When monetary policy tightening cycles begin, investors ponder which rates will rise faster and higher—those currencies will emerge as winners. When monetary tightening ends, a different puzzle emerges: which central banks will lower rates faster and lower? The currency of that country will lose. It seemed that expectations of a 40 bps rate cut by the Bank of England (BoE) in 2024, which is less than the Federal Reserve and the European Central Bank (ECB), should support the pound. But not so fast!

Unlike other central banks using "hawkish" rhetoric, the BoE stirred up a real scandal. Its chief economist, Huw Pill, stated that pricing in a repo rate cut in June 2024 makes sense. This was a complete surprise for the markets, which were accustomed to numerous speeches about the need for prolonged borrowing costs at elevated levels. In comparison, ECB President Christine Lagarde confidently stated that the deposit rate would remain at 4%, at least for two quarters. Federal Reserve Chairman Jerome Powell did not rule out another rate hike for federal funds.

The pound reacted with a decline, and BoE Governor Andrew Bailey was forced to reassure everyone. According to him, markets may have their own opinion, but the question of easing monetary policy is not discussed.

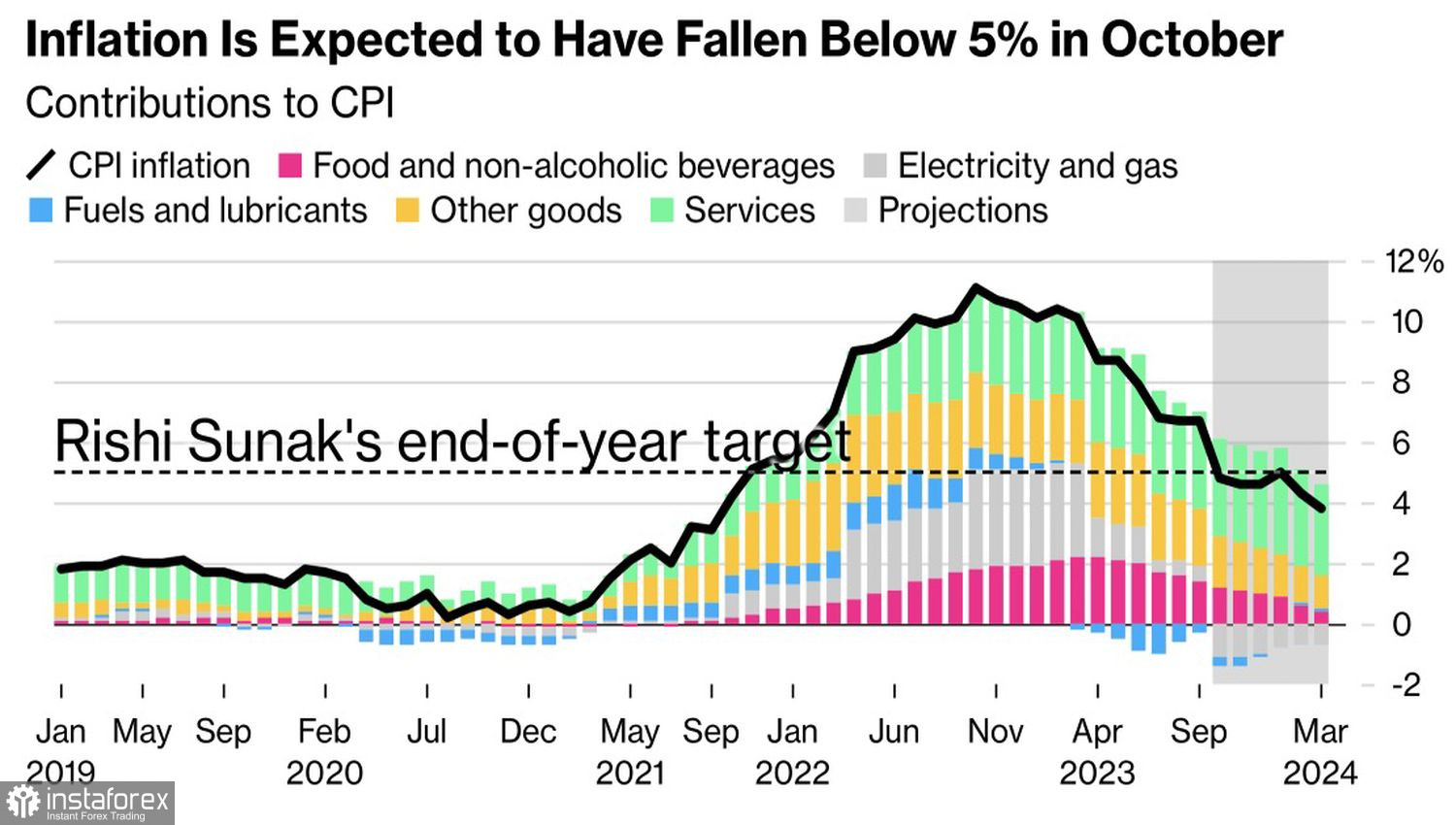

Who is right and who is not will be judged by inflation. When a central bank's monetary policy depends on incoming data, you can say anything. Statistics will dot the i's. In this regard, Bloomberg experts' forecast of a slowdown in consumer prices from 6.7% to 4.8% in October looks unequivocally "bearish" for GBP/USD. However, such an opinion is deceptive.

Structure and Dynamics of British Inflation

Credit Agricole believes that many negative factors are already priced into sterling quotes. The markets overreact to what the company considers neutral statements by BoE representatives. The slowdown in CPI is due to falling energy prices. At the same time, core inflation remains elevated. If it unexpectedly accelerates or is done by service prices, it will be difficult to find a better opportunity to buy GBP/USD.

A slowdown in the growth rate of consumer prices below 5% is good news for Chancellor Rishi Sunak. He promised to cut inflation in half from its peak in 2023 at 10.7%. Effective fiscal policy by Chancellor Jeremy Hunt and the fact that Britain will avoid a recession in 2023 could be a catalyst for strengthening the pound. Indeed, in the third quarter, GDP recorded zero growth, although Bloomberg experts expected it to contract by 0.1%.

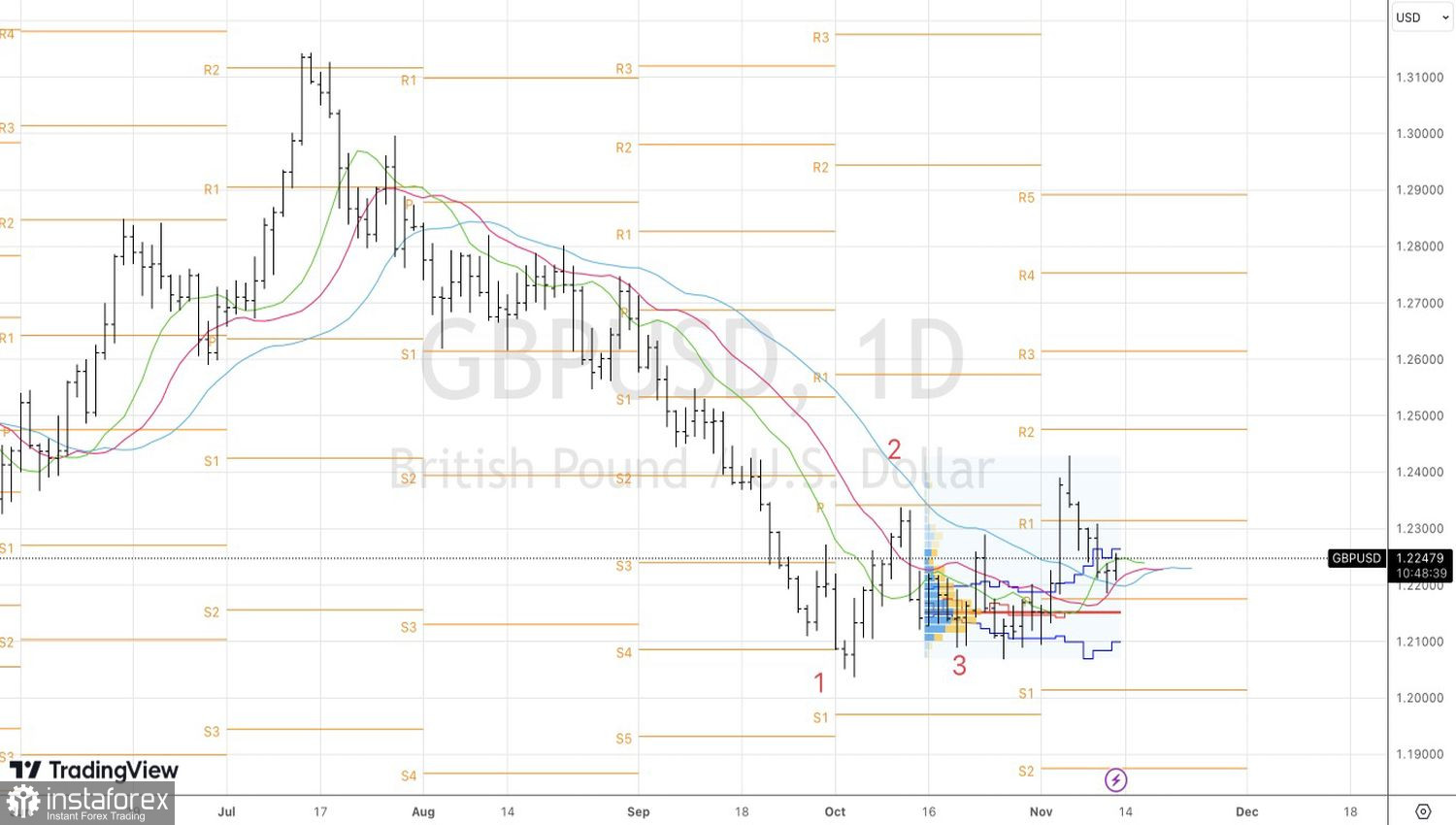

Technically, on the daily chart, GBP/USD formed a pin bar with a long lower shadow. Updating its high led to an increase in quotes. You can jump into the upward movement by buying the pound against the U.S. dollar on the breakout of the upper boundary of the fair value range of 1.210-1.226.