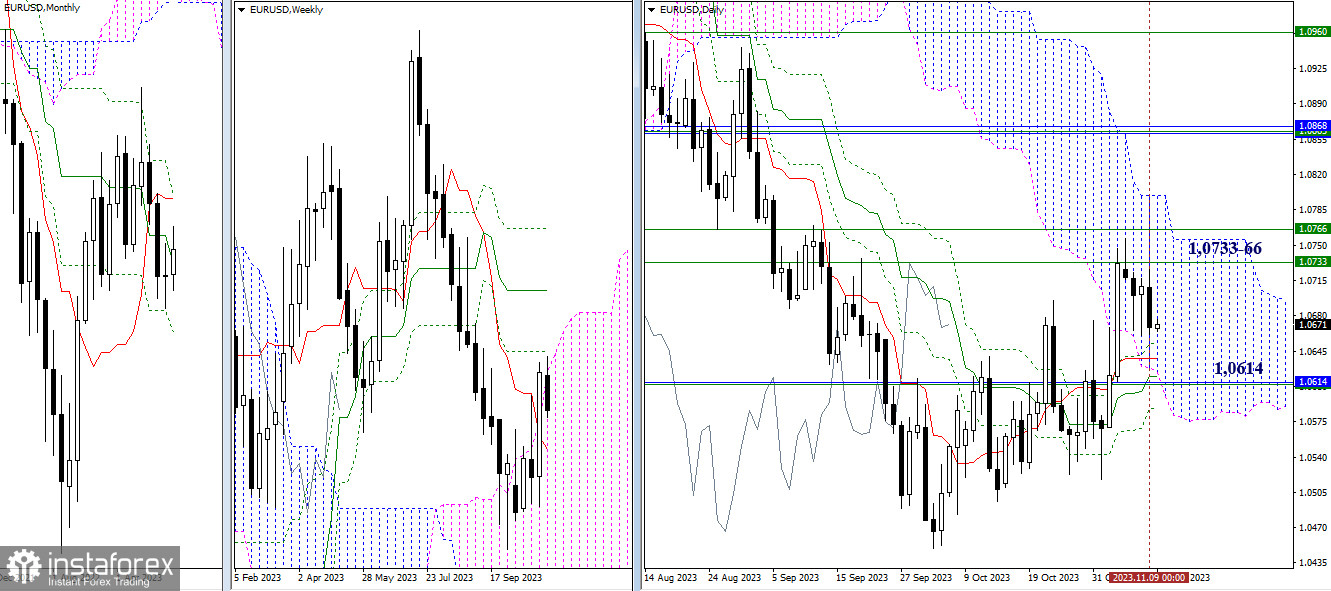

EUR/USD

Higher Timeframes

The past day has been bearish, but significant changes have not occurred as the pair continues to remain within the range of the previous days, forming consolidation. Today, we close the working week, and the result is of interest. If the bears manage to create a clear bearish sentiment in the weekly candlestick pattern, the euro's tasks will be aimed at breaking through the level of 1.0614 (weekly short-term trend + monthly medium-term trend) and eliminating the daily Ichimoku cross (1.0652 – 1.0638 – 1.0620 – 1.0588). For the bulls, the current situation still faces weekly resistances at 1.0733 – 1.0766.

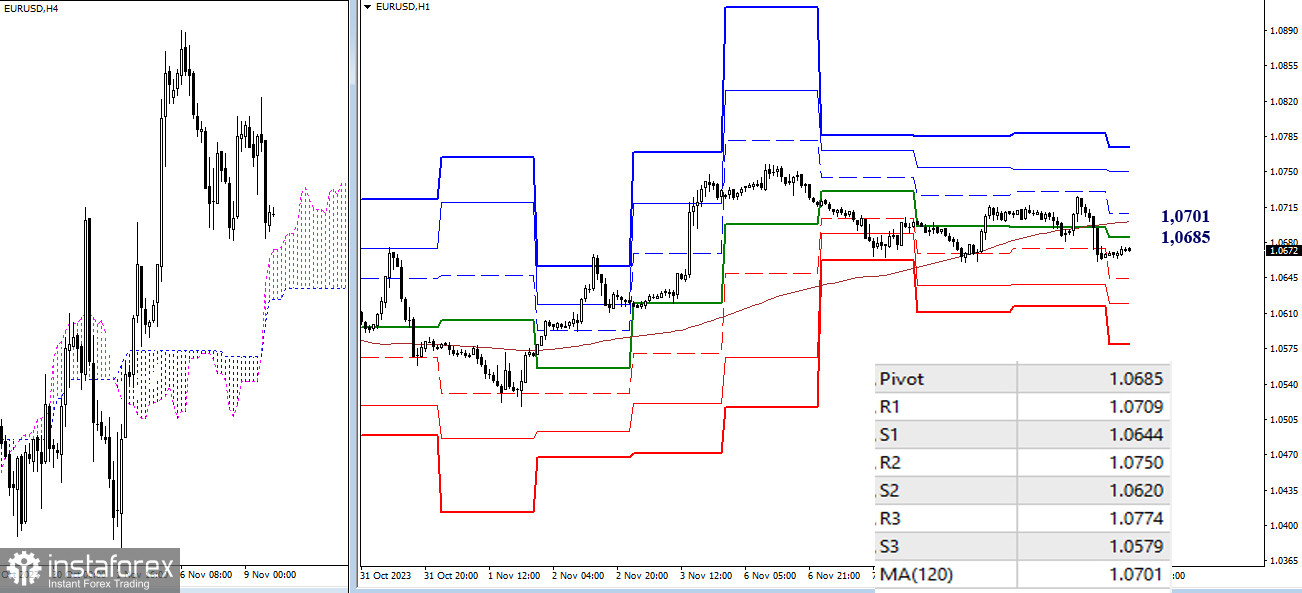

H4 – H1

On the lower timeframes, the bears managed to break below key levels towards the end of yesterday. Currently, this position is maintained, and strengthening their positions will be possible through the continuation of the current decline and gaining support from classic pivot points (1.0644 – 1.0620 – 1.0579). The key levels today are holding defense around 1.0685 – 1.0701 (central pivot point + weekly long-term trend). Consolidation above and a reversal of the movement could bring activity back into the market, favoring the bulls. Additional intraday bullish targets include 1.0709 – 1.0750 – 1.0774 (resistances of classic pivot points).

***

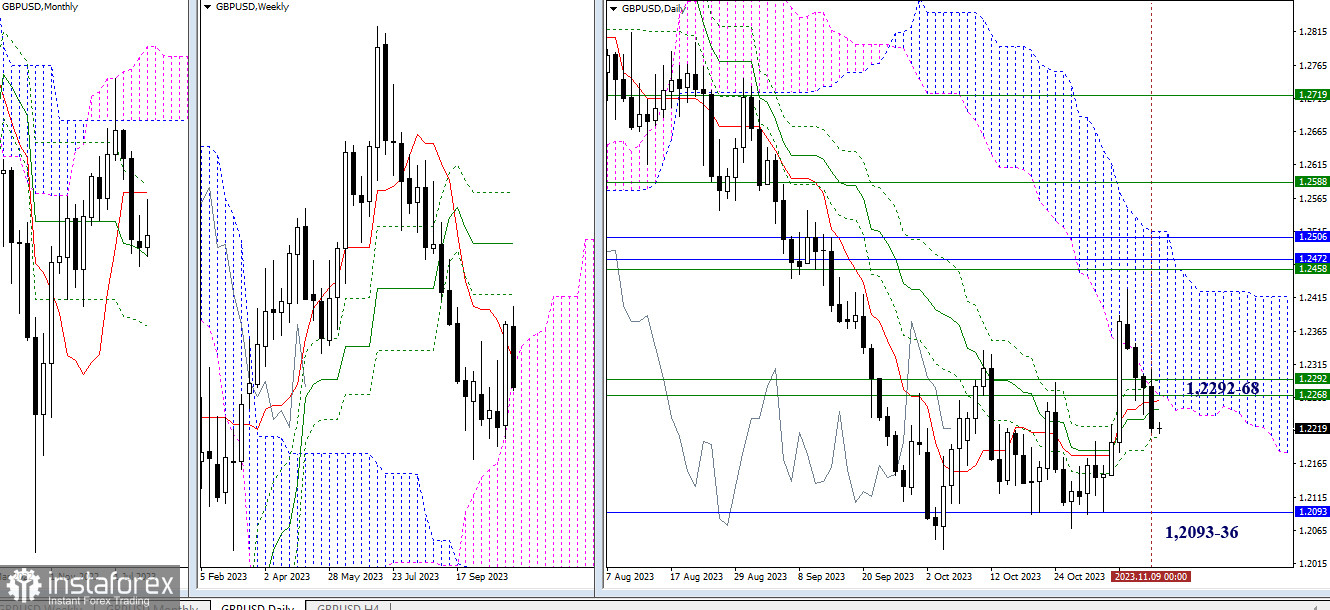

GBP/USD

Higher Timeframes

Bears successfully advanced yesterday and are close to closing the current week with a bearish candlestick combination, forming a rebound when testing important weekly levels (1.2268 – 1.2292). A weekly rebound and the elimination of the daily Ichimoku cross (1.2205) will draw attention to breaking the support of the monthly medium-term trend (1.2093) and the recovery of the weekly downward trend (1.2036).

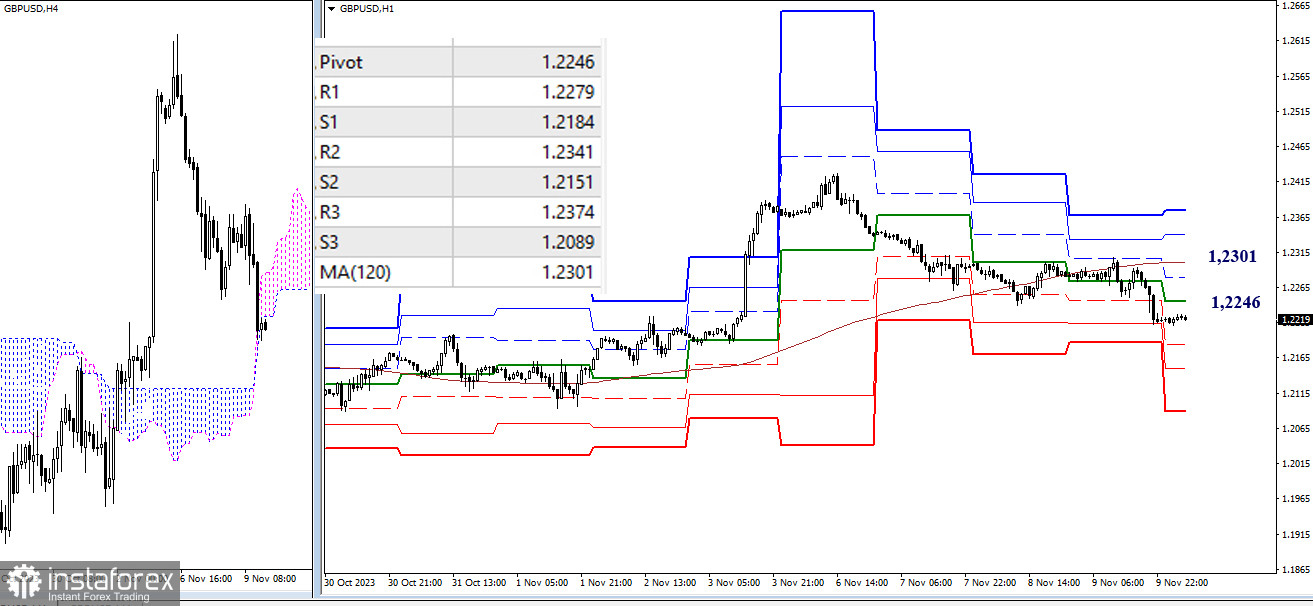

H4 – H1

On the lower timeframes, the bulls lost key levels yesterday, shifting the main advantage to the bears. To develop the decline, intraday targets today may be the supports of classic pivot points (1.2184 – 1.2151 – 1.2089). The key levels currently act as resistances and are located at 1.2246 (central pivot point of the day) and 1.2301 (weekly long-term trend). Consolidation above could change the current balance of power. The next targets for the recovery of bullish positions within the day will be 1.2341 and 1.2374 (resistances of classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)