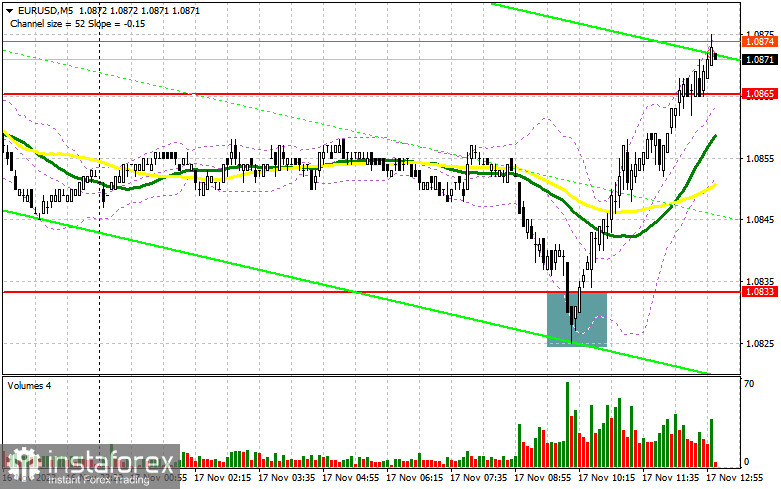

In my morning forecast, I emphasized the level of 1.0833 and recommended making trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at 1.0833 allowed for an excellent entry point for buying, anticipating an upward movement in continuation of the bullish trend. As a result, the rise was about 40 points. The technical picture for the second half of the day has yet to be reconsidered.

To open long positions on EUR/USD, the following is required:

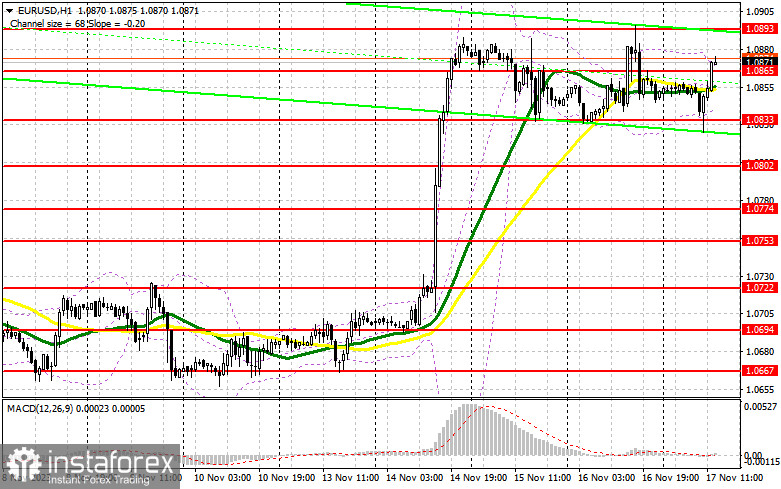

Weak data on the number of building permits issued and new foundations in the United States will help the euro rise and reach a new monthly high. With good indicators and a return of pressure on the euro, buyers will have to assert themselves again around 1.08833, as their presence is unlikely to be seen earlier. The formation of a false breakout there will provide a good entry point for long positions, anticipating further development of the bullish trend and a test of resistance at 1.0865, where the main struggle is currently taking place. Breaking and updating this range from top to bottom will allow a breakthrough to 1.0893. The ultimate target is the area of 1.0922, where I will take profit. In the case of a decline in EUR/USD and a lack of activity at 1.0833 in the second half of the day, pressure on the pair will sharply increase. In this case, I will postpone purchases until the formation of a false breakout around 1.0802. I will consider opening long positions only on a rebound from 1.0774 with a target of a 30-35 point upward correction within the day.

To open short positions on EUR/USD, the following is required:

Sellers tried, but something else worked. Now we need to wait for strong US data and regain control of 1.0865. In the case of weak statistics, only the formation of a false breakout at 1.0893 near the monthly maximum will signal a sale, anticipating another small downward correction to the middle of the channel at 1.0865 and then to the larger support at 1.0833, where significant buyers have already shown themselves once today. Only after breaking and firmly securing below this range, as well as a reverse test from bottom to top, do I expect to receive another sell signal with an exit to 1.0802. The ultimate target is the minimum of 1.0774, where I will take profit. In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.0893, it is best to postpone sales until 1.0922. Selling can be considered, but only after an unsuccessful consolidation. I will consider opening short positions immediately on a rebound from the maximum of 1.0944 with a target of a 30-35 point downward correction.

Indicator signals:

Moving averages

Trading is carried out around the 30 and 50-day moving averages, indicating market uncertainty about the direction.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decrease, the lower boundary of the indicator at 1.0833 will act as support.

Indicator Descriptions:

- Moving Average (50) - Yellow on the chart.

- Moving Average (30) - Green on the chart.

- MACD indicator (12, 26, 9).

- Bollinger Bands (20).

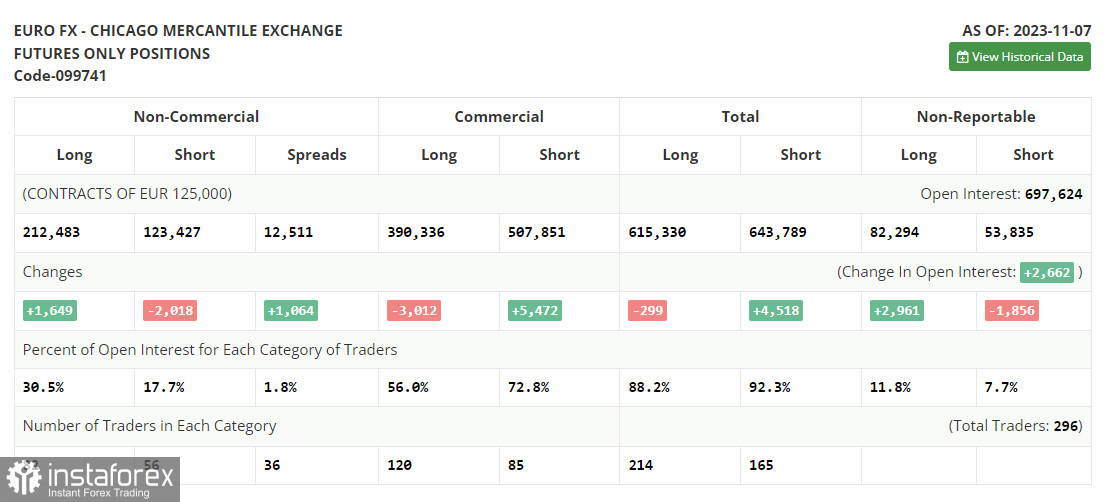

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long non-commercial positions.