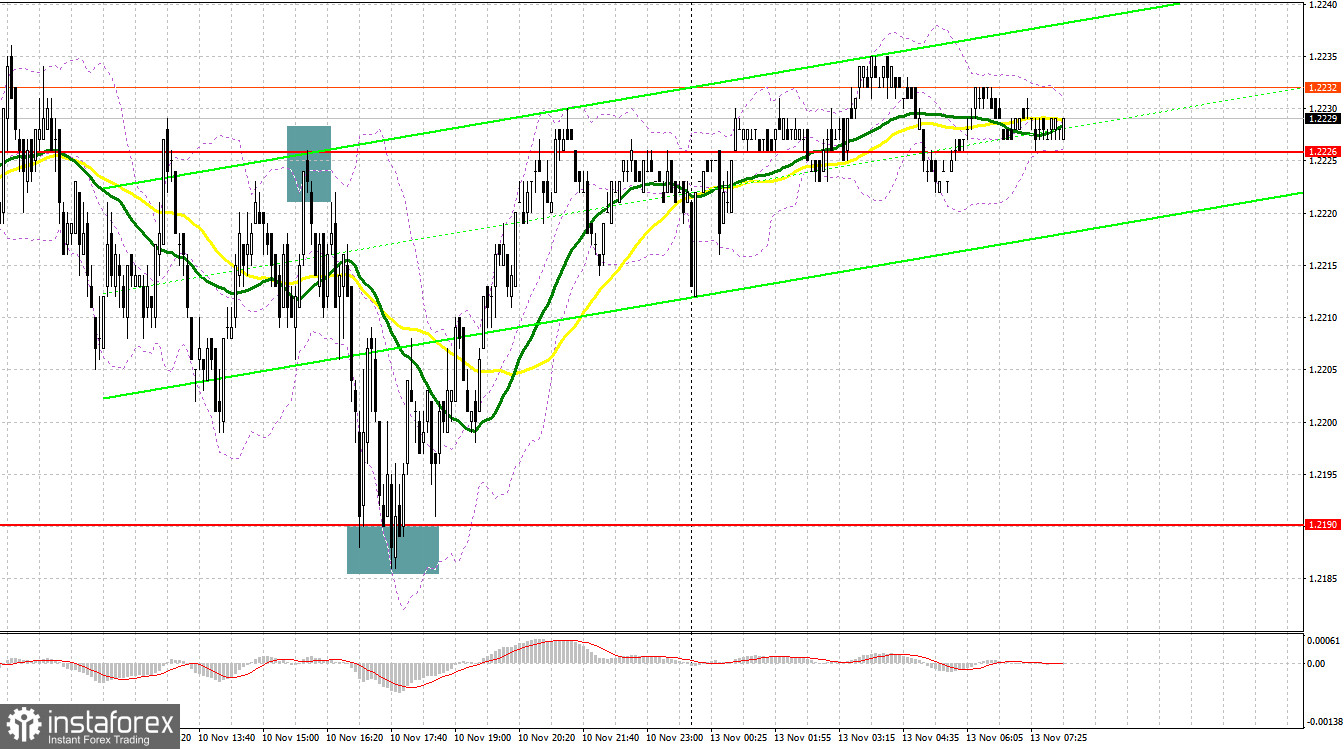

Last Friday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2215 as a possible entry point. A decline and false breakout at this mark produced a great buy signal, but after rising by 20 pips, the pair gradually shifted back to 1.2215, which led to a revision of the technical picture for the afternoon. During the US session, safeguarding 1.2226 generated a good sell signal, and the pair fell to the area of 1.2190 - more than 30 pips of profit. The bulls being active at 1.2190 produced a buy signal and the pound returned to 1.2226.

For long positions on GBP/USD:

Actively buying the pound after hitting a weekly low on Friday may indicate a pause in the downward correction and the pair could be stuck in a sideways channel. Bank of England Deputy Governor for Financial Stability Sarah Breeden and Bank of England MPC member Catherine Mann will speak today. A tough stance is expected from these officials, which could play to the British pound's favor. However, the bulls also need to stay above 1.2223 to maintain control of the market. Only a false breakout at this mark will provide an entry point for long positions with an aim to challenge the resistance at 1.2260. A breakout and consolidation above this range will produce a buy signal, potentially targeting the 1.2293 area. The ultimate target is found at 1.2335 where I will be taking profits. Should the pair decline and buyers show no initiative at 1.2223, the pressure on the pair will increase. A false breakout near the next support level at 1.2190 will signal the opportunity to open long positions. I plan to buy GBP/USD immediately on a rebound from 1.2157, aiming for a correction of 30-35 pips within the day.

For short positions on GBP/USD:

The bears did everything they could last week. Now the objective is to defend the nearest resistance at 1.2260, the pair could reach this mark after the speeches. A false breakout at 1.2260 will generate a sell signal with a movement towards the support level at 1.2223, formed at the end of last Friday. This is also in line with the moving averages. Breaching this level and subsequently retesting it from below will deal a more serious blow to the bulls' positions, lead to a cascade of stop orders, and open a path to 1.2190. The more distant target will be 1.2157, where I'd be taking profits. If GBP/USD grows and there are no bears at 1.2260, the bulls will get a chance to recover their positions at the start of the week. In that case, I will postpone selling until a false breakout at 1.2293. If downward movement stalls there, one can sell the British pound on a bounce from 1.2335, bearing in mind a 30-35-pips downward intraday correction.

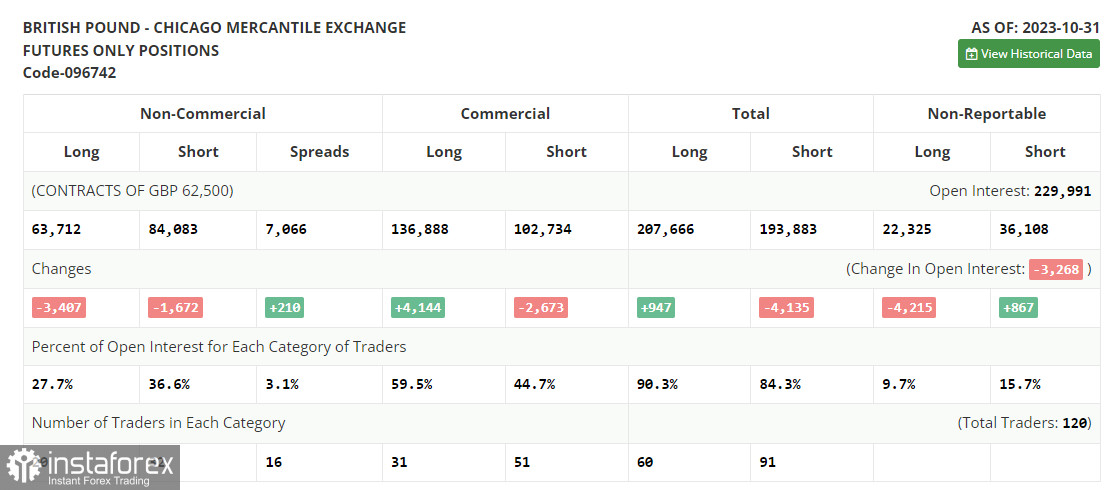

COT report:

The Commitments of Traders report for October 31 indicated a decline in both long and short positions, but this did not change the balance of power, as the data does not take into account the latest report on the state of the US labor market. The market had almost no reaction to the fact that the US Federal Reserve left the policy unchanged, but the reaction to the weak job figures supported the pound's sharp growth at the end of last week, which may affect the pair's trend in the medium-term. Talk that US interest rates may remain unchanged this December, due to early signs of weakness in the economy, will exert more pressure on the US dollar and boost the pound. Non-commercial long positions fell by 3,407 to 63,712 while non-commercial short positions fell by 1,672 to 84,083, increasing the spread by 210 positions. The weekly closing price declined to 1.2154 from 1.2165.

Indicator signals:

Moving Averages

Trading just around the 30- and 50-day moving averages indicates sideways movement.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border near 1.2200 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.