Bitcoin is approaching the end of the trading week with high market activity and a bullish sentiment. Thanks to this, the cryptocurrency managed to test the $38k level and once again update the annual price high. Positive sentiments prevail in the market, although they are based on assumptions and rumors.

The main reason for optimism in the crypto market remains the anxious anticipation of the approval of the spot BTC ETF. Essentially, we are witnessing a premature market reaction to the future approval of the crypto product. At the same time, more worrying signals are emerging, such as the lack of sustainable growth in buying volumes, indicating weakness in the upward trend.

Awaiting the SEC Decision

Considering the rapid rise in Bitcoin quotes this week, the crypto market has already solidified its belief that the SEC will approve the spot BTC ETF. Bloomberg data also supports this, indicating a 90% probability of approval of the crypto product in the next 60 days. However, JPMorgan analysts note that the Bitcoin rally looks excessive and may lead to a sharp decline after the ETF approval.

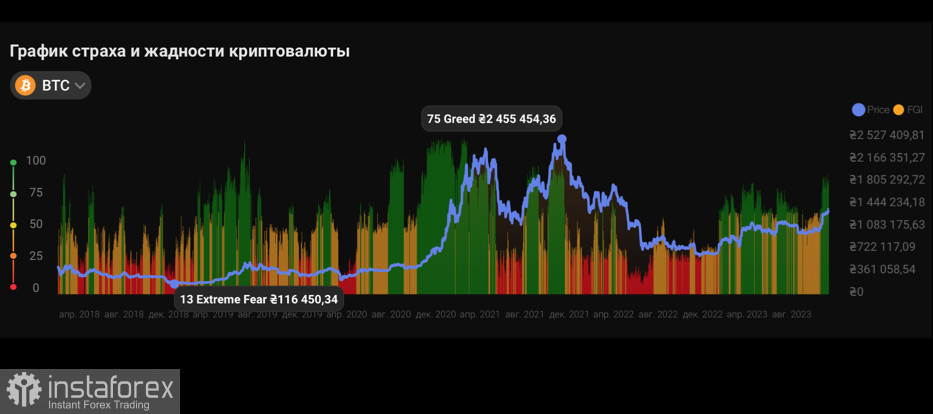

Meanwhile, the market remains in a state of euphoria, which increasingly puts investors in a "greedy" state. It became known that Tether has "printed" another billion USDT, which usually triggers another stage of the market rally. Investors expect the SEC to use the 8-day window to approve one or more spot ETF products on Bitcoin.

At the same time, on November 9, Ethereum also updated its local high, reaching the $2,000 level. This was facilitated by the Bitcoin rally, as well as the news that Ark Invest, in collaboration with 21Shares, plans to launch 5 new ETFs, including futures ETFs on BTC and ETH, as well as products investing in shares of blockchain companies. This additionally fueled interest in the market and triggered yesterday's rally in Bitcoin and Ethereum.

BTC/USD Analysis

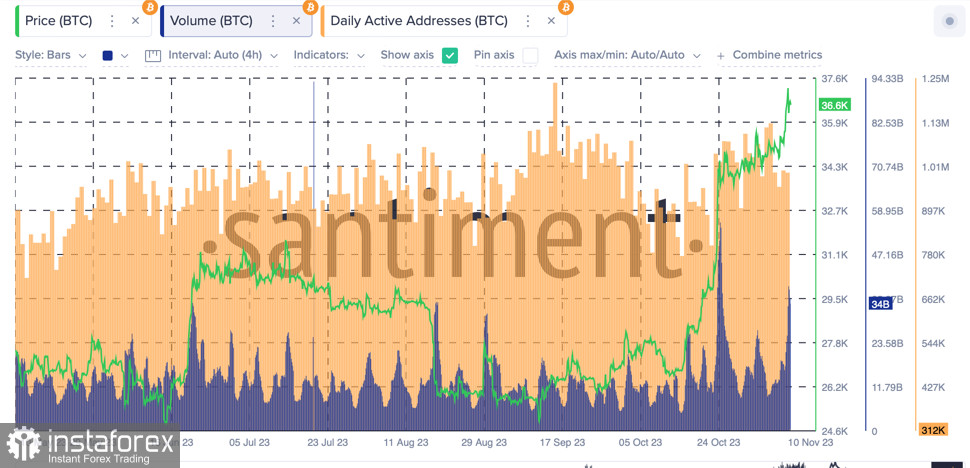

As of November 10, Bitcoin retested the $38k level, after which the asset's price dropped to the support zone near $36.5k. The sharp decline in the cryptocurrency's price led to the liquidation of long positions totaling over $120 million. Trading volumes, after reaching peak levels on Thursday fell to $34 billion.

Bitcoin continues its upward movement despite signals from technical metrics. The stochastic oscillator continues the implementation of the bearish crossover, but despite increasing sales, Bitcoin shows growth. Taking this into account, it can be concluded that Thursday's upward impulse is a reaction to the news rather than an influx of buying volumes.

Moreover, this week sees a disparity between the rise in BTC/USD quotes and buying volumes. The cryptocurrency is growing despite the absence of upward dynamics in bullish volumes, which also indicates an overbought market and a weakening of buyer positions. The sharp drop when reaching the $38k level also shows that more selling volumes are concentrated near the round level, and BTC bulls may not be able to break them on the first attempt.

Conclusion

Summing up all of the above, it can be concluded that Bitcoin is getting closer to a correction period. Buying volumes are decreasing, while the price has approached the complex area of $37.5k–$38k, where bearish volumes significantly exceed bullish ones. Simultaneously, various categories of investors are taking profits, which ultimately may lead to a collapse in BTC/USD quotes to the $32k–$33k levels.