Gold prices rose steadily last week, especially after the release of fresh economic data in the US. However, although market players predominantly maintain a bullish sentiment, some shifted to a neutral assessment of short-term prospects.

Adrian Day, President of Adrian Day Asset Management, said he anticipates little change in gold prices this week, adding that at some point, the Fed and other central banks will ease policy tightening, which will become a decisive factor for gold.

Meanwhile, RJO Futures Senior Commodities Broker Daniel Pavilonis predicts a period of prolonged consolidation, explaining that gold already hit the upper boundary of the trading range for a long time. He said further rate hikes may not happen, and a rate decrease could occur in May next year.

Gold will likely face challenges if inflation data continues to weaken while interest rates remain high. Without geopolitical factors, it lacks driving forces.

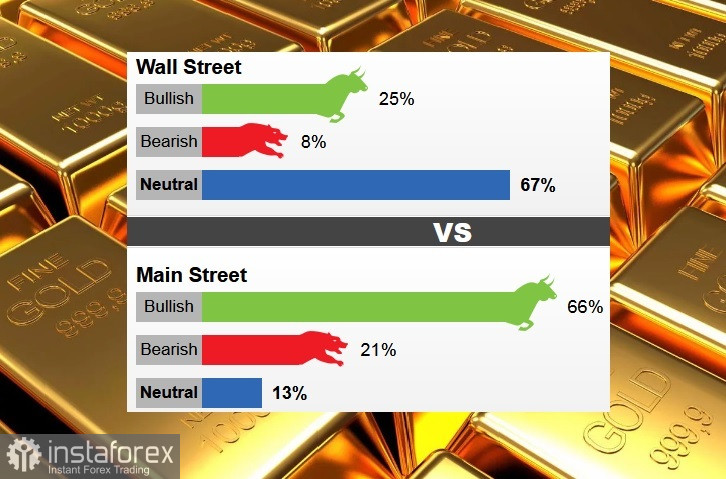

In a survey conducted last week, 25% said they expect price increases, 8% forecast a decrease, and 67% remained neutral. An online poll said 66% expect price growth, 21% believe the price will fall, and 13% remain neutral.

Everett Millman, chief market analyst at Gainesville Coins, pointed out that at the moment, investor attention in gold shifted from geopolitical towards macroeconomics, particularly focusing on the Fed's policy.

The current week will be short for the publication of US trade and economic data due to the Thanksgiving holiday on Thursday. Most events will be concentrated in the first three days of the week. Key events include the release of the latest FOMC minutes and October's existing home sales on Tuesday, followed by October's durable goods, the University of Michigan's consumer sentiment for November, and weekly jobless claims on Wednesday.