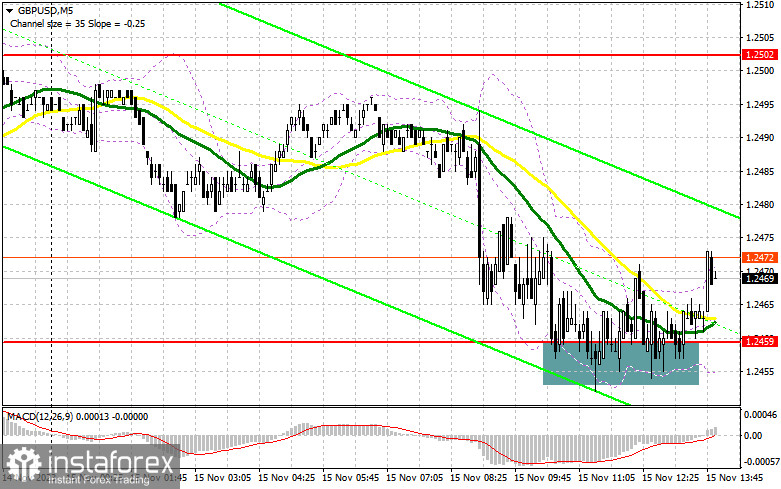

In my morning forecast, I drew attention to the level of 1.2459 and recommended making decisions on market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The decrease and the formation of a false breakout at this level allowed for an entry point for long positions, but an active upward movement of the pair has yet to occur. The technical picture for the second half of the day still needs to be revised.

To open long positions on GBP/USD, the following is required:

Below economists ' forecasts, the released inflation data in the UK led to a sharp drop in the British pound. However, a major sell-off has yet to materialize and is unlikely to happen. Ahead of us are data on changes in retail trade volume in the US and the producer price index. A decrease in retail sales in the US will lead to an immediate surge in the pair towards new monthly highs and the continuation of the bullish market. In the case of another decline in the pair after the reports, only the formation of a false breakout at 1.2459, similar to what I analyzed above, will confirm the correct entry point for long positions in continuation of the bullish scenario observed the day before. The target remains the high of yesterday at 1.2502. Breaking and consolidating above this range will lead to a new signal to open long positions with an exit to 1.2543. The ultimate target will be the area around 1.2881, where I will take profit. In the scenario of a pair decline and the absence of activity at 1.2459 from buyers in the second half of the day, the pressure on the pair will increase. However, expecting a major sell-off of the British pound, which held steady even after news of a sharp inflation decline, is unlikely. A false breakout in the area of the next support at 1.2425 will signal the opening of long positions. I plan to buy GBP/USD immediately on the rebound only from 1.2394, with a correction target of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Bears still have a chance for a more powerful correction, but it will depend on US inflation data. In the case of a positive reaction to the report, only the formation of a false breakout around the monthly maximum of 1.2502 will signal opening short positions in the pound, expecting a downward movement to support at 1.2459, tested today in the first half of the day. Breaking and a bottom-up retest of this range will deal a more serious blow to buyer positions, leading to stop-loss sweeps and opening the way to 1.2425. A more distant target will be the area of 1.2394, where I will take profit. In the scenario of GBP/USD growth and the absence of activity at 1.2502 in the second half of the day, buyers will have a chance to build an upward trend further. In this case, I will postpone sales until a false breakout at 1.2543. If there is no downward movement, I will sell GBP/USD immediately on the rebound from 1.2581, but I am only expecting a pair correction down by 30-35 points within the day.

Indicator Signals:

Moving Averages

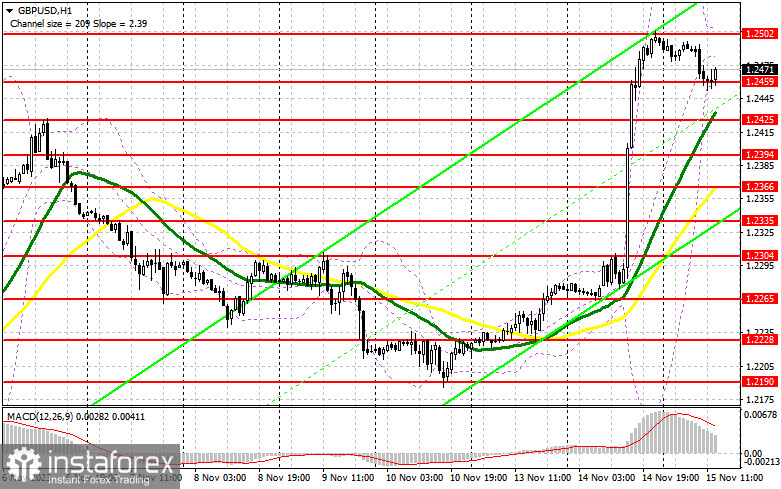

Trading is conducted above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator will act as support around 1.2459.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.