The weakening of the dollar continues. Market participants are still under the influence of last week's U.S. inflation data, which reduced the likelihood of a Fed interest rate hike at the December meeting. Moreover, the primary point of contention among opponents regarding the future dynamics of the dollar is when the Fed will begin to ease its monetary policy. The boldest estimates suggest that the Fed will start cutting interest rates as early as spring 2024.

However, there is almost no doubt among economists and market participants that the Fed has already completed its rate hike cycle. In this situation, the weakness of the dollar can probably be explained by this very factor.

In the short term, additional information on this issue will be available to market participants on Tuesday upon the release of the minutes of the recent (October 31 and November 1) Federal Open Market Committee (FOMC) meeting at 19:00 (GMT). The release of the minutes is extremely important for determining the course of the current Fed policy and the prospects for interest rate hikes in the United States. Following this meeting, Fed leaders decided once again to pause and not change the parameters of the current policy.

If the published documents contain new unexpected information regarding the Fed's monetary policy outlook, volatility in financial markets, especially in the dollar quotes, may sharply increase. A dovish tone in the minutes will positively impact stock indices and negatively impact the U.S. dollar. A firm stance by Fed officials on the outlook for monetary policy will halt the decline of the dollar and may bring it back on an upward trajectory.

Fed Chairman Jerome Powell stated at the press conference following the FOMC meeting that they were not considering or discussing rate cuts. He expressed his view that economic growth had significantly exceeded expectations, the labor market remained tight, and job growth rates were high.

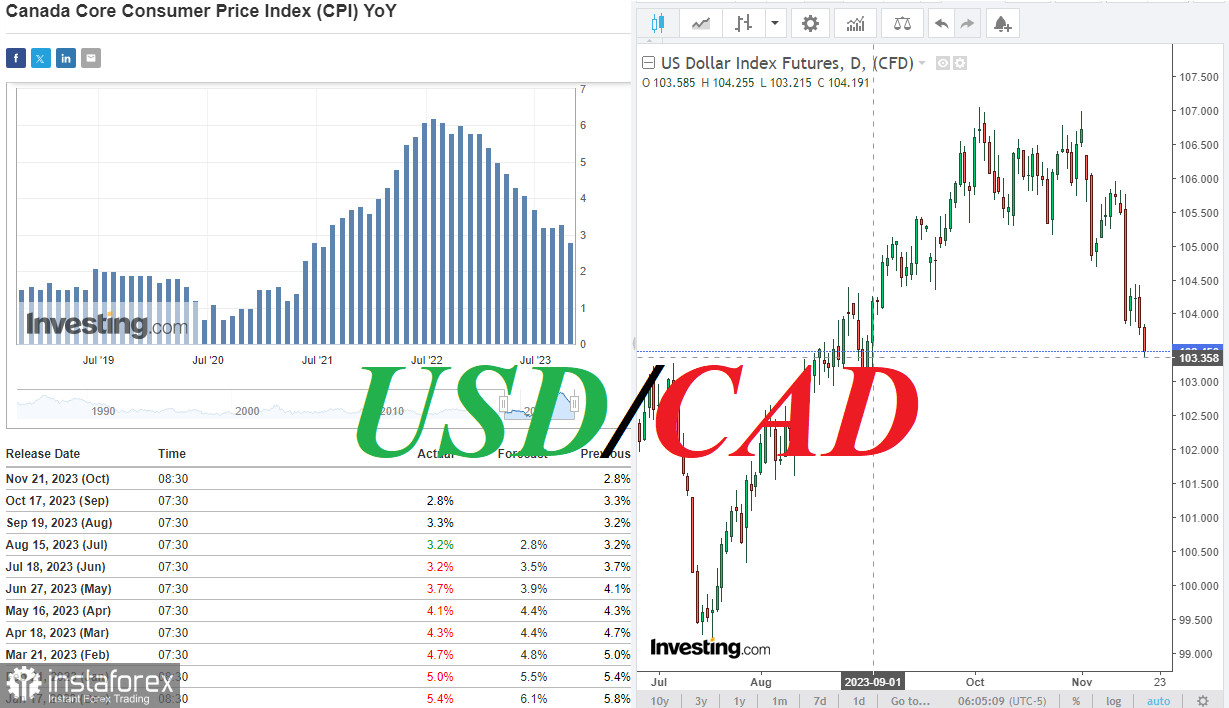

But for now, the dollar remains under pressure from sales triggered by the October U.S. inflation data. As of this writing, its DXY index stood at 103.45, 10 points higher than today's and above the September 1 low of 103.35.

It is also worth noting that on Tuesday, volatility will increase not only in the quotes of the U.S. dollar but also the Canadian dollar, as Canadian consumer price indices will be published at 13:30 (GMT).

Consumer prices account for a significant portion of overall inflation. Rising prices compel the central bank to raise interest rates to curb inflation, and conversely, in the case of decreasing inflation or signs of deflation (when the purchasing power of money increases and prices for goods and services decline), the central bank typically aims to devalue the national currency by lowering interest rates to boost aggregate demand.

This indicator (CPI and Core CPI) is crucial for assessing inflation and changes in consumer preferences.

Previous values (on an annual basis):

CPI: +3.8%, +4.0%, +3.3%, +2.8%, +3.4%, +4.4%, +4.3%, +5.2%, +5.9% (as of January 2023),

Core CPI: +2.8%, +3.3%, +3.2%, +3.2%, +3.7%, +4.1%, +4.3%, +4.7%, +5.0% (as of January 2023).

Considering that the Bank of Canada's target inflation rate is in the range of 1%-3%, an increase in the indicator (CPI and Core CPI) above this range is a precursor to a rate hike and a positive factor for CAD. Meanwhile, if the data turns out weaker than previous values, it will negatively impact CAD: a gradual approach of inflation to the target level is likely to lead the Bank of Canada to refrain from changes in its current credit and monetary policy parameters. Better-than-expected data indicating a resurgence in inflation is likely to strengthen the Canadian dollar, including in the USD/CAD pair, which will continue to decline.

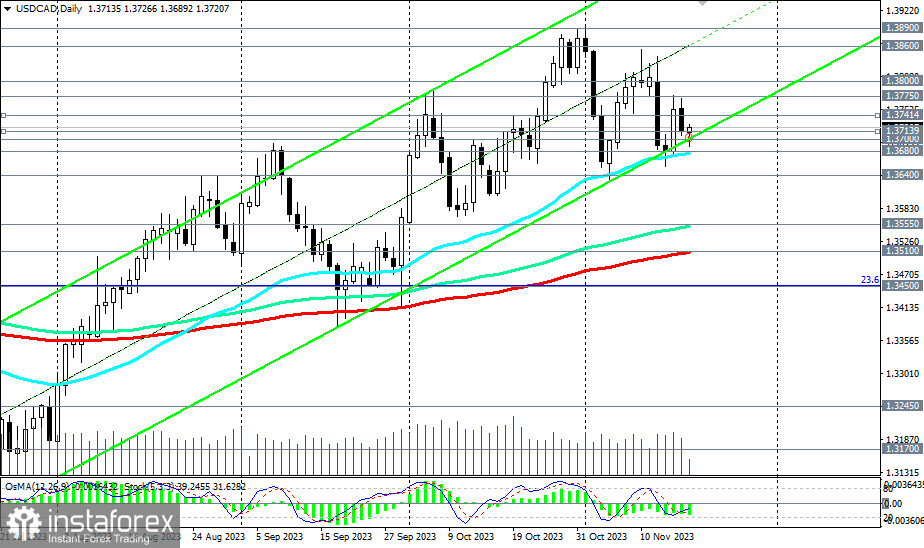

For now, USD/CAD is testing important support levels at 1.3714, 1.3700, while remaining within the zone of medium-term (above the support level of 1.3510), long-term (above the support level of 1.3170), and global (above the support level of 1.2700) bull markets.