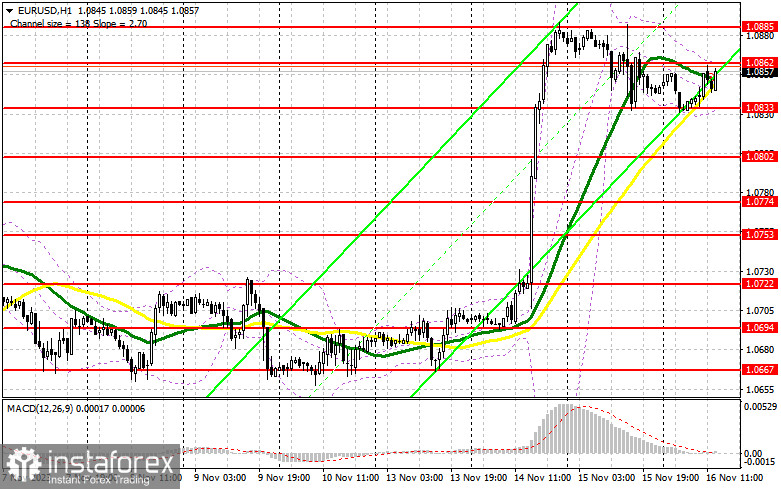

In my morning forecast, I drew attention to the level of 1.0855 and recommended making entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and formation of a false breakout at 1.0855 allowed for a good entry point, counting on the pair's downward movement. However, after a 10-point correction, demand for the euro returned. Due to low market volatility, it was necessary to reconsider the technical picture for the second half of the day.

To open long positions on EUR/USD, the following is required:

Today, there are a lot of statistics, and it all starts with data on the weekly number of initial claims for unemployment benefits in the United States and the Philadelphia Fed Manufacturing Index. Equally important will be reports on changes in industrial production volumes, where a decrease is expected, as well as the NAHB Housing Market Index. But if this is not enough to determine the future market direction, it is worth listening to what FOMC members John Williams, Loretta Mester, and Christopher Waller will say. Soft statements are a direct path for the euro to the area of the monthly maximum. In the event of a pair's downward movement after the data, I expect buyer activity only around the support at 1.0833, formed by the results of the first half of the day. The formation of a false breakout there will provide a good entry point for long positions, counting on the further development of the bullish trend and a test of resistance at 1.0862, also formed today. A breakthrough and an update from the top to the bottom of this range will allow a surge to 1.0885. The ultimate target will be the area of 1.0913, where I will take profits. With a decline in EUR/USD and the absence of activity at 1.0833 in the second half of the day, trading will remain within the range of a sideways channel. In this case, I will postpone purchases until the formation of a false breakout around 1.0802. I will open long positions immediately on a rebound from 1.0774 with the target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, the following is required:

Sellers showed themselves in the first half of the day, but a significant downward movement of the pair has yet to occur. Weak data from the United States will lead to a test of the new resistance at 1.0862, where I expect the first appearance of bears. The formation of a false breakout there, similar to what I discussed earlier, will signal a sale, counting on another small downward correction to support at 1.0833, where large buyers have already shown themselves once today. But only after a breakthrough and consolidation below this range, as well as a reverse test from bottom to top, do I expect to get another selling signal with an exit to 1.0802. The ultimate target will be a minimum of 1.0774, where I will take profits. In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.0862, this is likely the case; it is better to postpone sales until 1.0885. Selling can be done there, but only after an unsuccessful consolidation. I will open short positions immediately on a rebound from the maximum of 1.0913, with the target of a downward correction of 30-35 points.

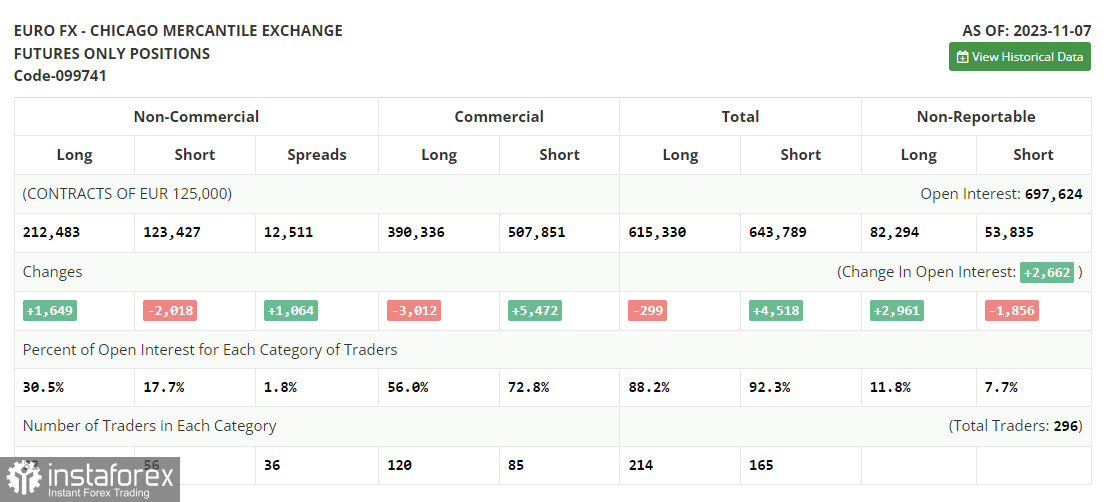

In the COT report (Commitment of Traders) for November 7, there was a reduction in short positions and an increase in long positions. It is worth noting that these data only include the market's reaction to the meeting of the US Federal Reserve, where decisions were made to keep the policy unchanged. However, last week, representatives of the Fed made it clear that the future of interest rates would entirely depend on incoming data, not excluding another rate hike at the end of this year. Soon, we will see the US inflation report, which can set the direction for the pair for several weeks ahead, and a series of other important statistics. The COT report indicated that long non-commercial positions increased by 1,649 to 212,483, while short non-commercial positions decreased by 2,018 to 123,427. As a result, the spread between long and short positions increased by 1,064. The closing price sharply increased and reached 1.0713 against 1.0603.

Indicator Signals:

Moving Averages:

Trading is carried out around the 30 and 50-day moving averages, indicating market uncertainty about the direction.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In the case of a decrease, the lower boundary of the indicator at 1.0833 will act as support.

Description of Indicators:

- Moving Average (MA) is a tool for smoothing volatility and noise in the current trend determination. The period is 50. It is marked on the chart in yellow.

- Moving Average (MA) is a tool for smoothing volatility and noise in the current trend determination. The period is 30. It is marked on the chart in green.

- Moving Average Convergence/Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands represent a volatility indicator consisting of two bands drawn at a certain distance above and below the simple moving average (SMA) of a security's price. The period is 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total number of short open positions non-commercial traders hold.

- The total non-commercial net position differs between non-commercial long and short positions.