As we warned in our previous articles, the EUR/USD currency pair is trading on Monday with the same minimal volatility as on Friday. The problem is that Mondays often see low market activity, and today, no important macroeconomic publications are scheduled. Thus, the market took a day off on Friday, and a similar decision has likely been made for today. Of course, movements during the American trading session may be more interesting but unlikely enough to prompt everyone to rush into trading.

Therefore, the technical picture remains unchanged for now. The European currency is still inclined to decline because it doesn't have many other options. The euro has two options at the moment. The first is to stay within a limited price range (consolidating, correcting, being in total flatness) and maintain its current value and cost. The second is to fall. As we have repeatedly mentioned, we expect further depreciation of the euro. It may have already started, or there may be several weeks of consolidation or correction before it resumes. We are still determining how long the consolidation will last.

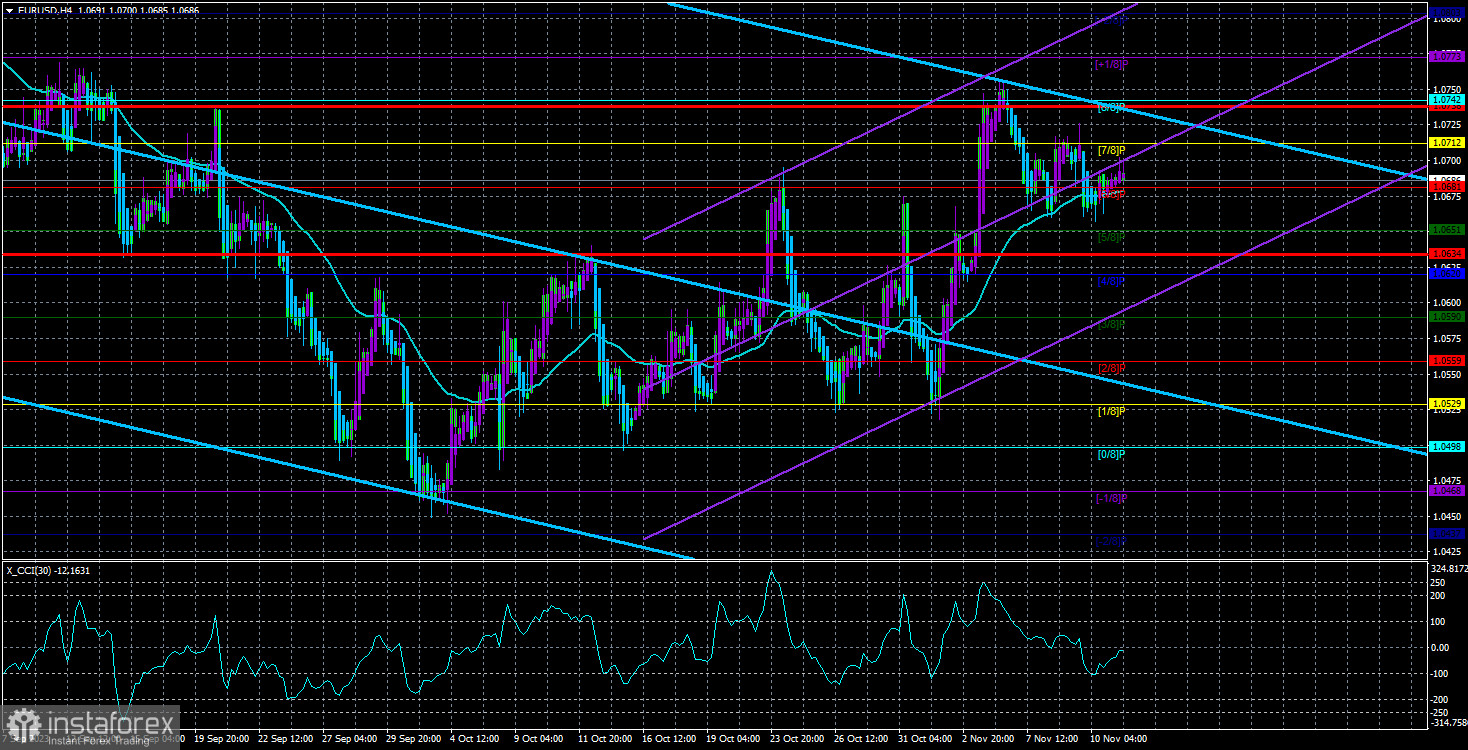

However, higher timeframes (TF) and their indicators have indicated readiness for a resumption of the downward movement several times. The rebound from the Senkou Span B line, of course, does not have a 100% guarantee of success, as well as the double overbought condition on the CCI indicator on the 4-hour TF. Nevertheless, these are strong signals. And if a strong fundamental background for the euro is on the horizon, anything is possible. However, there is no such background soon. Everything we hear and see at the moment relates to the possible further rate hike by the Federal Reserve, and there is very unlikely to be a new tightening of the ECB's monetary policy. Therefore, the path for the euro is only southward.

Luis de Guindos gave the euro a faint hope

Despite the absence of any significant publications today, there was a speech by ECB Vice President Luis de Guindos. He stated that the Central Bank does not want to speculate about the rate in a few months. According to him, the ECB has not put an end to the issue of tightening monetary policy; additional tightening is not required at the moment. De Guindos also mentioned that an inflation correction should be expected soon. In simpler terms, it is an acceleration of inflation. Recall that we have seen a similar rebound in US inflation lately. De Guindos also pointed out that the European economy will remain weak soon, and the labor market has weakened. In December, the ECB will review its inflation forecast and, based on new data, will decide on the rate. In the slightly more distant future, a resumption of the downward trajectory of inflation is expected.

What does all this mean? Luis de Guindos indicated that the rate may rise again, but only in major circumstances. There are no such circumstances, so there is no need to talk about a rate hike. We see that in the United States, representatives of the Federal Reserve have begun to worry about the rise in inflation to 3.7%, but so far, no steps have been taken. The same could happen in the European Union. The latest CPI report showed a decrease to 2.9%, so even if inflation rises to 3.5%, we do not believe bankers' rhetoric will become more "hawkish." In any case, there is no talk of a rate hike in December and January.

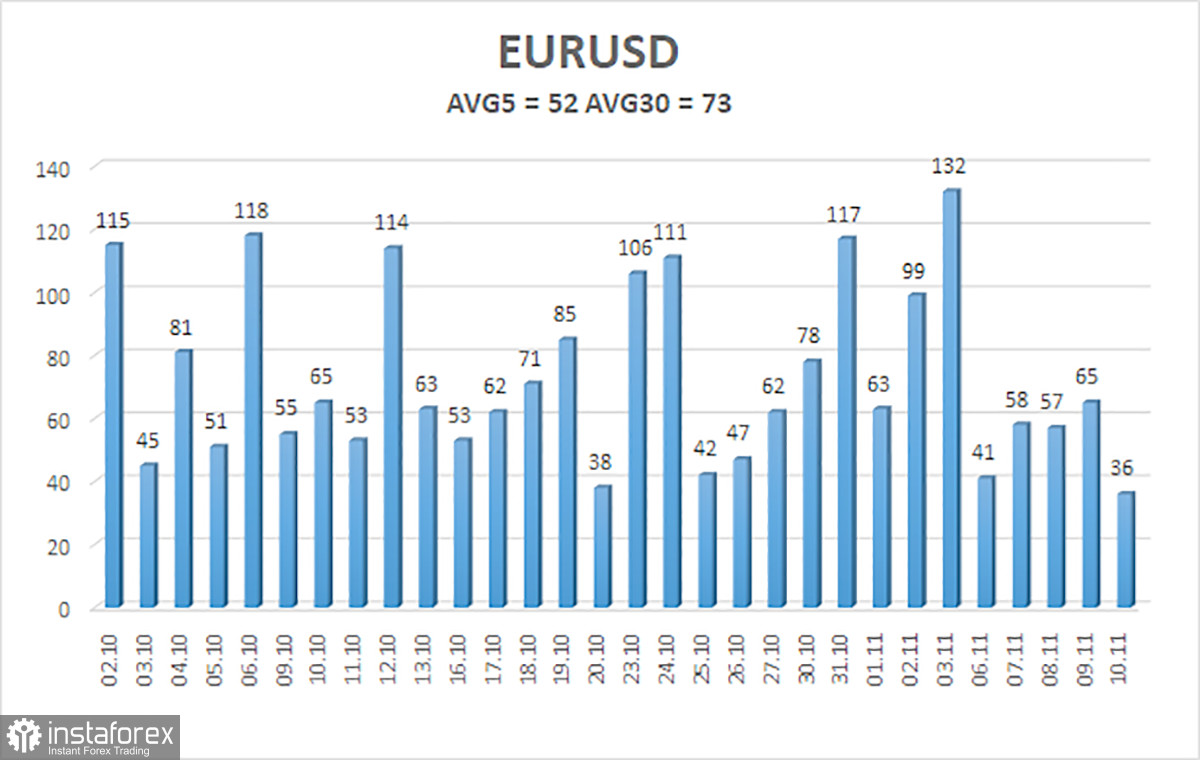

The average volatility of the euro/dollar currency pair for the last five trading days as of November 12 is 52 points and is average. Thus, we expect the pair to move between the levels of 1.0634 and 1.0738 on Monday. A downward reversal of the Heiken Ashi indicator will indicate a new attempt to resume the downward trend.

Nearest support levels:

S1 – 1.0651;

S2 – 1.0620;

S3 – 1.0590.

Nearest resistance levels:

R1 – 1.0681;

R2 – 1.0712;

R3 – 1.0742.

Trading recommendations:

The EUR/USD pair continues to change its direction almost every day. Therefore, relying on the moving average is a futile task. Last Friday, we saw a strong rise, but it is unlikely that the upward movement will continue. The growth was shown solely due to a strong background, which rarely happens. We believe that it is advisable to consider sales from the current positions, but it should be understood that "swings" may continue. Friday remained the same as the pair's movement.

Explanations for the illustrations:

Linear Regression Channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving Average Line (Settings 20.0, smoothed) - determines the short-term trend and direction in which it is currently worth trading.

Murray Levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.