 60 pts, reaching the lowest level since the beginning of this summer.

In the spring of this year, the Bank of Canada attempted to pause its rate-hike cycle, resulting in a sharp rise in housing prices and, consequently, increased inflationary risks. This forced the central bank to resume rate hikes in June and July. Currently, markets anticipate a second attempt amid slowing GDP growth, which, in theory, should lead to a reduction in inflation.

The minutes of the Bank of Canada's meeting on October 25 contained calls for another rate hike due to the lack of downward momentum in core inflation. This signals that the loonie's decline may come to an end in the near future.

It is unlikely for USD/CAD to exhibit sharp growth under current conditions. The US keeps releasing reports that suggest a sharp slowdown in the economy in Q4. The FOMC is also unlikely to raise the rate again. Altogether, these factors will mount pressure on the USD. At the same time, higher inflationary risks in Canada and a weaker USD could trigger a stock market rally by the end of the year, which typically supports the loonie against the greenback.

The net short CAD position has slightly increased (-16 million) to -3.555 billion, and speculative positioning remains firmly bearish. The price is above the long-term average, and the momentum is weak.

After a shallow correction, USD/CAD is resuming its uptrend. The nearest target is 1.3897, followed by 1.3997, and there are no reasons to expect a decline for now.

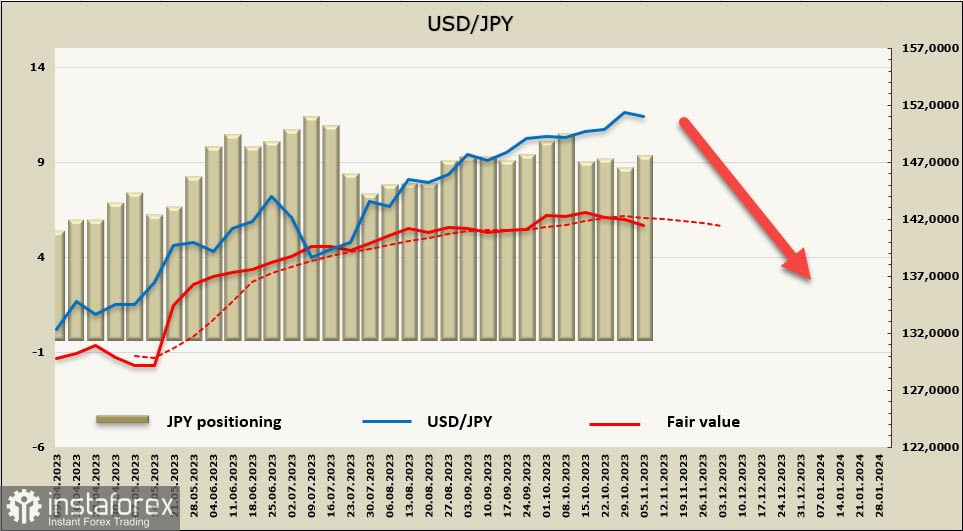

USD/JPY

Markets are increasingly interpreting the modification of the yield curve control (YCC) policy as defining the 1% boundary as a reference point rather than a rigid constraint, marking it as the last step before the complete dismantling of YCC. However, the BOJ still requires confirmation that inflation has stably exceeded the 2% target before it is ready to take more serious steps. They gradually realize that higher inflation is not a temporary phenomenon and have significantly raised their inflation forecast for the fiscal year 2024 from 1.9% to 2.8%.

Ueda suggested a low probability of ending negative rates this year. Accordingly, surprises are not expected from this side. He also mentioned that the Bank is monitoring wage negotiations next year, suggesting that more significant policy changes are unlikely until these results are known. Nominal cash earnings for workers rose 1.2% from the previous year, accelerating from a revised 0.8% increase in August, indicating a trend towards growth.

The net short JPY position increased by 251 million to -8.558 billion over the reporting week, and speculative positioning remains firmly bearish. At the same time, the price has moved below the long-term average and is pointing downwards, signaling the market's readiness for a reversal or a deep correction.

The primary driving force behind the dollar's rise is the difference in monetary policy, which has led to a significant gap in yields. This process is nearing completion - the Federal Reserve is concluding its rate hike cycle, and the BOJ is preparing to abandon yield curve control policies. We can't expect an immediate reversal, but the trend is pointing in that direction. It is still possible for the pair to test the resistance at 151.96, but with each passing day, this probability diminishes rather than increases. This is because a weaker yen serves as a channel for exporting external inflation to Japan due to the rising cost of imports. We expect a retracement to the middle of the channel at 146.10/40, which could be triggered by the government's currency intervention or comments from BOJ officials.