On the hourly chart, the GBP/USD pair continued its downward movement towards the corrective level of 23.6% (1.2321) on Thursday after rebounding from the zone of 1.2477 (1.2513). A rebound of quotes from the level of 1.2321 will favor the European currency and some growth of the euro. If the pair's rate is fixed below the level of 1.2321, it will contribute to the continuation of the decline towards the levels of 1.2250 and 1.2186.

The wave situation remains ambiguous for the pound. Look at the size of the last three waves. Waves can vary in size, but the stronger they are, the harder it is to determine the short-term trend. At the moment, the trend is clearly "bullish," but the pair can easily drop by 200-250 points within another "bearish" wave, and the "bullish" trend will not be violated. This is the current difficulty: the waves are so large that a drop of 250 points is quite possible in a "bullish" trend. It is extremely difficult to determine the potential completion point of the downward wave.

The information background yesterday was again not in favor of the American currency. Three reports were released in the USA, and all three were weaker or worse than traders expected. Thus, during the day, bulls again began to pull the rope to their side. The decline of the British pound continues, but the last downward wave may be weak. Today, the information background will also be weak. Two hours ago in the UK, a report on retail sales was released, again showing a decrease in volumes by 0.3%. Traders expected an increase of 0.3%. After this report, the decline of the pound began, but the effect of this report will not last long. However, the overall chart indicates a continuation of the quote decline, so that's what I expect today.

On the 4-hour chart, the pair reversed in favor of the American and consolidated below the level of 1.2450. Thus, the process of decline can be continued toward the next corrective level of 50.0% (1.2289). However, closing the pair's rate below the level of 1.2289 will increase the likelihood of further decline towards the next level of 1.2035. There are no impending divergences observed in any indicator today.

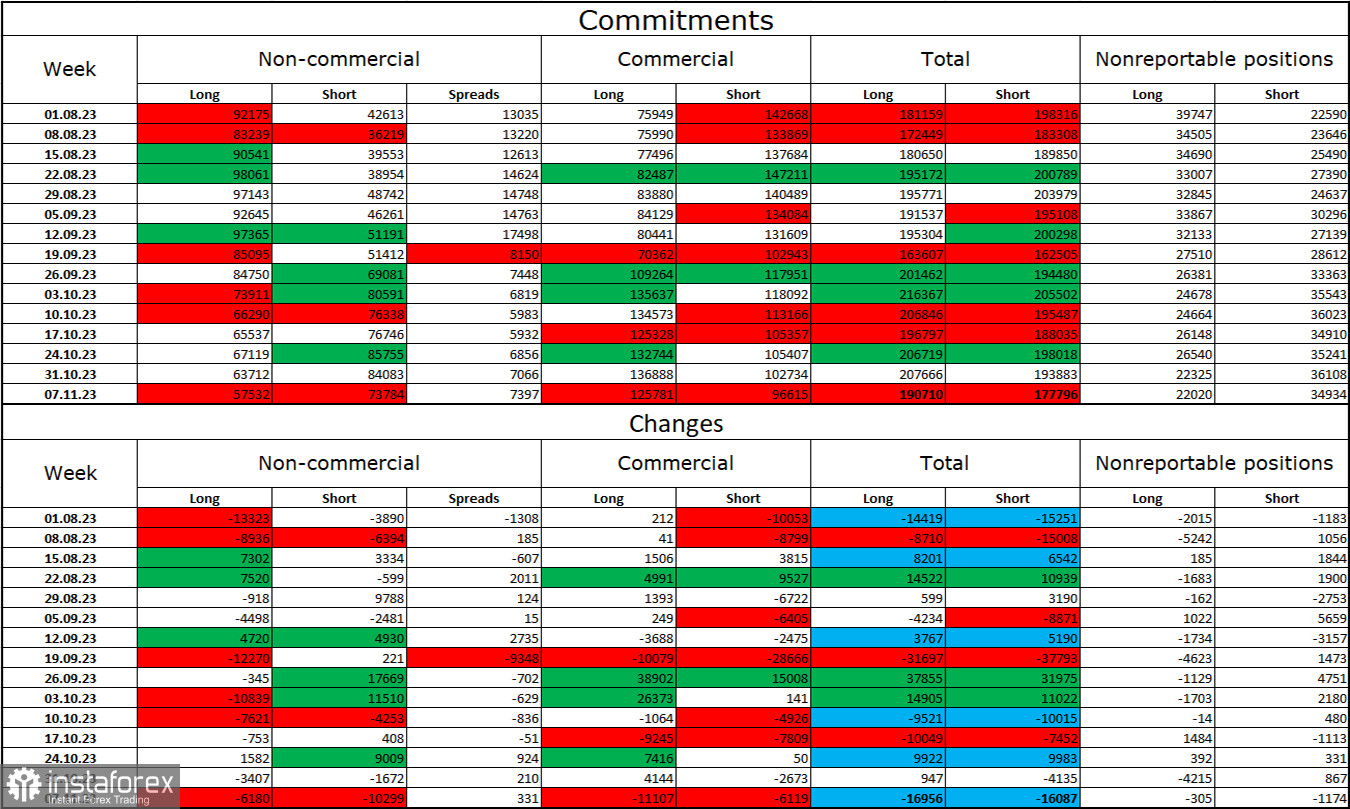

Commitments of Traders (COT) report:

The mood of the "Non-commercial" trader category is slightly less "bearish" in the last report. The number of long contracts held by speculators decreased by 6180 units, and the number of short contracts decreased by 10299. The overall sentiment of major players has long changed to "bearish," and the gap between the number of long and short contracts is increasing, but now in the other direction: 57 thousand against 74 thousand. The prospects for the pound to continue falling remain excellent. I still do not expect a strong rise in the British pound soon. Over time, bulls will continue to get rid of buy positions, as is the case with the European currency. The growth we have seen in recent weeks is corrective.

News Calendar for the USA and the UK:

UK – Retail Sales Volume (07:00 UTC).

USA – Number of Building Permits Issued (13:30 UTC).

On Friday, the economic events calendar contains two interesting entries, but the report on retail trade has already been released. The impact of the information background on market sentiment for the remaining part of the day may be very weak.

Forecast for GBP/USD and trader recommendations:

I recommended selling the pound on a rebound from 1.2477 on the hourly chart with targets at 1.2321 and 1.2250. These deals can be kept open now. I advise buying the pair on a rebound from the level of 1.2321, but I do not expect a strong rise in the British pound.