Details of the Economic Calendar on November 9

The volume of overall claims for unemployment benefits in the United States increased, which may be considered a negative signal for the American labor market. However, the main stimulus for the rise in the dollar's value may be the words of Federal Reserve Chairman Jerome Powell. Powell stated that the regulator would not hesitate and would immediately raise the refinancing rate if necessary.

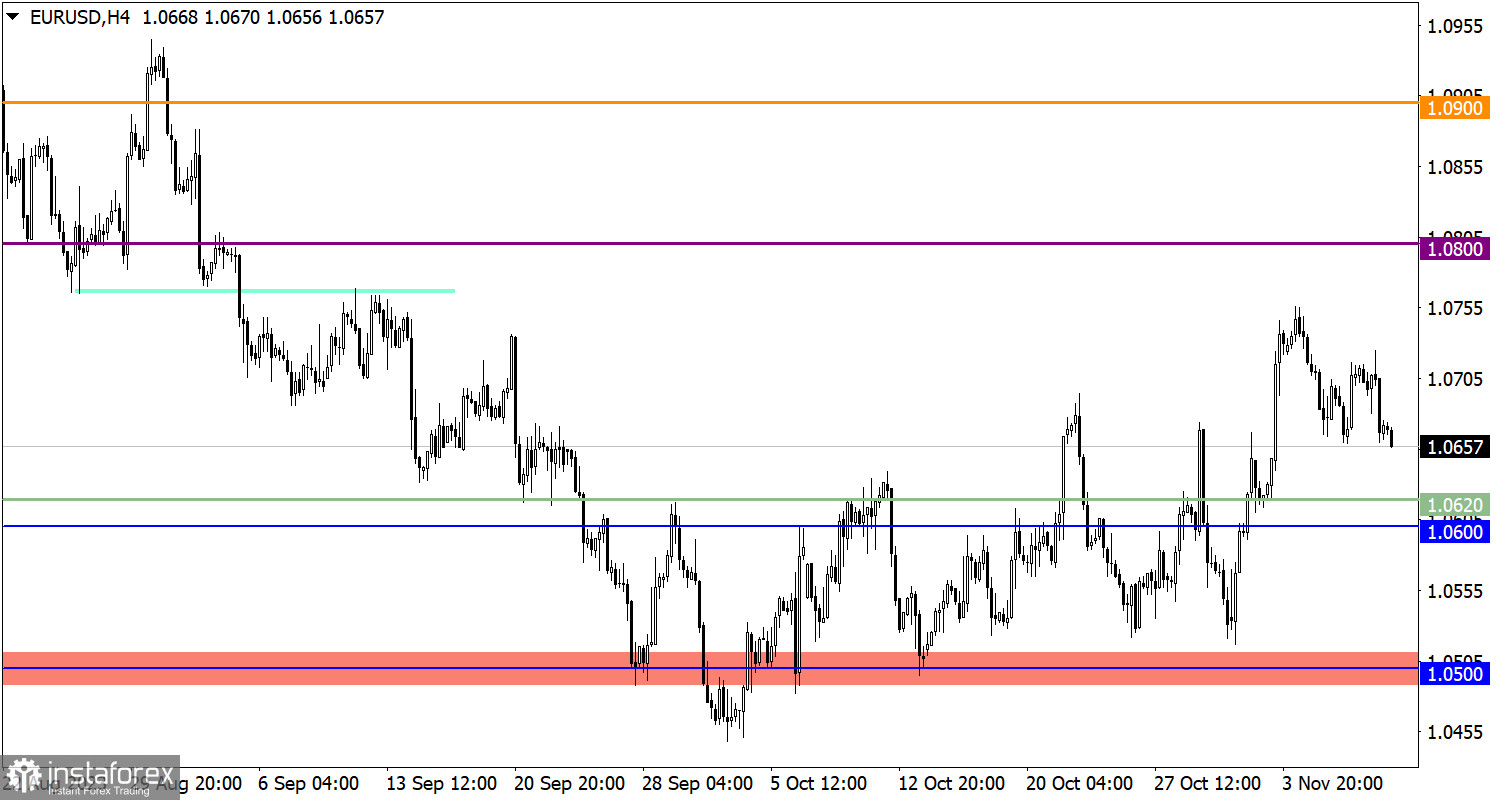

Analysis of Trading Charts from November 9

The EUR/USD currency pair resumed its decline after a brief pullback. As a result, the quote dropped below the 1.0700 mark, indicating an increase in the volume of short positions.

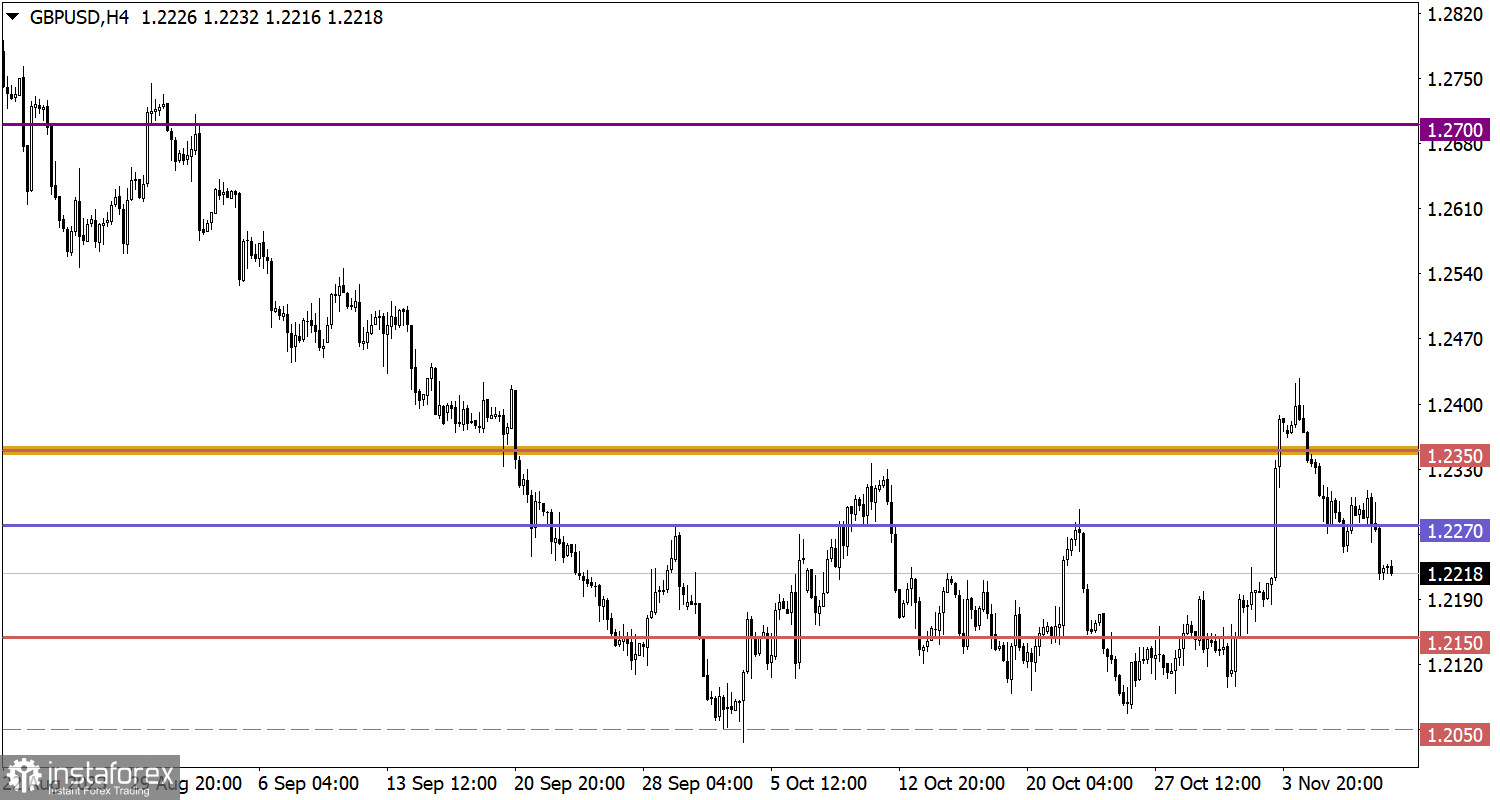

The GBP/USD pair shifted to active decline amid the market strengthening of the dollar. As a result, the quote dropped below the 1.2250 mark, indicating an increase in the volume of short positions.

Economic Calendar for November 10

With the opening of the European session, data on industrial production in the United Kingdom were published, where a slowdown from 1.3% to 1.1% was expected. As a result, the previous data were revised in favor of growth from 1.3% to 1.5%, and the actual indicators came out at the level of 1.5%.

EUR/USD Trading Plan for November 10

In case of price stabilization below the 1.0650 level, a subsequent decline is possible, which could lead to movement below 1.0600. As for the alternative scenario, the absence of price retention below the control level may result in an amplitude movement within the range of 1.0650/1.0700.

GBP/USD Trading Plan for November 10

For a subsequent decline in the pound's exchange rate, price stabilization below the 1.2200 level is necessary. In this case, movement towards 1.2150 is possible.

As for the upward scenario, it is considered a partial recovery of the pound's value due to local oversold conditions. The value of 1.2200 can serve as a variable support.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.