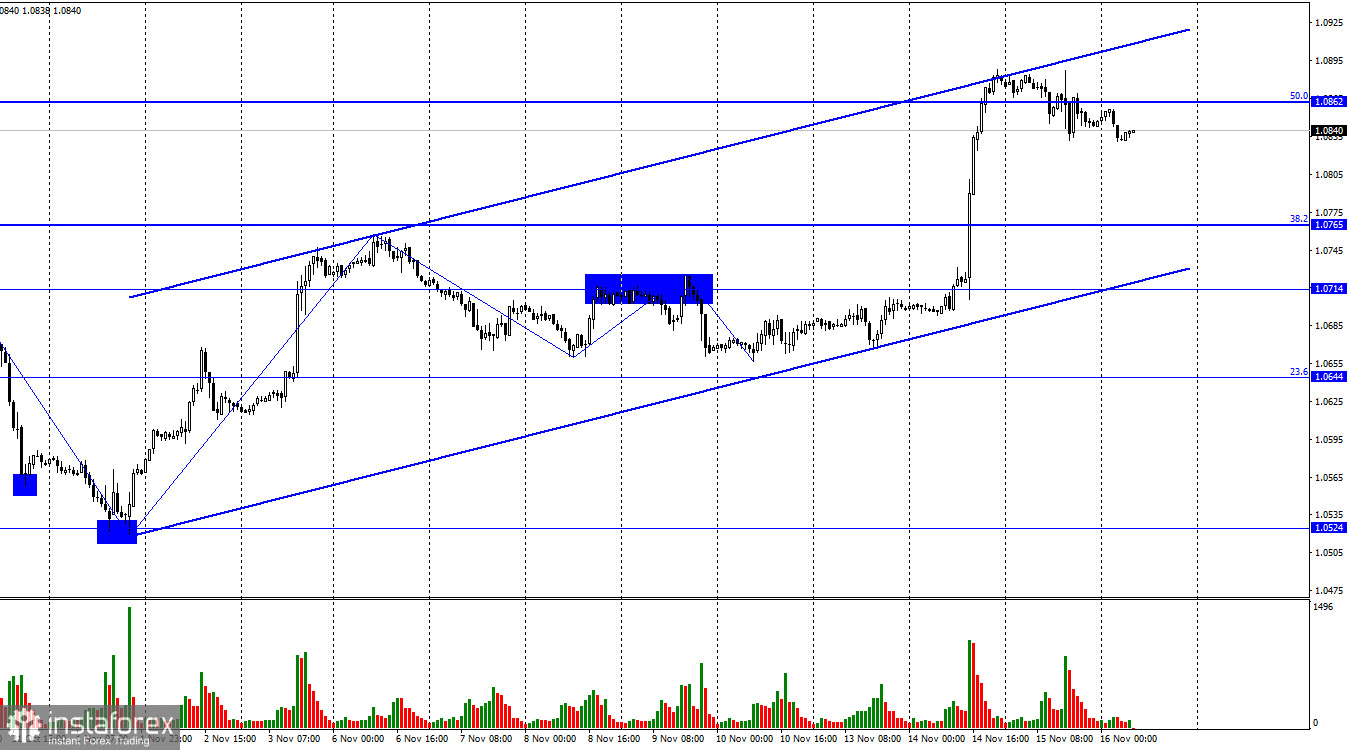

The EUR/USD pair reversed in favor of the US dollar on Wednesday and consolidated below the corrective level of 50.0% (1.0862). The pair also rebounded from the upper line of the ascending trend corridor, which characterizes the current sentiment of traders as "bullish." Thus, two sell signals were received, and the pair began falling towards the Fibonacci level of 38.2%–1.0765. Fixing quotes above the level of 1.0862 will work in favor of the euro and the resumption of growth towards the next corrective level of 61.8% (1.0958).

The wave situation remains ambiguous. We seem to have a clear "bullish" trend, but the waves' sizes and alternation leave many questions unanswered. It is now better to rely on the trend corridor and levels. For the current trend to change to "bullish," the pair needs to fall to 1.0644. This may take several days or even a week.

Yesterday, the European Union released a report on changes in industrial production volumes. Volumes decreased by 6.9% y/y and by 1.1% m/m. Traders expected more optimistic figures, and the euro came under market pressure from the beginning of the day. A little later, one of the members of the ECB Board, Peter Kazimir, spoke, stating that over the next few quarters, the regulator will have to keep interest rates at their peak. There is no talk of rate cuts in the first half of next year. Also, Kazimir noted that it is still too early to declare victory over inflation, and the process of tightening monetary policy cannot be considered complete. The risks of inflation acceleration still exist, and the ECB may need to intervene again. Kazimir states a new rate hike is possible if economic data necessitate it.

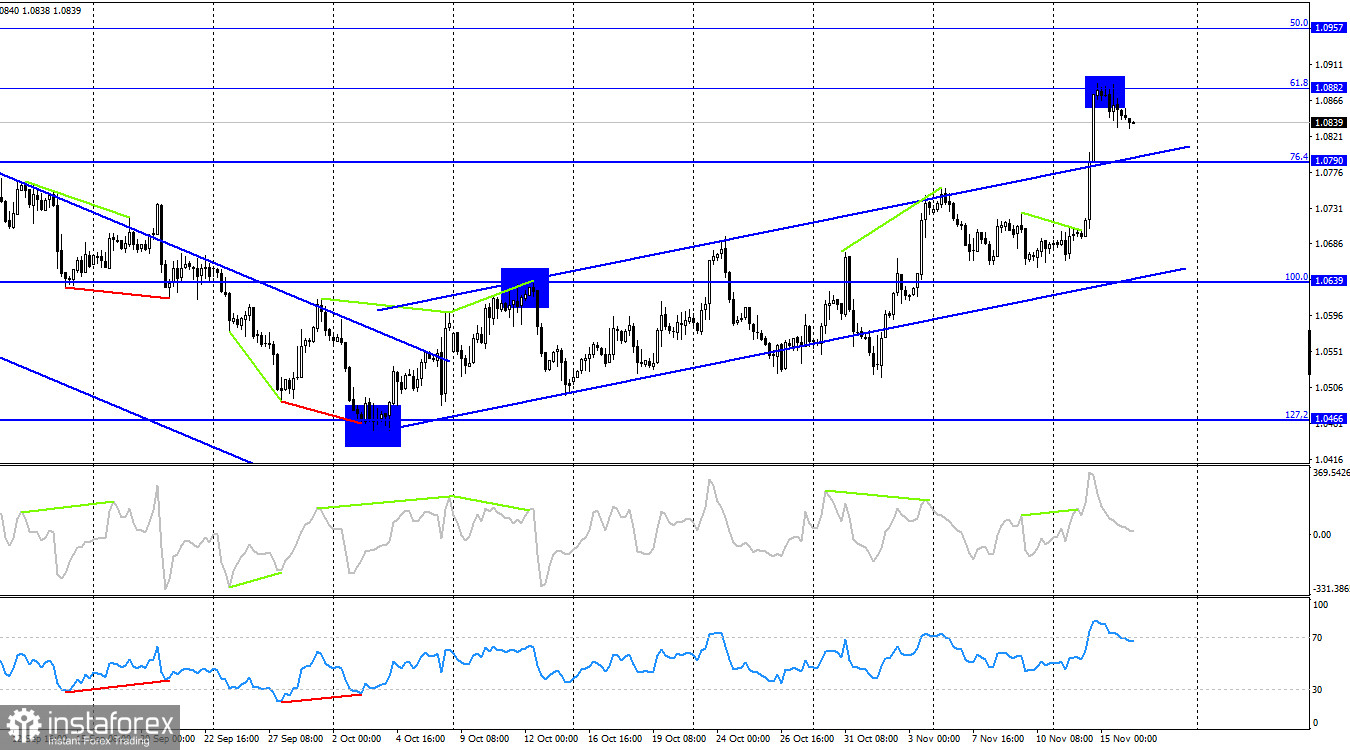

On the 4-hour chart, the pair rose to the corrective level of 61.8% (1.0882). The rebound of quotes from this level favored the US currency, and the pair began to fall toward the corrective level of 76.4% (1.0790). There are no impending divergences from any of the indicators today. Closing above the level of 1.0882 will further increase the probability of further growth towards the next Fibonacci level of 50.0%–1.0957.

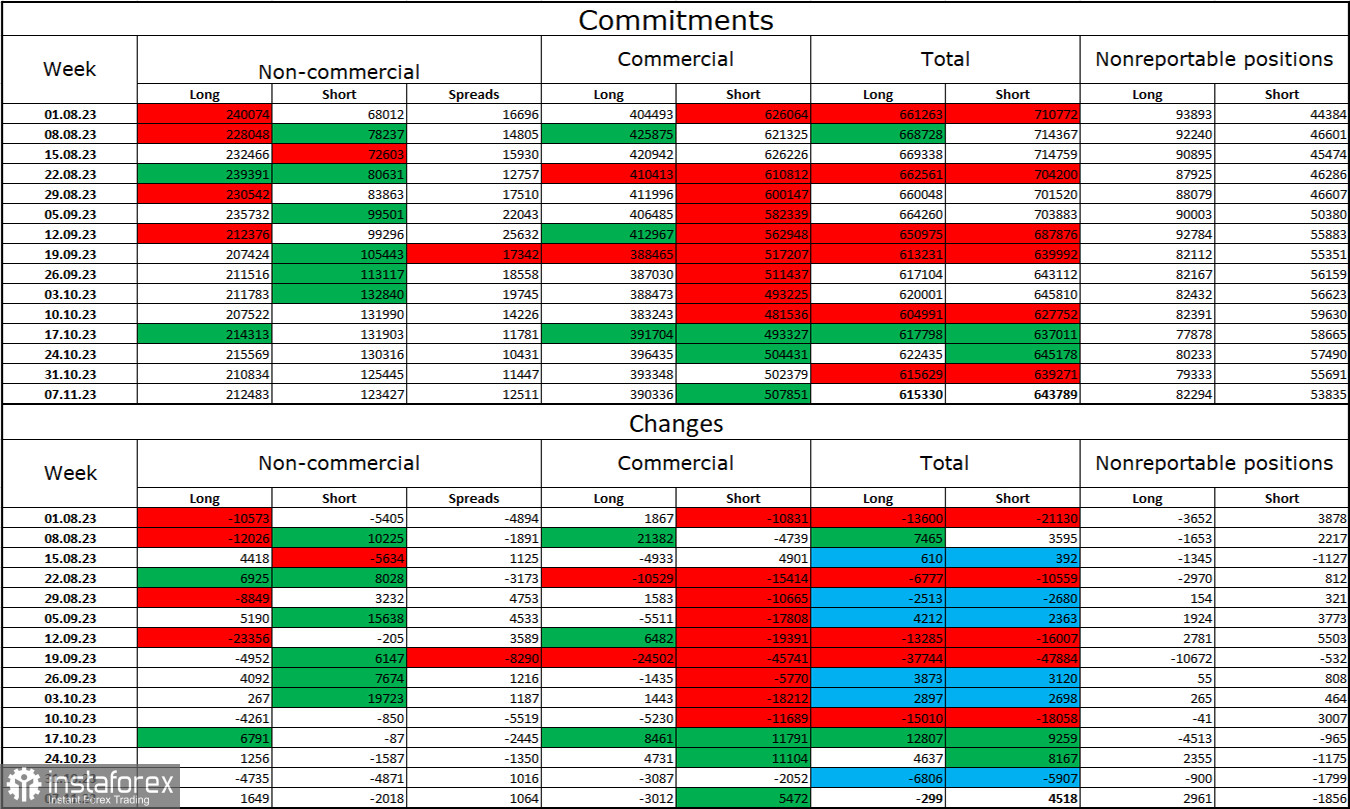

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 1649 long contracts and closed 2018 short contracts. The sentiment of major traders remains "bullish" but has noticeably weakened in recent weeks and months. The total number of long contracts concentrated in the hands of speculators is now 212 thousand, and short contracts - 123 thousand. The difference is now less than double, although a few months ago, the gap was threefold. The situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need strong information to start a new "bullish" trend. There is no such background now. Professional traders may continue to close long positions soon. The current figures allow for a continuation of the decline in the euro in the coming months.

News calendar for the US and the European Union:

US - Philadelphia Fed Manufacturing Index (13:30 UTC).

US - Initial Jobless Claims (13:30 UTC).

US - Industrial Production (14:15 UTC).

On November 16, the economic events calendar contains three second-order entries. The impact of the information background on traders' sentiment on Thursday may be weak.

Forecast for EUR/USD and trader recommendations:

I still do not recommend considering buying the pair at the moment. In the case of quotes consolidating above 1.0862 with the target of 1.0958, it should be understood that after a rise of 200 points, the probability of such a movement is low. I recommended selling yesterday when closing below the level of 1.0862 on the hourly chart with a target of 1.0765. These deals can be kept open now.