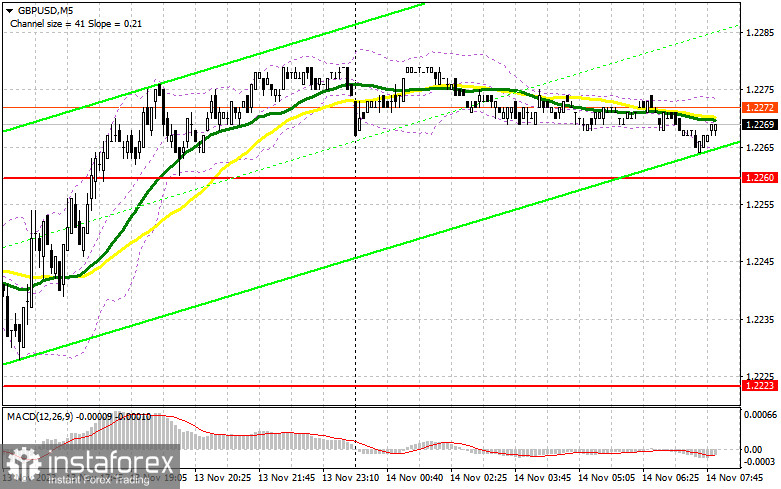

Yesterday, the pair did not form any relevant entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2260 as a possible entry point. The pound approached this level but due to low volatility, it failed to reach it. In the afternoon, the pair moved down slightly but couldn't test the level of 1.2223, preventing my market entry.

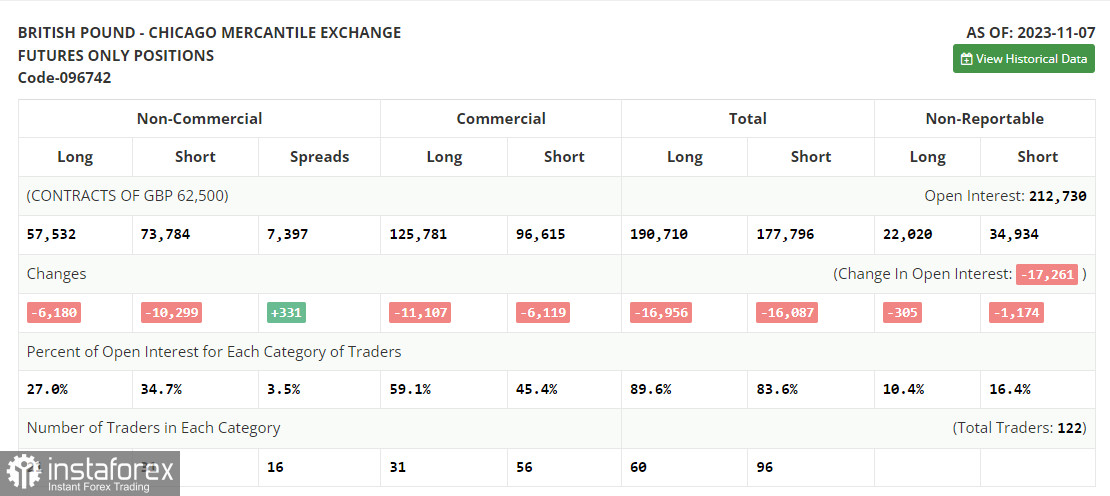

COT report

Before discussing the technical aspects of the pound, let's review the recent developments in the futures market. The Commitments of Traders (COT) report for November 7 showed a decrease in both long and short positions, but this did not significantly alter the market dynamics. Persistent pressure on the pound was observed throughout the week as the latest report on the UK's economic growth rate was disappointing, hinting at the real chances of a recession in Q4 this year. Considering the Bank of England's statements on maintaining high interest rates for an extended period, the chances of a substantial rise in the British pound remain slim. The only factor that could change this dynamic is weak US data indicating a further reduction in price pressures. The more the talks about unchanged US rates in December, the more pressure there will be on the US dollar, making the pound more valuable. The latest COT report states that non-commercial long positions decreased by 6,180 to 57,532, while non-commercial short positions fell by 10,299 to 73,784. Consequently, the spread between long and short positions increased by 310. The weekly closing price rose to 1.2298 from 1.2154.

For long positions on GBP/USD

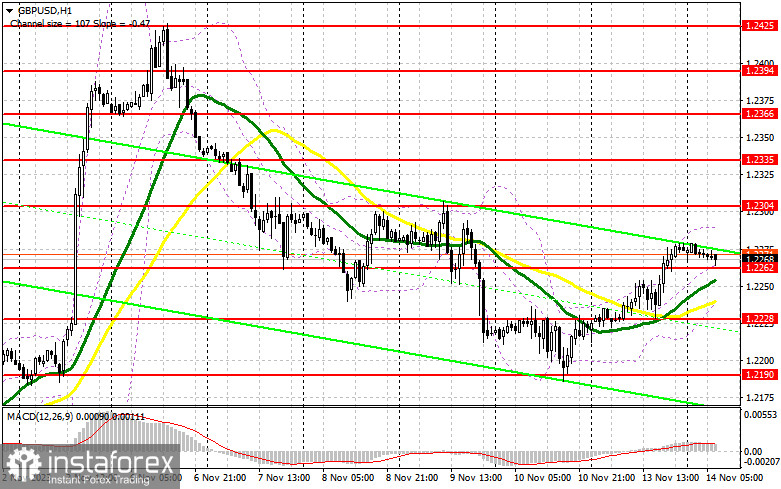

Today's reports on the UK's unemployment rate, the number of unemployment claims, and changes in average earnings may negatively impact the British pound. If buyers are counting on a continued upward trend, they need to make their presence felt around 1.2262, below which the moving averages are supporting the buyers. A false breakout there will provide an entry point for long positions aimed at the resistance at 1.2304. Only a breakthrough and a test from above this range will strengthen recovery chances, creating a buy signal to reach the new resistance at 1.2335. A move above this range will indicate a surge towards the high of 1.2366, where I plan to take profits. In a scenario of GBP/USD falling and the absence of buyers at 1.2262, sellers will get a chance to regain market control, at least until the US data is released. In that case, I'll postpone opening long positions until the price tests the support at 1.2228 that was formed yesterday. Buying is also possible there but only on a false breakout. Long positions on GBP/USD can be opened immediately on a rebound from 1.2190, aiming for a correction of 30-35 pips within the day.

For short positions on GBP/USD

Yesterday, bears made an attempt to break through, but market optimism prevailed. Many are betting on further growth of risk assets following a series of important US statistics released this week. So they hesitate to sell the pound. If there is a positive response to the UK labor market data, it would be nice to see bears protecting the 1.2304 resistance before making any decisions. A false breakout at this level would confirm the presence of major sellers in the market, creating a sell signal with the expectation of the pair's decline and the renewal of the 1.2262 support formed yesterday. A breakthrough and retest from below this range will increase pressure on the pair, giving bears an advantage and a sell entry point with the aim of retesting 1.2228, where I anticipate more active buyers. The next target would be last week's low of 1.2190, where I plan to take profits. If GBP/USD rises and there are no bears at 1.2304, the bulls will gain a strong advantage, leading to an upward movement towards the next resistance at 1.2335. I would also advise selling there only on a false breakout. If there is no activity there either, I recommend opening short positions on GBP/USD at 1.2366, anticipating a 30-35 pip downward rebound within the day.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates a continued correction in the pound.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a rise, the upper band of the indicator at 1.2295 will serve as resistance. If the pair declines, the lower band of the indicator at 1.2235 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.