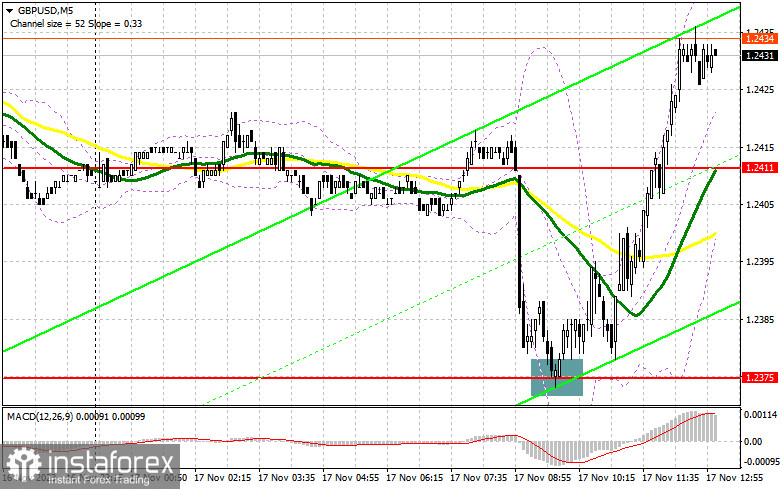

In my morning forecast, I drew attention to the level of 1.2375 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at this level allowed for an entry point into long positions, resulting in a pair's rise of more than 60 points. The technical picture for the second half of the day has yet to be reconsidered.

To open long positions on GBP/USD, the following is required:

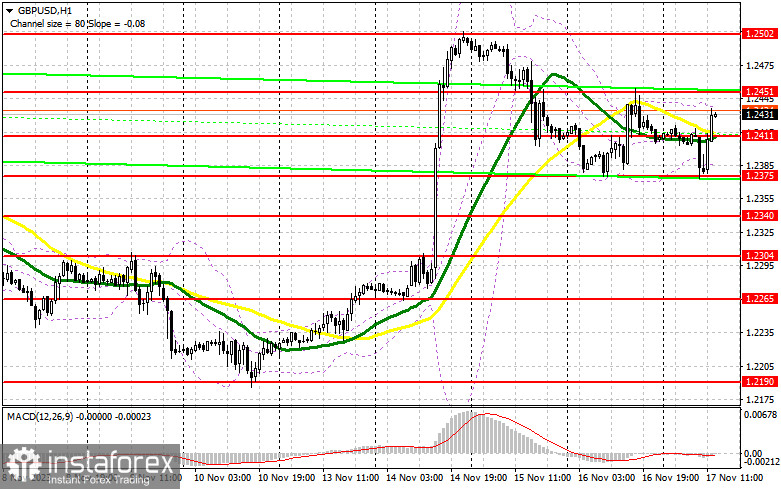

Now, everything will depend on US statistics. Important real estate market data is expected, and weak reports can only strengthen the pound and buyers' positions. Planned speeches by FOMC representatives are likely to play a role in determining the pair's direction. In the case of a decline in GBP/USD after the release of reports, only the formation of a false breakout at 1.2411, similar to what I discussed earlier, will confirm the correct entry point for long positions in continuation of the bullish scenario. The target will be yesterday's high at 1.2451. Breaking and firmly securing above this range will lead to a new signal to open long positions with an exit to 1.2502. The ultimate target is the area of 1.2543, where I will take profit. In the scenario of a pair's decline and the absence of buyer activity at 1.2411, pressure on the pair will increase, but trading will remain within the range of a sideways channel. A false breakout around the next support at 1.2375 will signal an opening of long positions. I plan to buy GBP/USD immediately on a rebound only from 1.2340 with a 30-35 point correction target within the day.

To open short positions on GBP/USD, the following is required:

Despite the unsuccessful attempt to break the lower channel boundary and defend its middle, nothing terrible has happened for sellers yet. In the case of further pair growth, only the formation of a false breakout around the upper channel boundary at 1.2451 will signal the opening of short positions in anticipation of a new downward movement to 1.2411, where the moving averages supporting buyers are located. Breaking and reverse testing from the bottom to the top of this range will deal a more serious blow to bullish positions, leading to stop orders being triggered and opening the way to 1.2375, where the pound has already demonstrated strong growth once today. The more distant target will be the area of 1.2340, where I will take profit. In the scenario of GBP/USD rising and the absence of activity at 1.2451 in the second half of the day, buyers will have a chance to return to the upward trend. In this case, I will postpone sales until a false breakout at 1.2502. In the absence of downward movement, I will sell GBP/USD immediately on a rebound from 1.2543, but I am only expecting a pair correction down by 30-35 points within the day.

Indicator signals:

Moving averages

Trading is carried out above the 30 and 50-day moving averages, indicating the likelihood of pound growth.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decrease, the lower boundary of the indicator at 1.2380 will act as support.

Indicator Descriptions:

- Moving Average (50) - Yellow on the chart.

- Moving Average (30) - Green on the chart.

- MACD indicator (12, 26, 9).

- Bollinger Bands (20).

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long non-commercial positions.