Formally, initial claims for state unemployment benefits fell by 3,000, but it generally remained unchanged, as the previous US data was upwardly revised by the same amount. However, the report said continuing claims also rose by 22,000, against expectations of 4,000. The downward revision of the previous data by 6,000 does not play a significant role. So, in summary, the US unemployment claims data was quite disappointing, but the dollar still strengthened significantly. The key factor was Federal Reserve Chairman Jerome Powell's statements. Just a couple of days ago, the market was certain that there would be no further interest rate hikes by the Fed, and that it was more appropriate to prepare for rate cuts. But suddenly, Powell said that the central bank "will not hesitate" to raise interest rates further if needed. Although it may seem that there are no prerequisites for tightening monetary policy, why make such statements then? Also, it's important to remember that the Fed is much more informed than anyone else and likely has information indicating a possible need for further tightening of monetary policy. And this is why the dollar continued to rise. As for today, the eurozone economic calendar is basically empty, and the only thing traders can pay attention to is the speeches of the Fed officials. However, they probably won't say anything that contradicts Powell's words. It is also possible that the absence of any new information will be a reason for some kind of rebound.

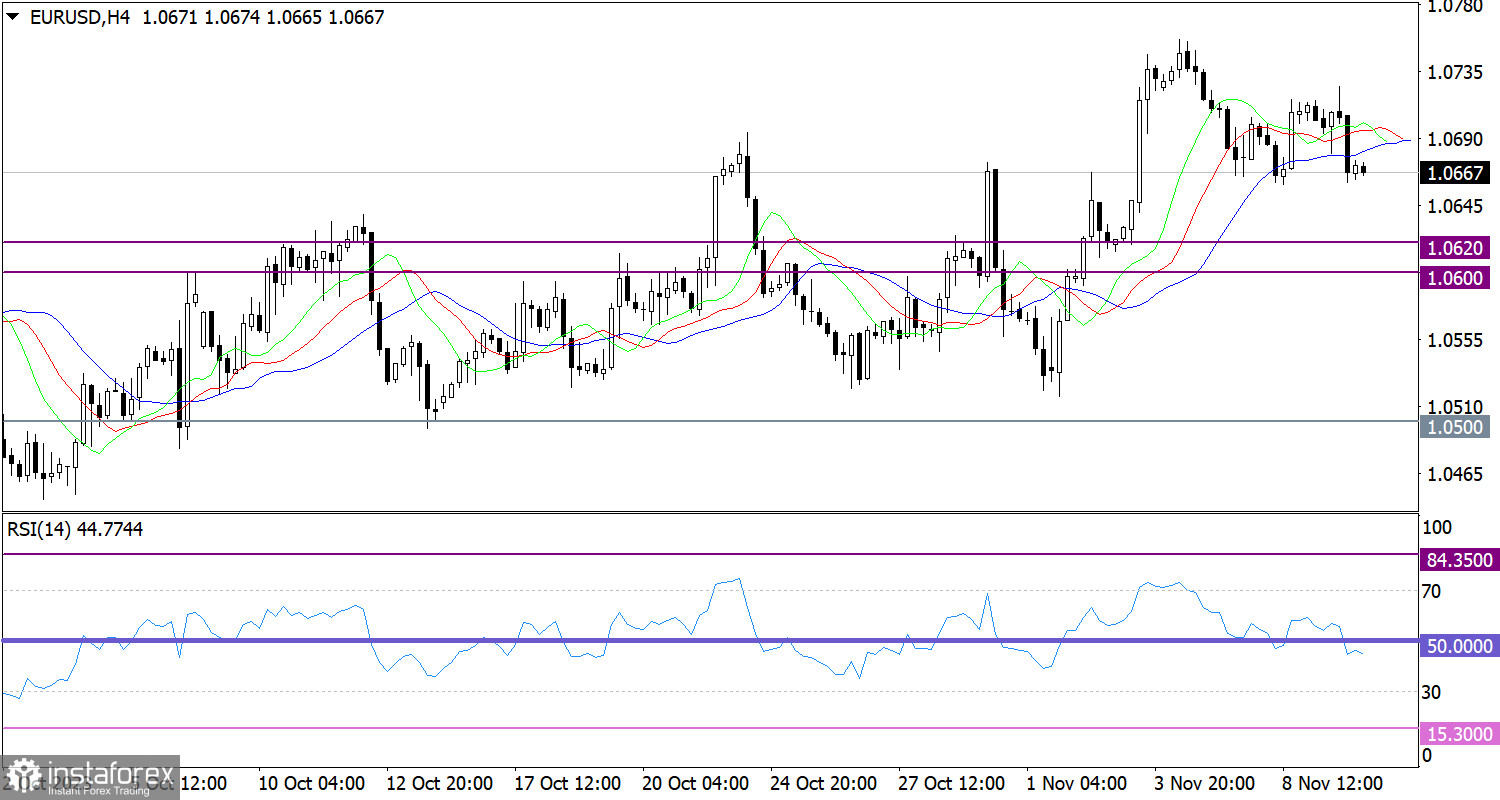

The EUR/USD traded lower after a brief pullback. As a result, the quote has fallen below the 1.0700 level, indicating an increase in the volume of short positions.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, confirming an increase in selling volumes.

The Alligator Indicator on the same time frame has some intersections between the MAs, meaning that the upward cycle is slowing down. This could also indicate a change in sentiment.

Outlook:

In case the price settles below the 1.0650 level, EUR/USD could fall further, which means that it could drop below 1.0600. The alternative scenario will come into play if the price does not settle below the control level and this may result in significant movement within the 1.0650/1.0700 range.

The complex indicator analysis unveiled that in the short-term and intraday periods, indicators are providing a downward signal.