On Wednesday, the GBP/USD currency pair showed the same breathtaking and inadequate growth as the EUR/USD pair. Thus, the upward correction that has been forming over the past month and a half has taken on a convincing look and may now resume the downward trend. We still do not believe that the annual upward trend will resume, as we see no grounds for the dollar to fall and the pound to rise.

In November, two important events largely determined the fate of the dollar and the pound. First, the Non-Farm Payrolls report in the US turned out to be weaker than expected, and then the inflation report turned out to be below forecasts. In both cases, the deviations of actual values from forecasts were insignificant, but the market reacted as if Non-Farms had dropped to zero and inflation had already returned to 2%. The market reacted inadequately in both cases - the dollar fell too sharply.

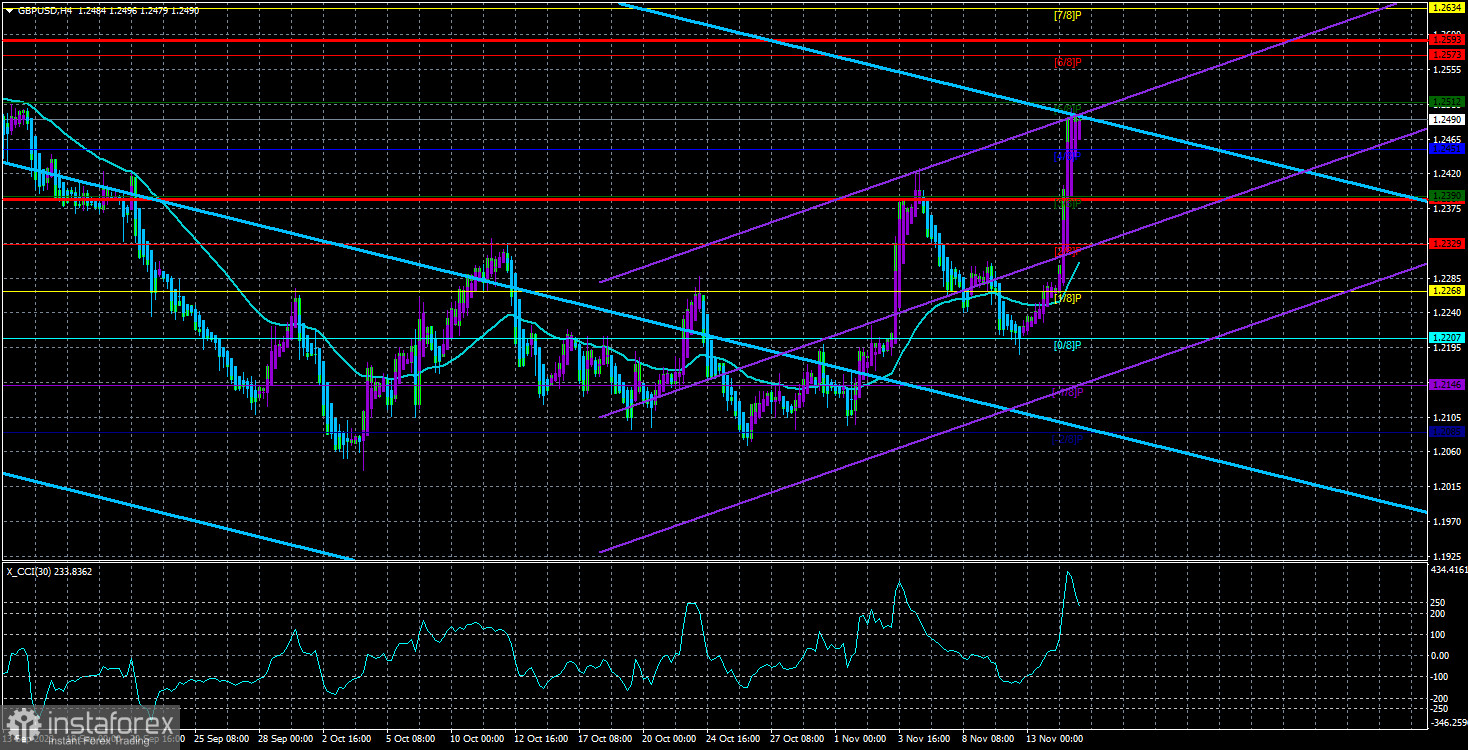

Meanwhile, the CCI indicator for the pound has entered the overbought zone for the third time. The last two times would not have happened without the notorious Non-Farm Payrolls and inflation reports. So, it can be said that the correction has already exceeded its plan, and the British pound got lucky to climb so high. Based on these conclusions, the medium-term downward trend will be resumed; it's just a matter of time.

As mentioned in the article on the euro, the pound has no "own" reasons to continue its upward movement against the dollar. The economy of the United Kingdom (unlike the American one) has not been growing for several quarters, the Bank of England's rate is lower than the Federal Reserve's rate, and the British regulator does not send any signals about readiness to continue tightening. Today, the inflation report in Britain will be released, and according to forecasts, it may immediately drop by 2%. Seeing the market's reaction to this report will be very interesting. A significant drop in inflation in Britain will also reduce the likelihood of the Bank of England tightening monetary policy, just like the Federal Reserve. So, the pound should have already dropped by 200 points today. Let's see how much the market adheres to the principle of fairness.

Is British inflation preparing a surprise for us?

So, in half an hour today, the Consumer Price Index in the UK for October will be announced. The September value was 6.7%. Expert forecasts are 4.8%. Although 4.8% is also a lot, the British pound should collapse like a stone if the forecast comes true. Or better to say, like the US dollar yesterday. Recall that the fall of the American currency could only be caused by the market's expectations, which openly did not believe in a forecast reduction to 3.3%, which is why we saw an inadequate reaction. Since the pound has been rising lately, it can be assumed that the market does not believe in the decline of British inflation to 4.8%. If this is the case, any value around 4.8% should trigger a pound collapse. This is if the market is fair and reacts to today's report like yesterday's.

Although, we don't see anything terrible for the pound or the dollar in the inflation decline. After all, this is what both central banks were trying to achieve. And now, when inflation is falling as expected, the market reacts as if it is hearing about it for the first time. So today, we have yet to attempt to predict what the market's reaction might be. It can be anything. British inflation is less important than American; that's a fact. Therefore, the reaction may be much weaker. But no one can predict in advance what the actual value will be, so guessing is pointless.

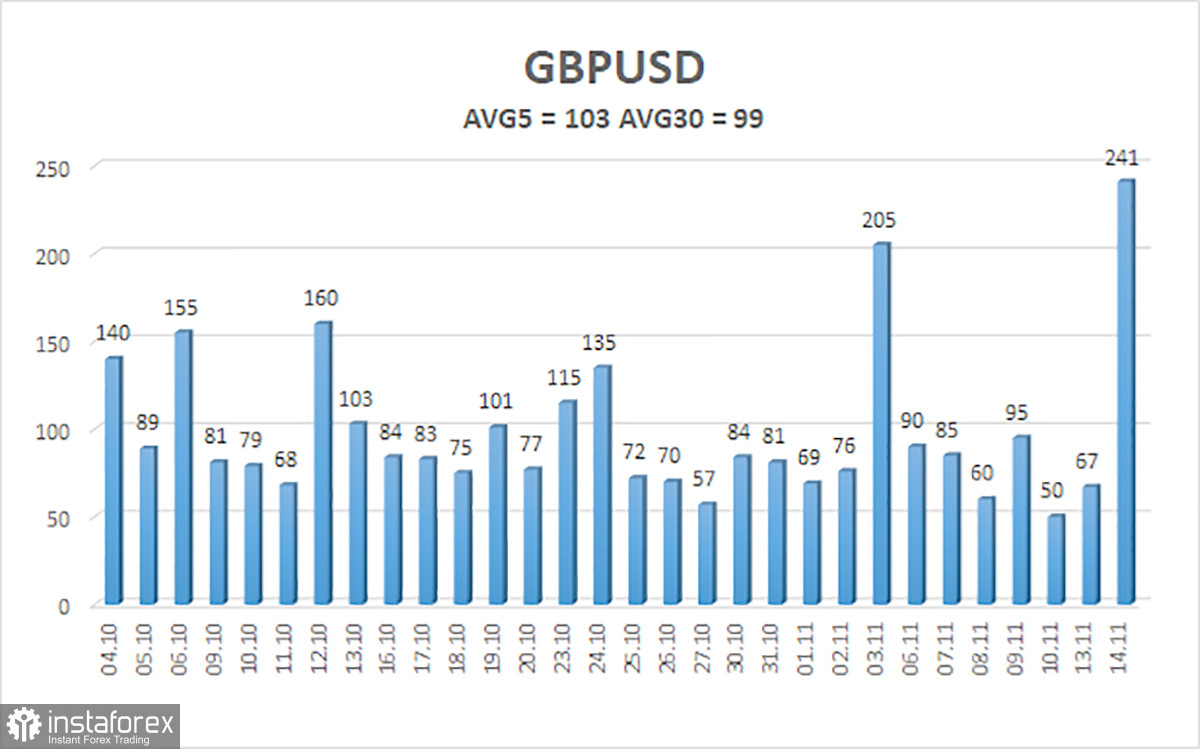

The average volatility of the GBP/USD pair over the last five trading days is 103 points. For the pound/dollar pair, this value is considered "average." Therefore, on Wednesday, November 15, we expect movements within the range limited by the levels of 1.2387 and 1.2593. A reversal of the Heiken Ashi indicator will indicate a new phase of the downward correction.

Nearest support levels:

S1 - 1.2451

S2 - 1.2390

S3 - 1.2329

Nearest resistance levels:

R1 - 1.2512

R2 - 1.2573

R3 - 1.2634

Trading recommendations:

The GBP/USD currency pair started a new downward movement phase and immediately ended it. Short positions can be considered with targets of 1.2268 and 1.2207 if the price consolidates below the moving average. Long positions can technically be considered since the price has settled above the moving average, with targets of 1.2512 and 1.2593. Still, today, the pair's movement can be anything due to the British inflation report.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) means that a trend reversal is approaching in the opposite direction.