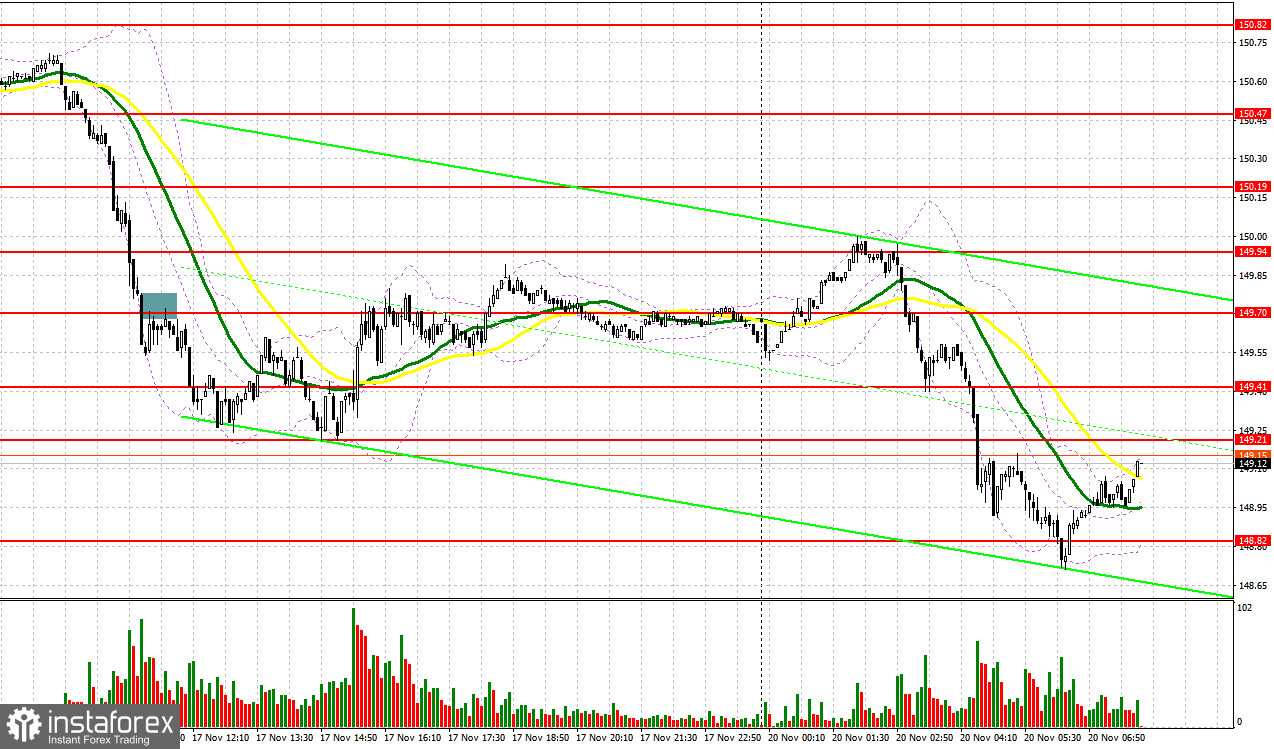

Last Friday, only one signal was generated to enter the market. Let's look at the 5-minute chart and figure out what happened there. A breakthrough and reverse test from bottom to top at 149.70 allowed us to get an entry point to sell the dollar. As a result, USD/JPY fell by more than 50 pips.

What is needed to open long positions on USD/JPY

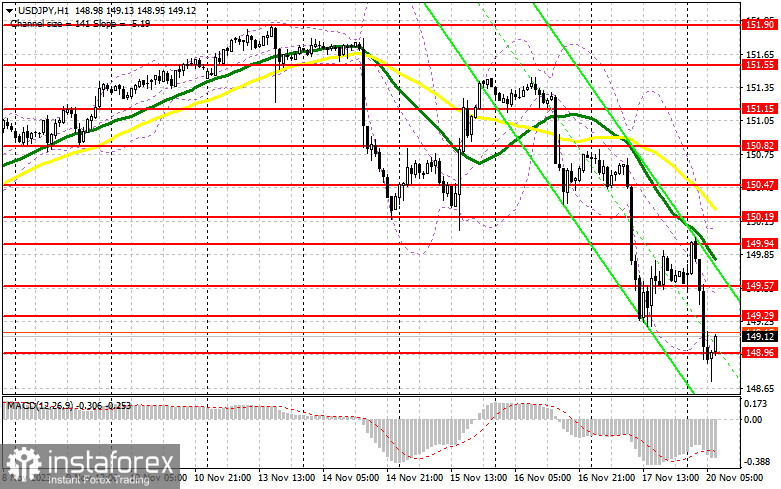

The US dollar remains under strong selling pressure amid expectations that the Federal Reserve is completing its cycle of rate hikes and is likely to announce three consecutive rate cuts in 2024. The weakness of the US dollar led to a sharp sell-off of the USD/JPY pair, which the Bank of Japan had been anticipating. Today, due to the empty economic calendar, USD/JPY could recoup some of its losses, but the sellers will likely be prepared for this. For this reason, I prefer to act on the decline around the new support level of 148.96, formed as a result of today's Asian session. A false breakout there will provide an entry point into long positions in anticipation of recovery and testing the resistance at 149.29. A breakout and consolidation above this range will also allow the buyers to regain some positions, suggesting buying activity with a target of 149.57. The highest target will be the 149.94 area, where I plan to lock in profits. The moving averages, favoring the sellers, are also located there. In a scenario of the decline and absence of buying activity at 148.96, the bears will quickly regain market control. For this reason, I advise delaying long positions until the low of 148.59 is tested. Only a false breakout there will convince traders to open long positions. I plan to buy USD/JPY immediately on the dip only from 148.20, aiming for a correction of 30-35 pips within the day.

What is needed to open short positions on USD/JPY

The sellers maintain all chances to insist on a downward correction, but much will depend on whether they manage to defend the resistance at 149.29 or not. The first entry point into short positions is anticipated only after a false breakout around 149.29, where a surge may occur very soon. This will return pressure on the pair and give a chance for a further correction down to the support at 148.96. A breakthrough and reverse test from the bottom to the top of this range will deal a more serious blow to the buyers' positions. It could trigger stop orders and open a path to the low of 148.59. A lower target will be the 148.20 area, where I plan to lock in profits. In the scenario of USD/JPY rising, which is most realistic, and the absence of activity at 148.29, the buyers will not regain the dominance but will maintain chances for a small correction after the morning sell-off. In such a case, I will delay opening short positions until a false breakout at 149.57. If a downward movement does not develop there, I will sell USD/JPY immediately on the rebound from 149.54, bearing in mind a downward correction by 30-35 pips within the day.

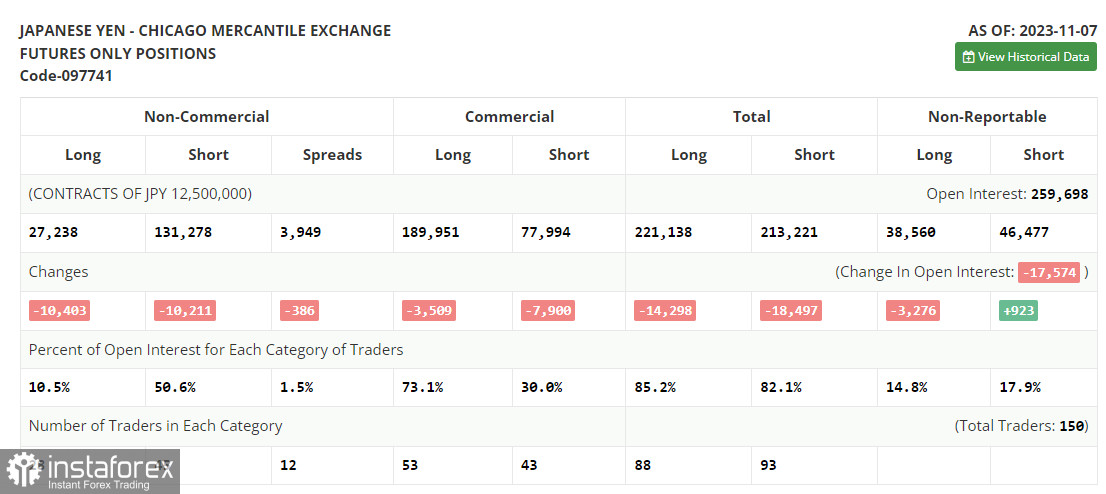

In the Commitment of Traders (COT) report dated November 7, there was a decrease in both long and short positions. However, this didn't significantly alter the balance of trading forces as the decrease was nearly equal. The fact that the buyers took out the psychological level of 151 indicates a strong difference in demand and supply, as the policies of central banks are very diverse, making the US dollar more attractive. It's very important how the yen will react to crucial US economic data in the near term, which could set the direction for the pair in the near future. However, it's premature to talk about a return in demand for the yen without significant changes in the monetary policy of the Bank of Japan. The latest COT report states that non-commercial long positions declined by 10,403 to 27,238, while non-commercial short positions dropped by 10,211 to 131,278. All this indicates protracted pressure on the yen and an overall trend towards strengthening the US dollar. Consequently, the spread between long and short positions narrowed by 386.

Indicators' signals

Moving Averages

The instrument is trading below the 30 and 50-day moving averages. It indicates the likelihood of a fall in the US dollar.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case USD/JPY goes up, the indicator's lower border at about 148.96 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.