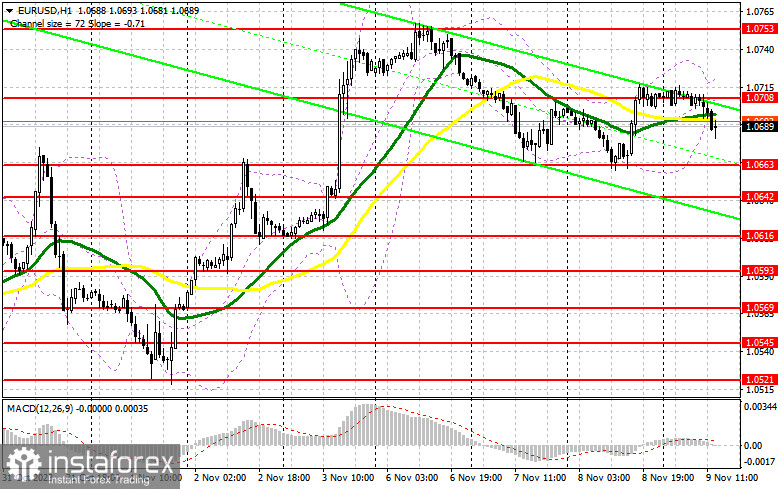

In my morning forecast, I drew attention to the level of 1.0690 and recommended making decisions on market entry based on it. Let's take a look at the 5-minute chart and figure out what happened there. The decline to the area of 1.0690 happened, but before the formation of a false breakout, it didn't go that far, so suitable entry points into the market were not formed. The technical picture was revised for the second half of the day.

To open long positions on EUR/USD, the following is required:

Ahead of us are data on the weekly number of initial jobless claims in the United States, as well as the next speeches by the chairman of the Federal Reserve, Jerome Powell, and his colleagues, members of the FOMC, Raphael Bostic and Thomas Barkin. Powell is unlikely to tell us anything new that he didn't say yesterday, so pressure on the European currency in the second half of the day may intensify after the speeches of other Fed representatives. In the event of a negative market reaction to the speeches, buyers will have to show themselves in the area of the new support at 1.0663. Only the formation of a false breakout there, similar to yesterday, will provide a good entry point for long positions with the expectation of building an upward trend and testing the resistance at 1.0708, formed at the end of yesterday. Breaking and updating this range from top to bottom will give a chance for a leap to 1.0753. The ultimate target will be the area of 1.0774, where I will make a profit. In the case of a further decline in EUR/USD and the absence of activity at 1.0663 in the second half of the day, bears can seriously take control of the market, which will strengthen the downward correction and lead to a larger downward movement to 1.0642. Only the formation of a false breakout will signal an entry into the market. I will open long positions only on a rebound from 1.0616, with the target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, the following is required:

Sellers continue their attempts to take full control of the market. Definitely, as yesterday, the euro can react well to Powell's speech today, so active defense of the nearest resistance at 1.0708, just below which the moving averages are located, is a priority task. The formation of a false breakout at this level will provide a good selling signal for the continuation of the downward correction to the support at 1.0663, formed at the end of yesterday. Testing this level with a consolidation below will allow for another selling signal with an exit to 1.0642. The ultimate target will be the minimum of 1.0616, where I will take a profit. In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.0708, buyers will return to the market and try to reach the weekly maximum of 1.0753. It is possible to sell there, but only after an unsuccessful consolidation. I will open short positions only on a rebound from the monthly maximum of 1.0774, with the target of a downward correction of 30-35 points.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating the possibility of a further decline in the euro.

Note: On the hourly chart H1, the author sets the period and prices for moving averages, which are different from the standard definition of traditional daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator will act as support in the area of 1.0690.

Description of indicators:

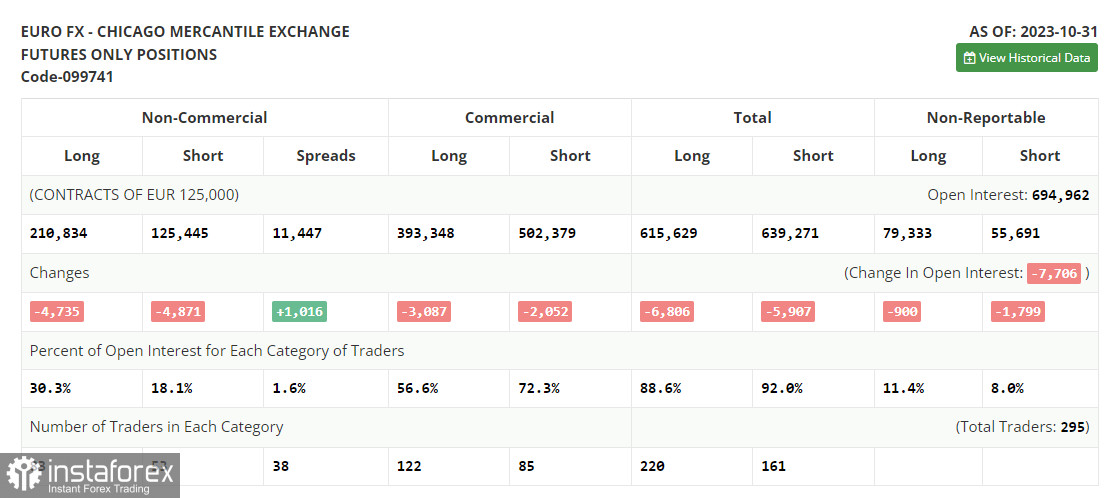

Moving average (MA) is an indicator of the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.Moving average (MA) is an indicator of the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9Bollinger Bands (Bollinger Bands). Period 20Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.Long non-commercial positions represent the total long open positions of non-commercial traders.Short non-commercial positions represent the total short open positions of non-commercial traders.The total non-commercial net position is the difference between short and long positions of non-commercial traders.