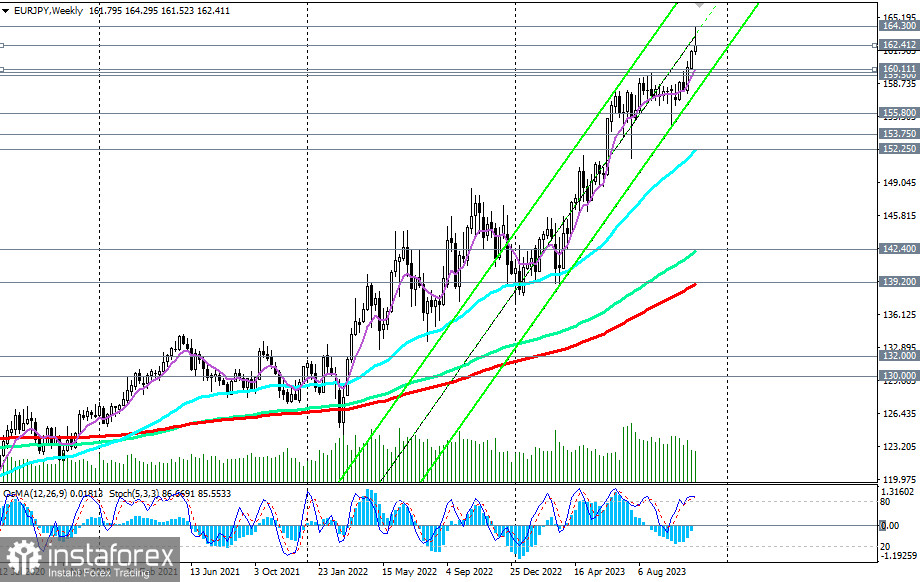

The yen remains vulnerable amid differences in the monetary policies of the Bank of Japan and other major global central banks, such as the Federal Reserve and the European Central Bank. Some economists believe that raising interest rates in Japan is impossible "under the conditions of a hopelessly indebted government." This means that the credit and monetary policy of the Bank of Japan will continue to be very accommodative for a long time. The Bank of Japan will be limited in its actions to curb excessive yen weakening through currency interventions and measures to expand the yield curve of 10-year government bonds within the so-called "YCC policy."

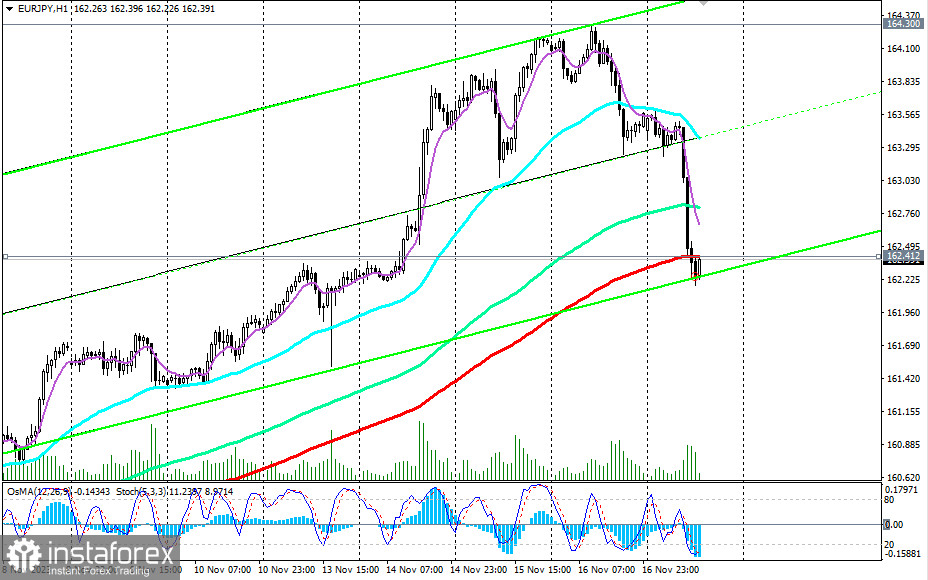

From the mentioned analysis, it logically follows that further weakening of the Japanese yen is plausible, selling it, including in the EUR/JPY cross pair, especially on downward corrections, such as the current one—where the price has reached a significant support level of 162.41 (200 EMA on the 1-hour chart).

The downward correction may, of course, not stop at this support level and, breaking through it, move further.

In this case, it is necessary to limit the BUY order from the level of 162.41 with a stop-loss below today's local low of 162.18. If the decline in EUR/JPY continues, new BUY orders can be placed near the support zone near levels 160.70 (144 EMA on the 4-hour chart), 160.10 (200 EMA on the 4-hour chart), 159.75, 159.50 (50 EMA on the daily chart). Our main scenario is further growth of EUR/JPY.

An alternative scenario would be associated with breaking the support level of 159.50 and further decline down to key supports at levels 155.80, 153.75 (200 EMA on the daily chart), 153.00, 152.25 (50 EMA on the weekly chart), separating the medium-term bullish market from the bearish one.

Breaking today's low of 162.18 will be a signal to implement this scenario and for new short positions with intermediate targets at the above-mentioned support levels of 160.70, 160.10, 159.75, 159.50.

Currently, a strong bullish trend and a robust upward impulse prevail, so expecting such a decline in the pair is not advisable. Long positions remain preferable.

Support levels: 162.41, 161.00, 160.70, 160.10, 160.00, 159.75, 159.50, 156.00, 155.80, 155.00, 153.75, 153.00, 152.25

Resistance levels: 162.85, 163.60, 164.00, 164.30