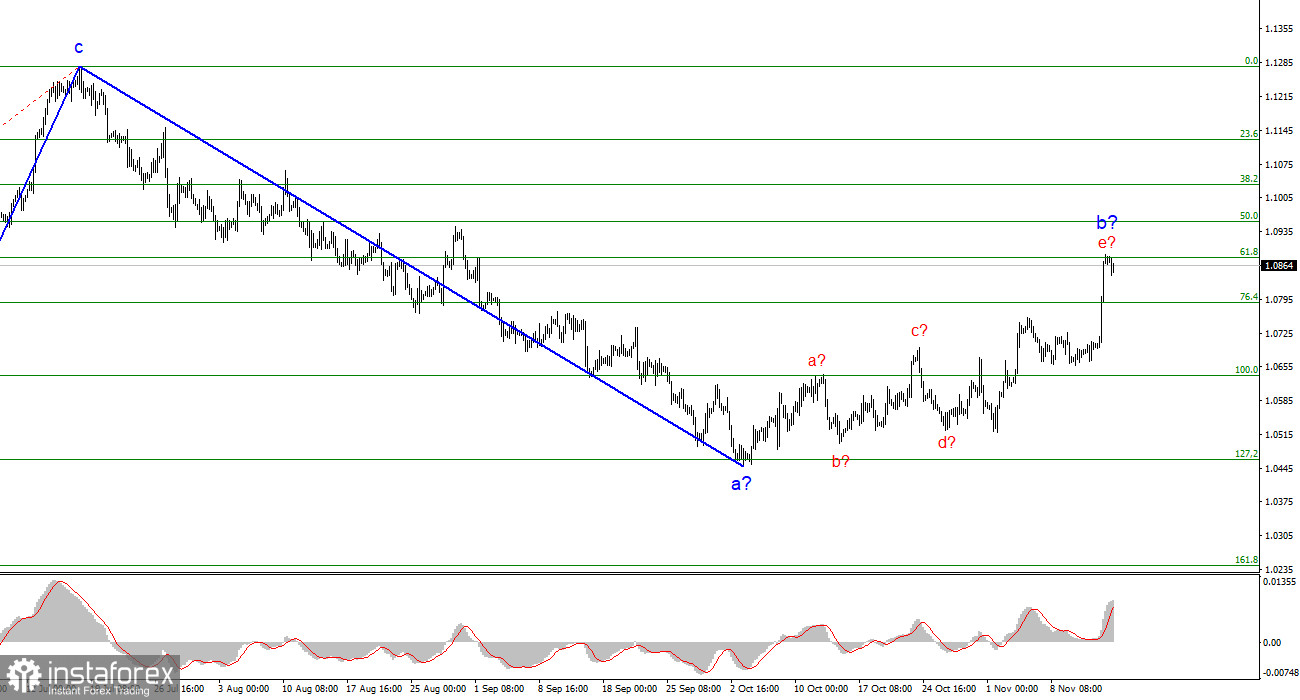

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past months, I have regularly mentioned that I expect the pair near the 5th figure, where the construction of the last upward three-wave structure began. This target was reached after a two-month decline. After reaching this target, the construction of corrective wave 2 or b began predictably, which has already taken a clear five-wave form, but the inflation report caused this wave to take an even more complex shape. Nevertheless, the working scenario remains the same – wave 3 or c construction.

Whatever wave 2 or b eventually turns out to be (I warned that it could be much more complex), overall, the decline of the European currency will not be complete because, in any case, the construction of the third wave of the downtrend is required. Wave e in 2 or b will likely take a five-wave form, after which the rise in quotes will be completed.

European statistics continue to disappoint

The euro/dollar pair rate decreased by ten basis points on Wednesday after rising by 180 on Tuesday. Excellent correction. Yesterday, I already mentioned that the decline in the US currency caused by the US inflation report looks excessive. Wave analysis always allows for the complication of the wave structure, but now the assumed wave e has taken a five-wave form, which could have been avoided. In general, yesterday's inflation report was in the markets and the wave analysis. According to the current wave picture, I still expect a descending wave 3 or c construction. An unsuccessful attempt to break through the level of 1.0880, which corresponds to 61.8% according to Fibonacci, may indicate the market's readiness to sell the pair finally.

Today, a report on industrial production was released in the European Union, the volumes of which decreased by 1.1% in September every month. The market was prepared for this scenario, so it did not react to this report. However, yesterday, the market was prepared for a decrease in US inflation to 3.3%. Nevertheless, the reaction was very strong, even excessively strong. Therefore, what is happening now in the foreign exchange market does not fit into the usual picture of things. Movements are very nervous and can lead to even greater complexity of the current wave analysis. I want to avoid this, but I don't control the market.

General conclusions.

Based on the conducted analysis, the construction of a downward wave set continues. Targets around the level of 1.0463 have been perfectly worked out, and an unsuccessful attempt to break this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so in the near future, I expect the construction of an impulsive descending wave 3 or c with a significant decrease in the pair. I still recommend sales with targets below the low of wave 1 or a. Wave 2 or b may take a more prolonged form, so sales should be cautious initially.

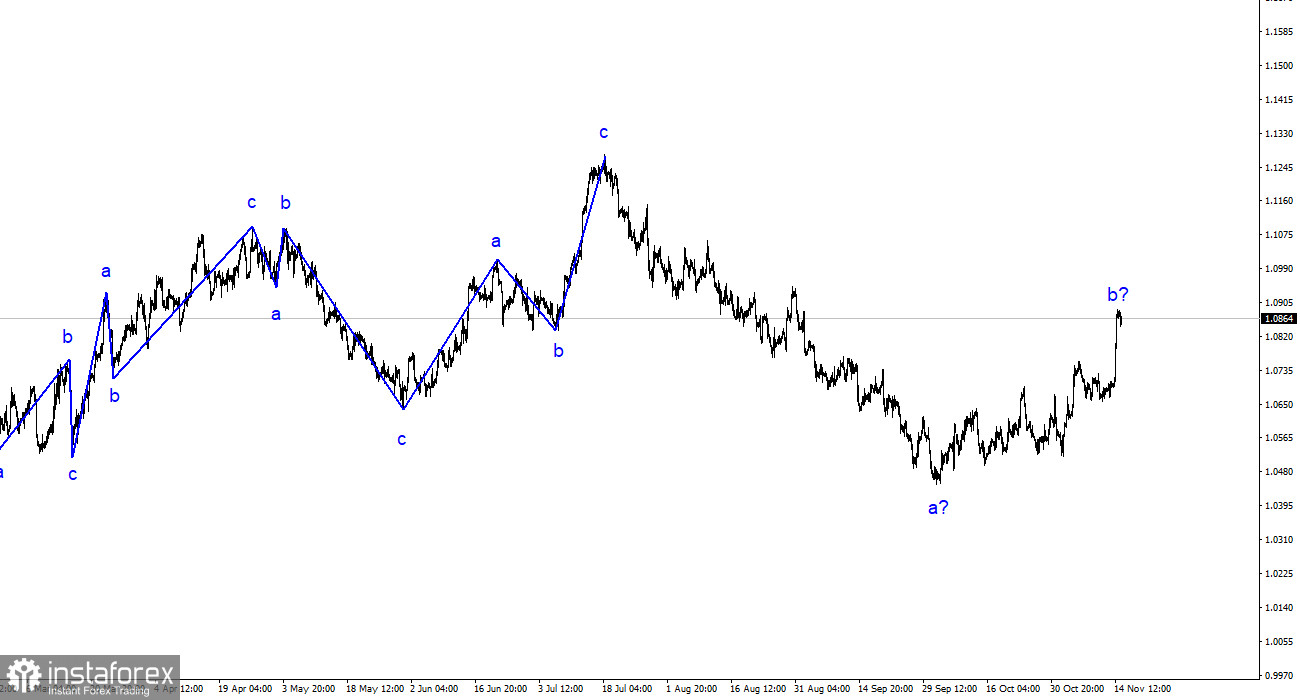

On a larger wave scale, the upward trend wave analysis has taken an extended form but is likely completed. We have seen five waves up, most likely a structure a-b-c-d-e. Further, the pair built four three-wave structures: two down and two up. Now, it has moved on to building another extended downward three-wave structure.