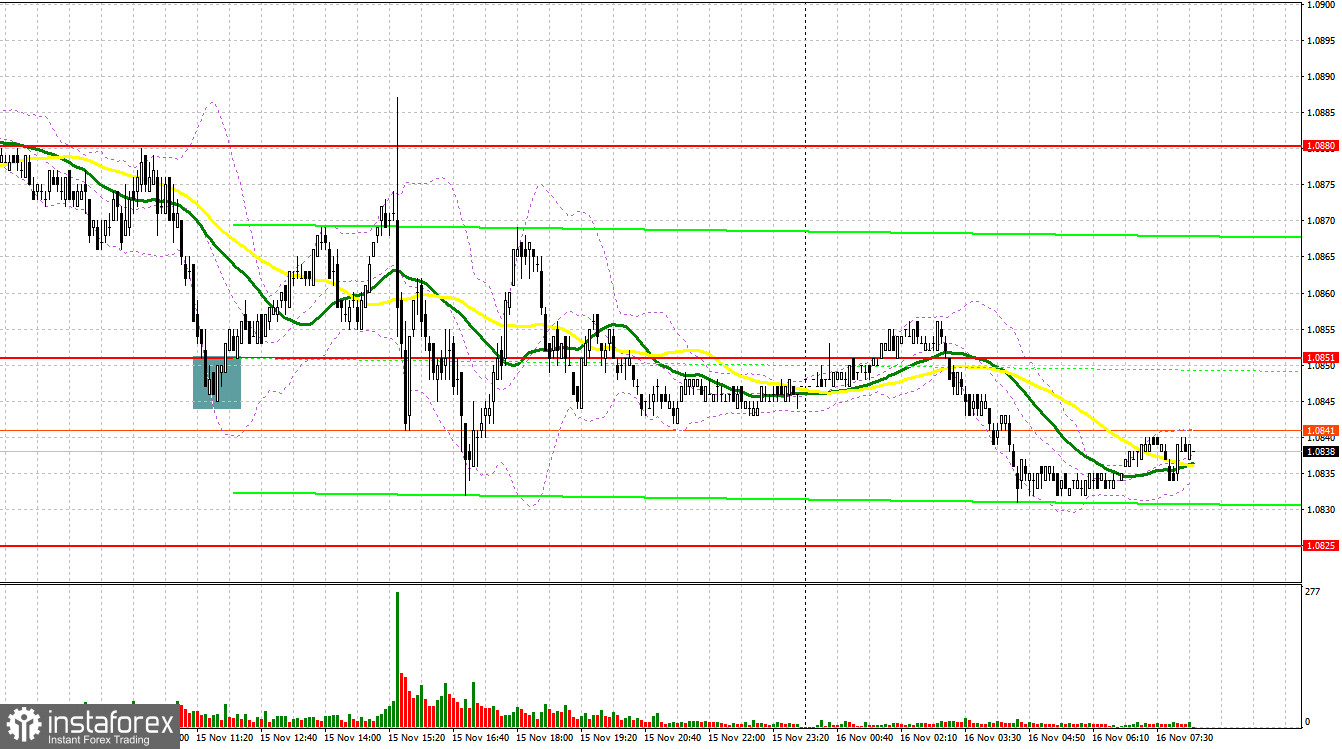

Yesterday, only one market entry signal was formed. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0851 as a possible entry point. A decline and a false breakout at 1.0851 produced a buy signal. As a result, the pair was up by more than 30 pips. In the afternoon, we did not get any good entry points.

For long positions on EUR/USD:

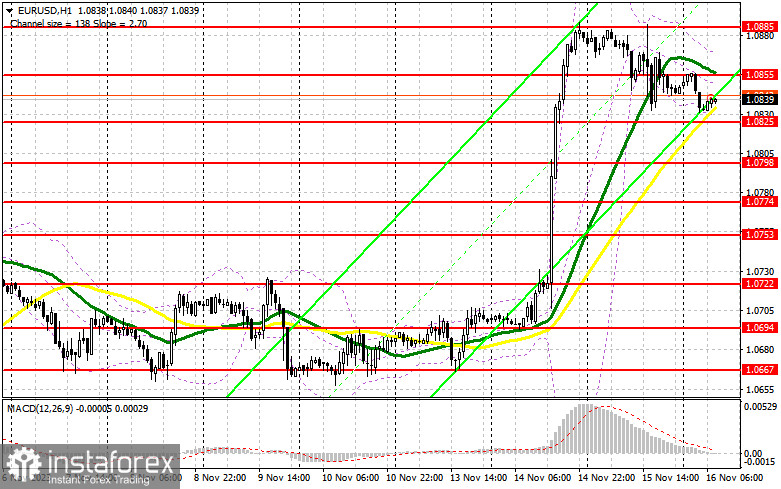

The US retail sales data brought confusion to the market, as it turned out to be better than economists' forecasts, but was worse than the previous month. The single currency fell after this report, but it wasn't a selloff. No economic reports scheduled in the first half of the day, and traders will probably ignore Italy's balance of trade data. Market participants may keep an eye on European Central Bank President Christine Lagarde's speech, as it may help the euro recover its losses. If she shows a completely dovish stance, the pressure on EUR/USD will remain. Due to this, I intend to act on dips near the nearest support at 1.0825. A false breakout on this mark, similar to what I described above, will serve as a confirmation of an entry point for long positions in hopes of building an uptrend and aiming for growth towards resistance at 1.0855, which was formed yesterday. This is in line with the bearish moving averages. A breakout and a downward test of this range will produce another buy signal, offering it a chance to spike to a monthly high of 1.0885. The ultimate target will be 1.0908, where I will lock in profits. In the event of EUR/USD dropping and a lack of activity at 1.0825, things will not go well for the bulls. In such a scenario, only the formation of a false breakout near the next support at 1.0798 will give a buy signal. I will open long positions immediately on a rebound from 1.0774, considering an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

Sellers are trying their best to bring the euro back from heaven to earth, but the recent economic reports are not helping. A very dovish remark from the ECB president may exert a lot of pressure on the euro. But until that happens, the objective is to defend 1.0855. A false breakout at this mark will give a good sell signal to support the downward correction and test support at 1.0825. This is where large buyers may step in. After a breakout and consolidation below this range, as well as its upward retest, do I expect to receive another signal to sell the pair with a target at 1.0798. The ultimate target will be the 1.0774 low where I will be taking profits. In the event of an upward movement in EUR/USD during the European session and the absence of bears at 1.0855, buyers will regain control of the market. Under such circumstances, I will postpone selling the pair until the price hits the monthly high at 1.0885. Selling there is also an option, but only after a failed consolidation. I will initiate short positions immediately on a pullback from 1.0913, considering a downward correction of 30-35 pips.

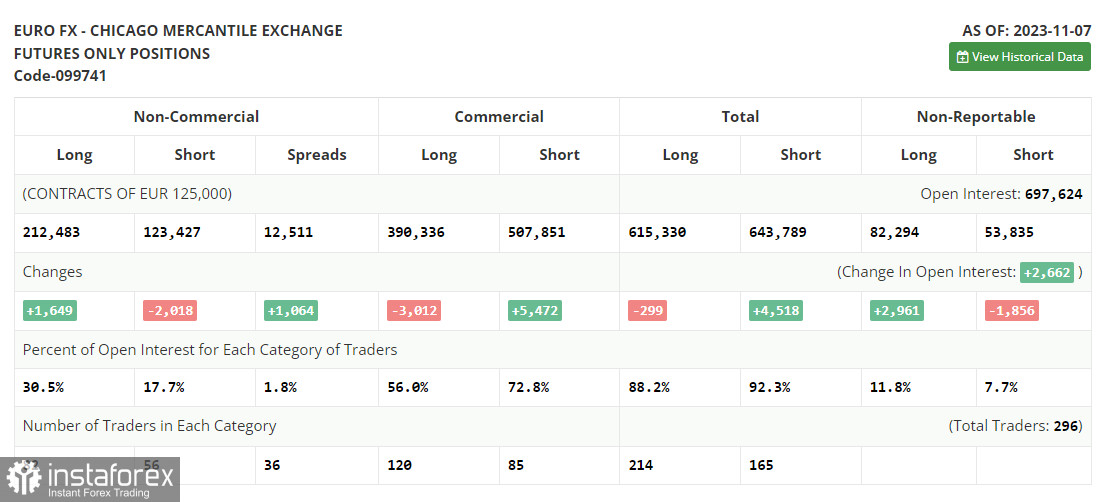

COT report:

The COT report for November 7 showed a reduction in short positions and an increase in long ones. Take note that this report only includes the market's reaction to the Federal Reserve meeting, which kept interest rates steady. However, last week the Fed officials made it clear that their interest rate decisions will depend on the incoming data, leaving the door open for another rate increase projected by the end of the year. This week, we will be familiarized with the US inflation report, which may set the pair's direction for a few weeks ahead, as well as other important data. According to the latest COT report, non-commercial positions increased by 1,649 to 212,483, while short non-commercial positions fell by 2,018 to 123,427. As a result, the spread between long and short positions increased by 1,064. The closing price rose sharply to 1.0713 from 1.0603.

Indicator signals:

Moving averages:

Trading just around the 30- and 50-day moving averages indicates sideways movement.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0825 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.