Despite investors' concerns about currency interventions by the Bank of Japan, the USD/JPY pair finally broke the psychologically significant level of 150.00 last month. Moreover, at the end of last month, during the Bank of Japan's monetary policy meeting, USD/JPY successfully surpassed the 151.00 mark, falling just 30 points short of the 152.00 mark.

Economists believe that if the dollar does not start to decline in anticipation of the imminent conclusion of the Federal Reserve's tough monetary policy cycle, we may soon witness a test of the 152.00 mark, with the prospect of further growth.

In this regard, it will be interesting to hear the opinion of Federal Reserve Chairman Jerome Powell regarding the near-term prospects of the U.S. central bank's credit and monetary policy.

As known, during the meeting on October 31 to November 1, the Federal Reserve leaders left the key rate in the range of 5.25%–5.50%, justifying this decision with the need to combat inflation, which still significantly exceeds the 2% target. Subsequent statements by Powell were ambiguous.

"Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully," Powell said, adding that they "will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks." His position on the need for further tightening of monetary conditions was considered cautious by market participants, leading to a weakening of the dollar amid its sales and reduction of long positions last week.

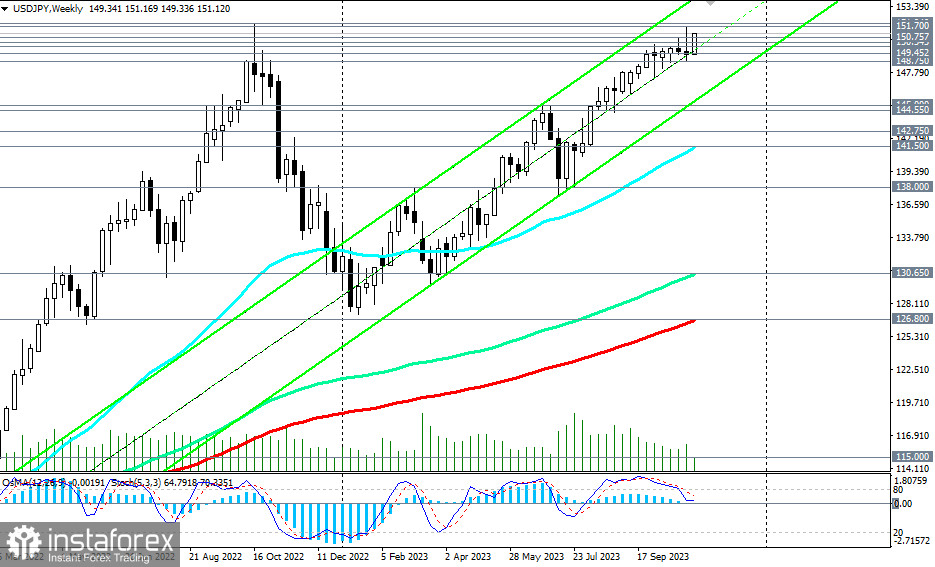

Nevertheless, USD/JPY maintains a positive dynamic, remaining in the area of a stable bullish market, short-term—above support levels of 150.35 (200 EMA on the 1-hour chart), 149.45 (200 EMA on the 4-hour chart), medium-term—above support levels of 144.55 (144 EMA on the daily chart), 142.75 (200 EMA on the daily chart), long-term—above support levels of 130.65 (144 EMA on the weekly chart), 126.80 (200 EMA on the weekly chart). A breakout of today's high at 151.17 may signal the opening of new long positions.

In an alternative scenario, the first signal to open short positions may be a breakdown of the local support level of 150.75 and the important short-term support level of 150.35 (200 EMA on the 1-hour chart).

If the downward correction does not stop near the support levels of 149.45 (200 EMA on the 4-hour chart), 148.75 (50 EMA on the daily chart), the decline may continue to the local support level of 145.00 and key support levels of 144.55, 143.00, 142.75.

Further decline will lead the pair into the medium-term bearish market zone (while maintaining the long-term and global bullish markets).

In the main scenario, we expect the continuation of the upward trend.

Support levels: 151.00, 150.75, 150.35, 150.00, 149.45, 149.00, 148.75, 148.00, 147.00, 146.00, 145.00, 144.55, 144.00, 143.00, 142.75, 141.50

Resistance levels: 151.70, 152.00, 153.00