On Wednesday, the EUR/USD pair attempted to start a downward movement, which is a correction against the previous correction. It is worth reminding that the upward movement of the past one and a half months is a correction against a stronger and more prolonged decline in the pair. Accordingly, the current pullback will be a correction against this correction. We expect the resumption of the downward trend since we still do not see grounds for a strong rise in the European currency. This month, a significant portion of macroeconomic reports from the United States failed, leading to a slightly stronger strengthening of the euro. The ISM indices fell, Nonfarm Payrolls were below forecasts, and inflation slowed more than expected. It is these reports that propelled the pair so high.

However, looking at European statistics, there are few optimistic news. Suppose the market eagerly sold the dollar upon learning about a slightly stronger slowdown in inflation in the United States. In that case, it should also sell the euro because inflation in the EU is even lower. Economic growth in the European Union has been absent for practically five quarters, unlike the United States, where the economy is not just growing but growing at a high pace. Business activity in the European Union has long been below the "waterline" of 50.0. Therefore, there is no reason to buy the euro now. Yes, a few American reports failed, so the euro appreciated, but we need long-term reasons for growth.

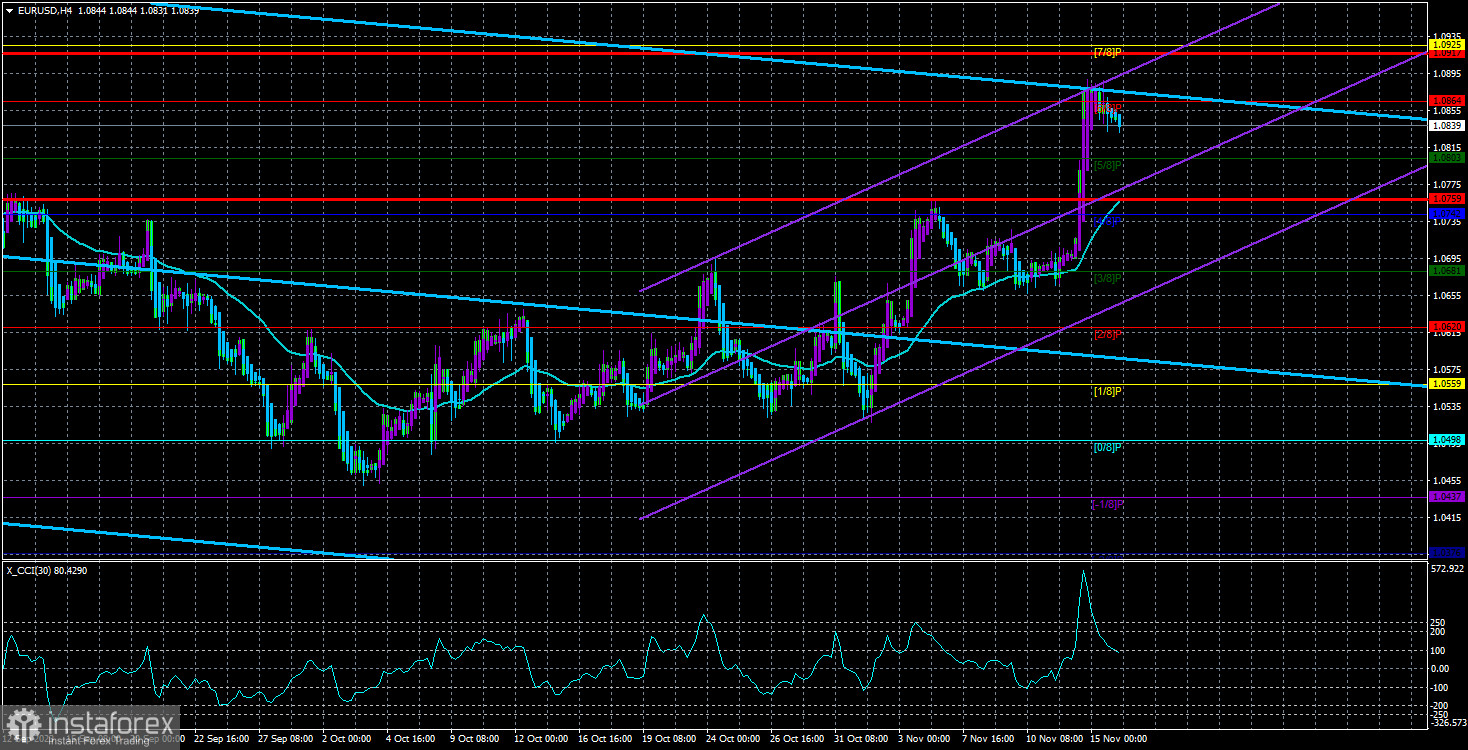

In the 24-hour timeframe, the price has settled above the Ichimoku cloud, and this is a buy signal. Therefore, from a technical point of view, it is now more challenging to believe in a new decline in the pair than it was a few weeks ago. However, Ichimoku sometimes generates false signals. The triple overbought condition of the CCI indicator on the 4-hour timeframe indicates that the pair's decline should have started long ago. It would have started without a series of weak reports from the United States.

The European Commission is lowering economic forecasts. Yesterday, the European Commission published updated forecasts for the economy and inflation, and there are no revelations or surprises for traders. The forecast for economic growth in 2023 has been reduced from 0.8% to 0.6%, and it must be said that this is still quite good. Economic growth exists, and just a year ago, everyone expected a recession, especially from the European Union. The fact that the pace of economic growth is falling is undoubtedly negative, but they have not fallen into negative territory, and there is no recession. If inflation declines, the ECB may start easing monetary policy next year.

For the euro, all this information is simultaneously "hot and cold." Falling inflation and the prospects of an ECB rate cut are negative. Less severe economic decline and recovery prospects are positive. Inflation, the pace of its slowdown, and the timing of the ECB easing program will still be significant for the market soon. It is challenging to say whose fundamental background is stronger because the Fed has fewer reasons to raise rates soon. Thus, from a fundamental point of view, neither the euro nor the dollar should be falling now.

However, remembering how much the euro has appreciated over the past year and a half and how weakly it has corrected downwards, we believe the southward movement still needs to be completed. A scenario of global consolidation is also possible, where the pair will remain in a limited price range for a long time. The market has already worked out all the most global factors, so there are no new reasons for long-term and large purchases of the euro or the dollar now. Thus, it should be remembered that a new decline is possible in the coming months, but it may be weaker than the first downward spiral in July-October of this year.

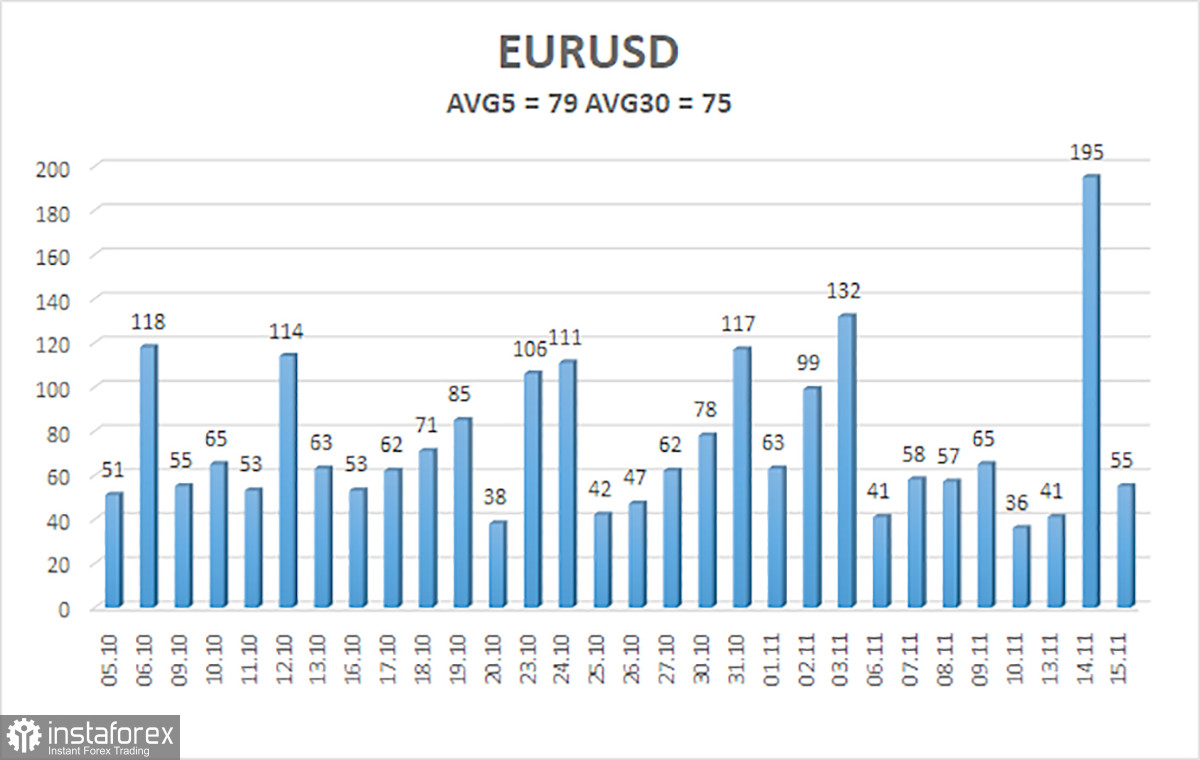

The average volatility of the EUR/USD currency pair for the last five trading days as of November 16 is 79 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0759 and 1.0917 on Thursday. The reversal of the Heiken Ashi indicator downwards indicates the beginning of a downward correction.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair has shown a new upward movement above the moving average. At the moment, one should consider buying, but we strongly doubt that the pair's growth will continue, given the triple overbought condition of the CCI indicator. Selling the euro will become relevant after the price is firmly below the moving average, with targets at 1.0681 and 1.0620.

Explanations for illustrations:

Linear regression channels help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which it is currently advisable to trade.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.