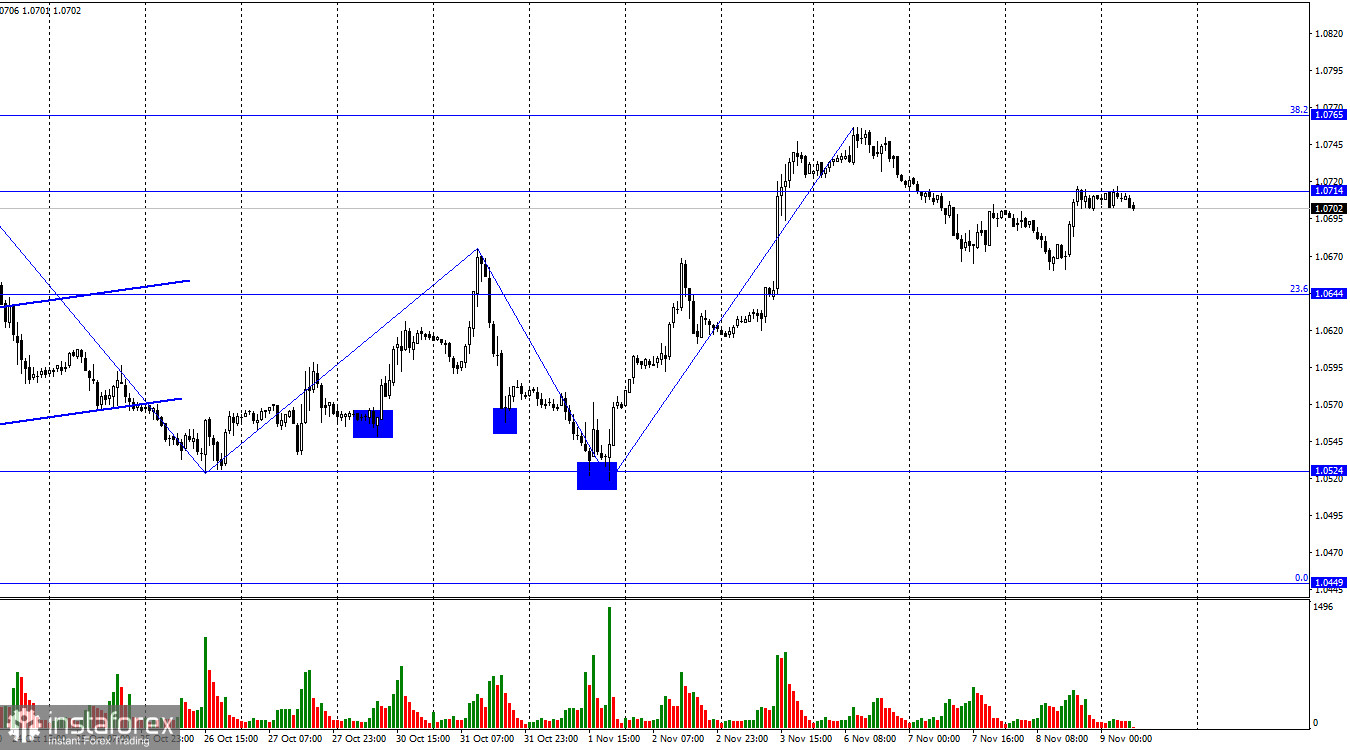

The EUR/USD pair made a reversal in favor of the European currency on Wednesday and returned to the level of 1.0714. A bounce of quotes from this level will work in favor of the US currency and resume the decline towards the corrective level of 23.6% (1.0644). Closing the pair's rate above the level of 1.0714 will allow traders to count on a new rise towards the Fibonacci level of 38.2% (1.0765). For me, the main scenario remains a decline.

The wave situation continues to remain ambiguous. In recent weeks, we have observed horizontal movement with some reservations. Waves often alternate without forming even short-term trends. The last upward wave is independent. It broke the peak of all previous waves in the last month. In order for us to consider the pair's movement as a "bearish" trend, the next upward wave should not break the peak from November 6. And a new downward wave should break the low of yesterday. But even in this case, one can initially expect a decline only to the level of 1.0524.

Yesterday in the European Union, a report on retail trade was released, the volumes of which decreased by 0.3% in September. Traders expected a higher value. There was also a speech by one of the members of the ECB Governing Council, Madis Muller, who stated that a military conflict in the Middle East could cause a new rise in energy prices, which is a factor in inflation growth. He also noted that one of the reasons for high inflation is the high growth rates of wages (the same problem as in the UK). Muller did not say a word about the interest rate or its change. I believe that the information background has not changed, and we can expect further declines in the European currency.

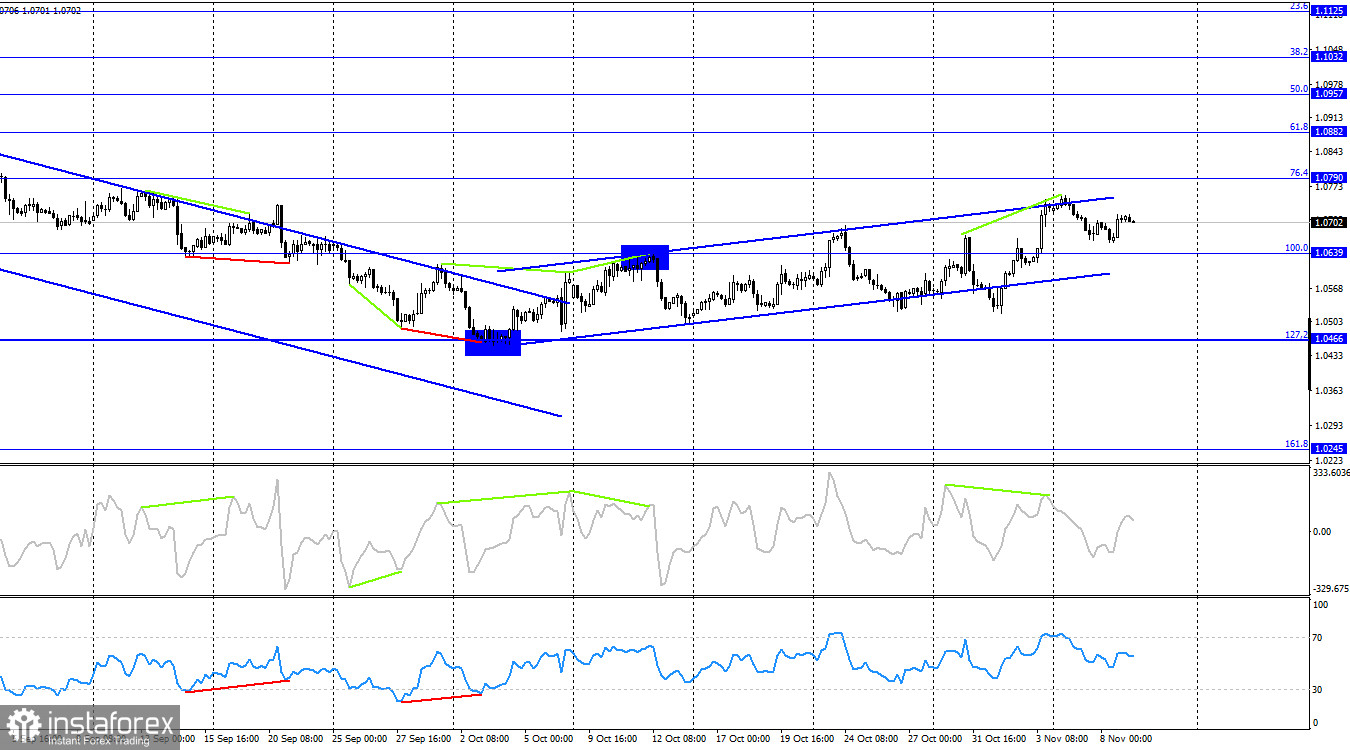

On the 4-hour chart, the pair made a reversal in favor of the European currency and a new consolidation above the corrective level of 100.0% (1.0639). However, the "bearish" divergence on the CCI indicator worked in favor of the US currency and started the decline towards the level of 1.0639. Closing the pair's rate below this level will allow for further decline towards the next Fibonacci level of 127.2% (1.0466). There are no new impending divergences at the moment.

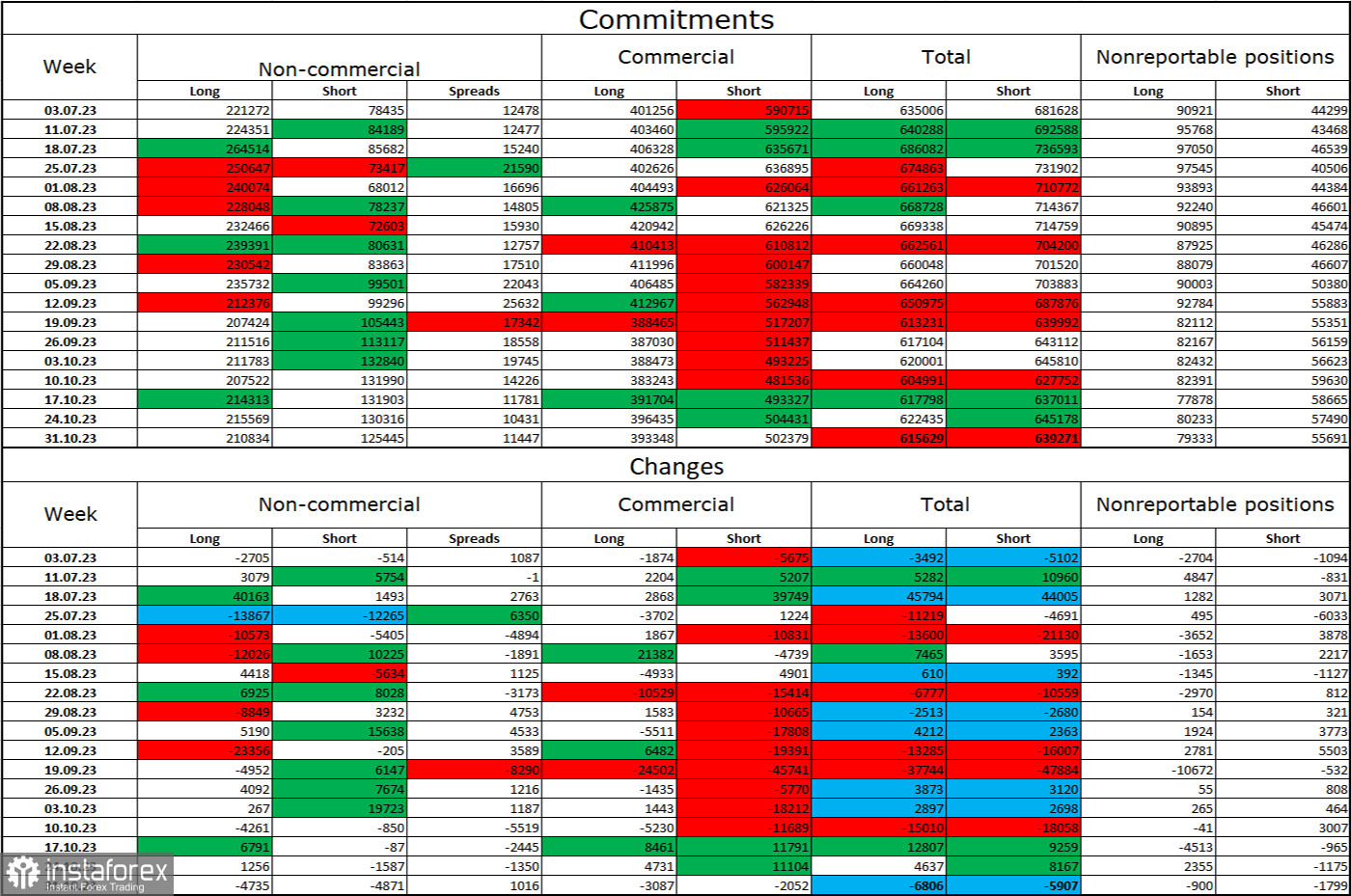

Commitments of Traders (COT) report:

In the last reporting week, speculators closed 4735 long contracts and 4871 short contracts. The sentiment of major traders remains "bullish" but has noticeably weakened in recent weeks and months. The total number of long contracts concentrated in the hands of speculators now amounts to 210,000, and short contracts amount to 125,000. The gap is already less than double, although a few months ago, it was triple. I think the situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need a strong information background to start a new "bullish" trend. There is no such background now. Professional traders may continue to close long positions in the near future. I believe that the current figures allow for a continuation of the decline of the euro in the coming months.

News Calendar for the US and the European Union:

US - Initial Jobless Claims (13:30 UTC).

European Union - Speech by ECB President Christine Lagarde (17:30 UTC).

US - Speech by the head of the Fed, Mr. Powell (19:00 UTC).

On November 9, the economic events calendar contains three entries, of which speeches by the heads of the Fed and the ECB stand out. The impact of the information background on traders' sentiment on Wednesday can be of moderate strength.

Forecast for EUR/USD and trader advice:

Purchases of the pair were possible on the hourly chart with a rebound from the level of 1.0524 and targets of 1.0644 and 1.0714. Both targets have been worked out. I do not advise considering new purchases for now. I recommended selling when consolidating below the level of 1.0714 with a target of 1.0644 and below. These trades can be kept open. Today, you can sell on a rebound from the level of 1.0714 with the same target.