Has someone learned important information ahead of others? The rally of EUR/USD started even before the release of statistics on American inflation. It could have been a coincidence; however, a data leak might have occurred. Nevertheless, weaker-than-expected figures compared to Bloomberg experts' forecasts triggered a surge in the main currency pair to its highest levels since early September.

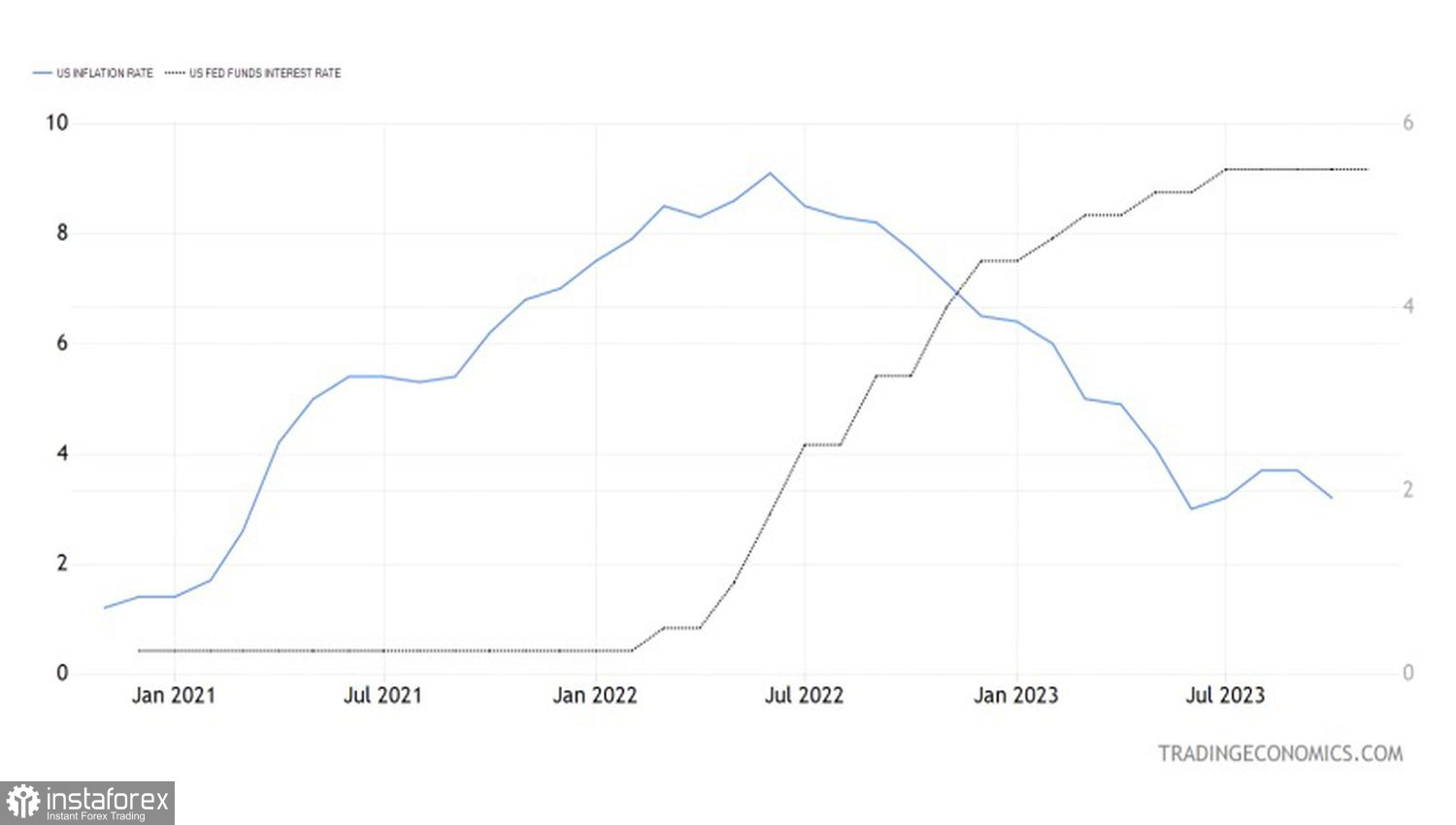

In October, consumer prices rose by 3.2% in annual terms, marking a zero increase on a monthly basis. Core inflation slowed to 4% YoY, and its more modest than expected growth of 0.2% made Bloomberg's opinion relevant. The publication claimed that several months of a 0.2% increase in the indicator would allow the Federal Reserve System to start discussing rate cuts. What better reason for the rise of EUR/USD?

Dynamics of American Inflation and Fed's Rates

The rally of the main currency pair is based on both an improvement in global risk appetite and investors' belief that the Fed has completed the cycle of tightening monetary policy. If so, it is time to start contemplating a reduction in the federal funds rate, despite FOMC officials' attempts to convince markets otherwise.

Typically, there is a period of several months between the end of the monetary restriction cycle and a reduction in borrowing costs, and investors are counting on this once again. The exception was the 1970s, when inflation reached a new peak. Today, consumer prices continue to slow rapidly due to the dissipation of pandemic effects. Disruptions in supply chains increased the cost of supply, and massive fiscal stimulus inflated demand. In 2023, these processes are reversing, so why shouldn't CPI and PCE return to their previous values?

If this happens, the Fed may find itself in an extremely uncomfortable situation if it continues to hold the federal funds rate at a plateau for an extended period. This threatens deflation and monetary expansion, which financial markets are sincerely counting on. It would create an ideal environment for U.S. stock indices and a strong headwind for the U.S. dollar.

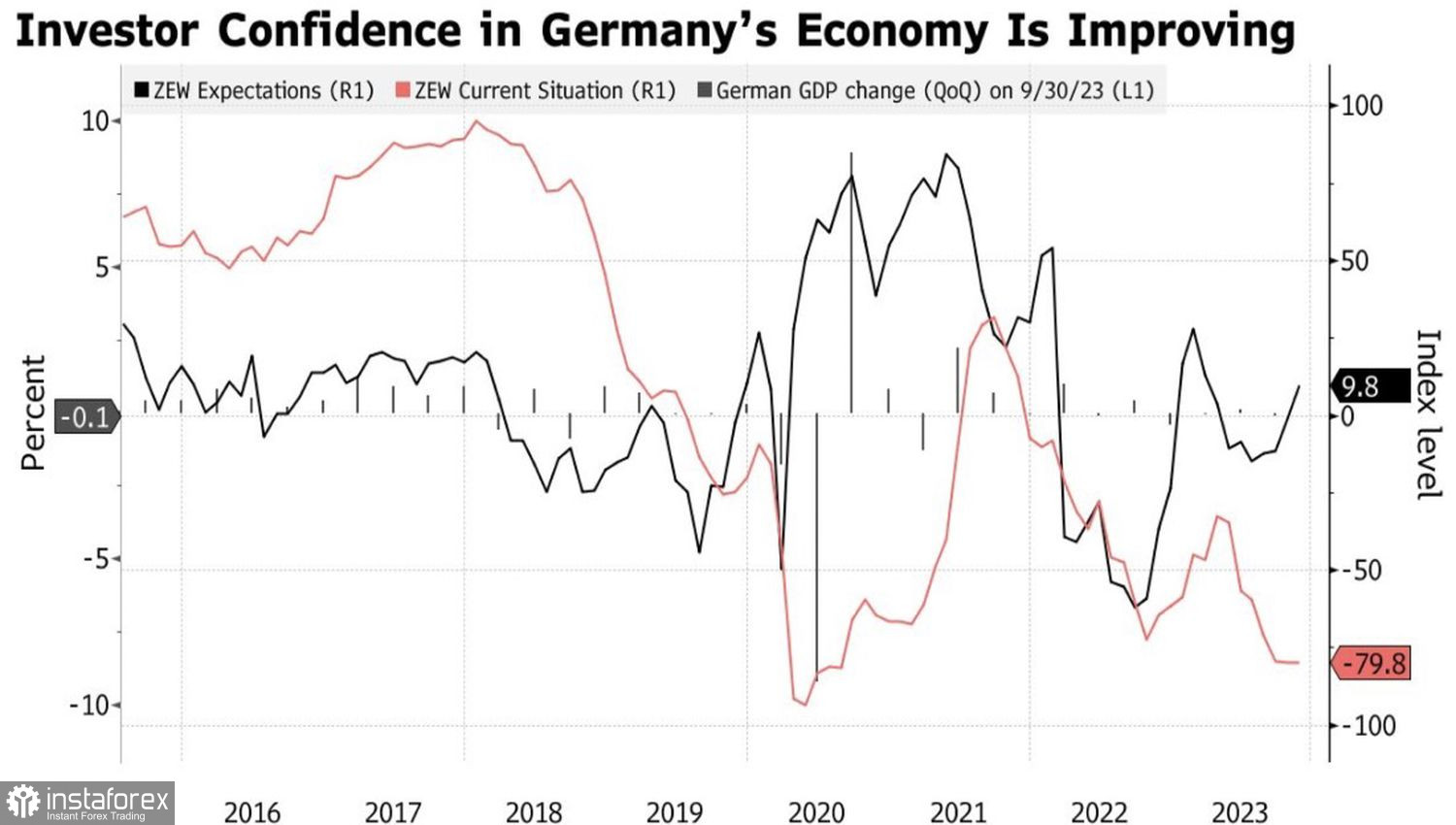

Dynamics of ZEW Expectations and Current Conditions Indices

On the euro's side, there is strong statistics on the expectations index of German investors and the hawkish rhetoric of European Central Bank officials. The positive ZEW allows us to assume that the German economy has finally bounced off the bottom and will avoid a recession in 2023. ECB President Christine Lagarde asserts that the deposit rate will remain at 4%, at least for several quarters.

Thus, the U.S. dollar is losing its advantages, while the euro gains them. This circumstance allows us to consider a downward trend reversal in the main currency pair.

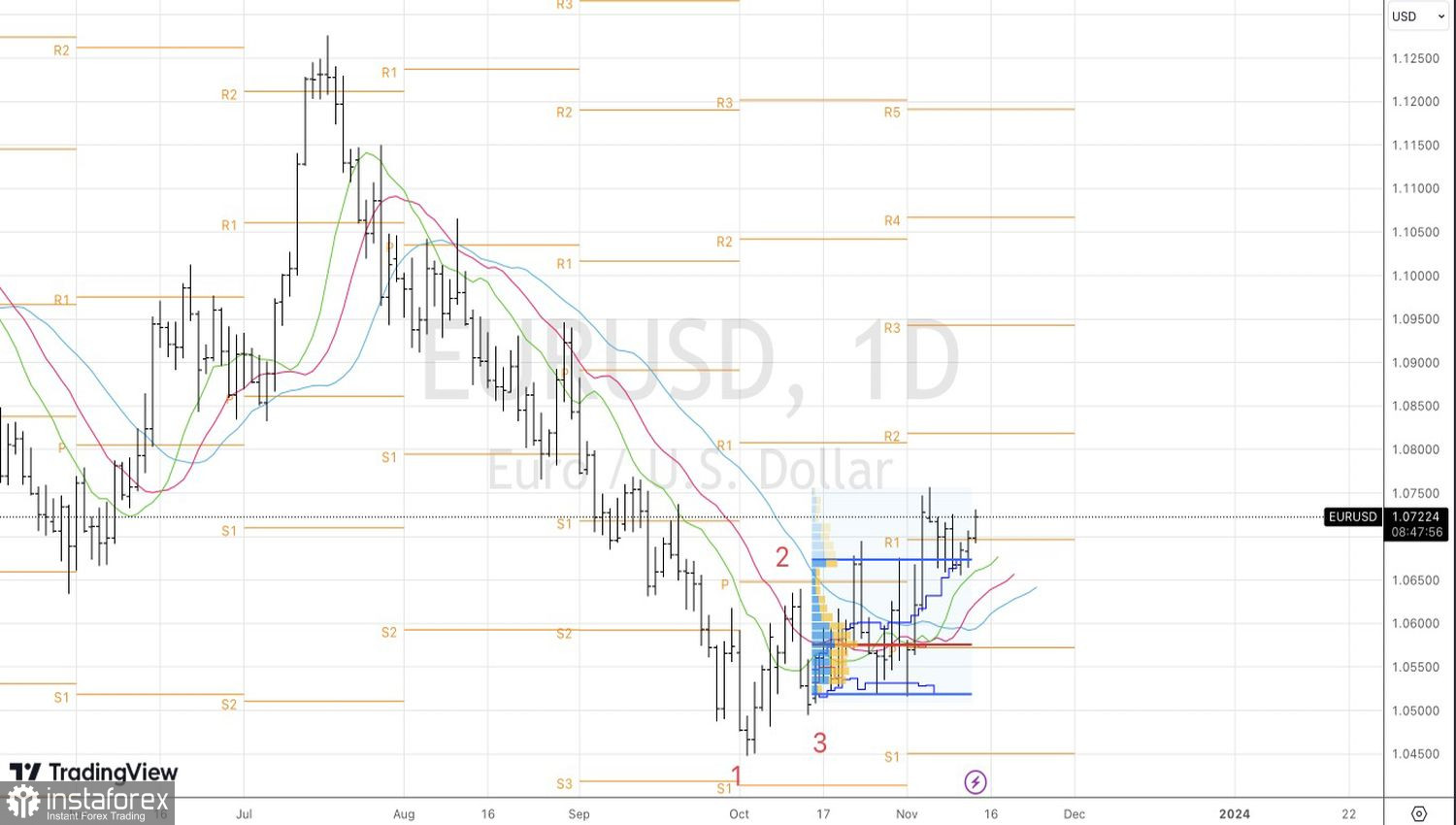

Technically, on the daily chart of EUR/USD, the inability of the bears to return the pair quotes within the fair value range of 1.052-1.068 indicates their weakness. We hold and periodically increase long positions formed from levels 1.07 and 1.072.