The EUR/USD currency pair continued its upward movement on Monday. In previous articles, we mentioned no grounds for such a movement. Moreover, even Friday's increase needs to be more logical, not to mention the weak attempt to correct it on Wednesday and Thursday. It all started last Tuesday when another inflation report was released in the United States. This report cannot be called shocking or resonant, but the market reacted as if inflation had suddenly dropped to 2%, and the Federal Reserve immediately announced a key rate cut. Since then, a week has passed, and the European currency has not slightly corrected downward. Such movement by the pair seems strange to us.

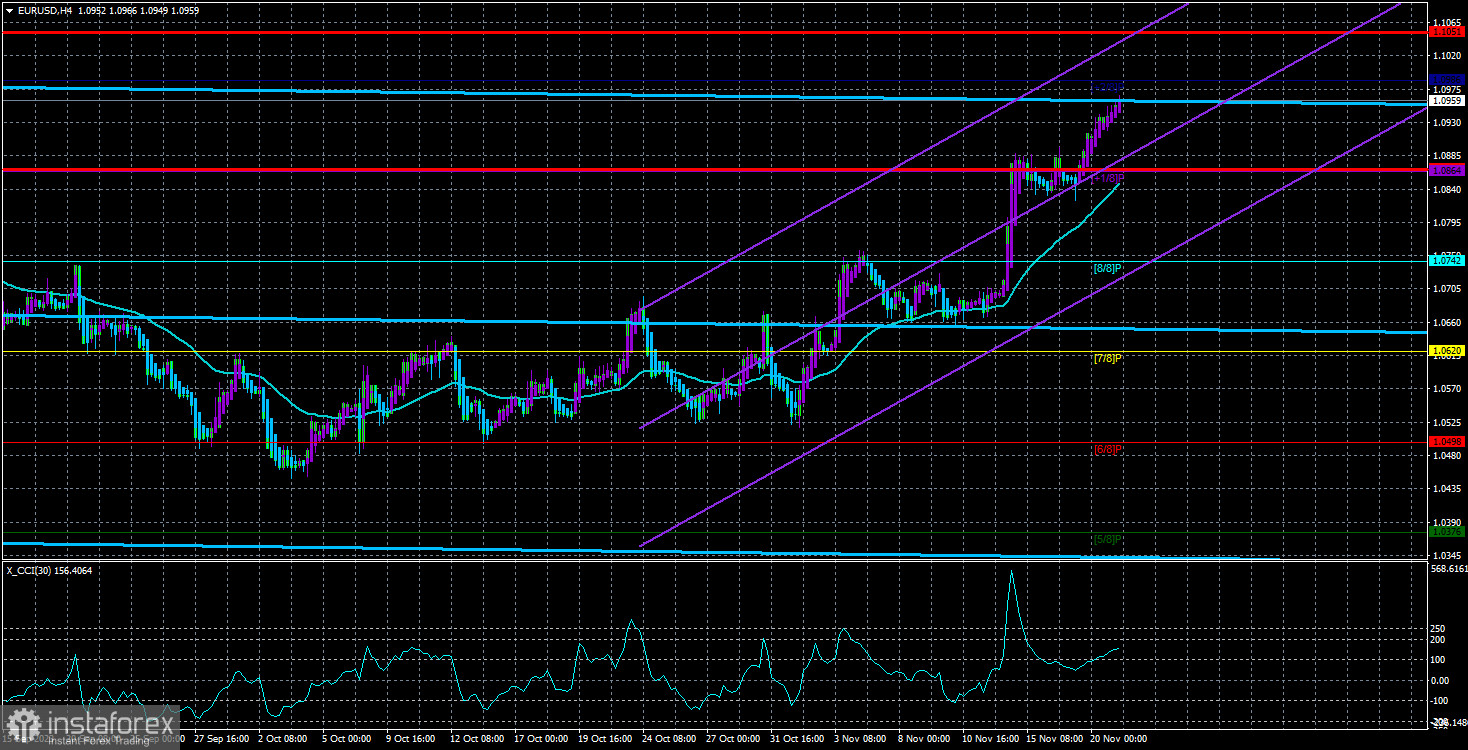

The next very strange point is the triple-overbought condition of the CCI indicator. Of course, it's just an indicator. Indicators can be wrong; the market rules the market, not indicators. Nevertheless, indicators exist to facilitate the analysis process. If they were of no use, no one would use them. Therefore, we assume that indicators do help in the analysis and make mistakes less often than they prove to be correct. What do we see now? There was no hint of correction after the last entry into the overbought zone. The indicator and the price are moving towards their fourth entry into the extreme zone.

All this tells us that the Eurozone currency is severely overbought. The rise may continue for some time, but we already see no grounds for its continuation. Unfortunately, the movement increasingly resembles the first half of this year when the euro either rose or stood still, although it had many more reasons to fall. If we witness inertia growth again, all technical indicators, fundamentals, and macroeconomics can be safely ignored because the market will buy the pair against all odds.

And what about the fundamentals?

Above, we indicated why we expect a decline in the EUR/USD pair, but we did not touch on macroeconomic statistics and fundamentals. Macroeconomic reports have indeed been in favor of the euro recently. Mainly thanks to the United States, where November is turning out to be a disappointing month. Even the inflation report, which cannot be called "bad" in the direct sense of the word, exerted strong pressure on the dollar. However, it is worth remembering that European statistics are not significantly different from American ones. If we try to characterize the state of European and American indicators as accurately and briefly as possible, the following will be obtained: American data deteriorate from high values, and European data remain at average or poor values. Therefore, there is an obvious weakening of key reports in the United States now, but in the European Union, they are still worse and show no signs of recovery.

The same applies to the fundamental background. The Federal Reserve is unlikely to raise the key rate if inflation suddenly does not start to accelerate again. But the ECB is not going to tighten either. Central banks are starting to talk very softly about easing monetary policy next year. But again, both banks, not just one. The Fed's rate remains 1% higher than the ECB's, which will persist for a long time. Thus, we do not see any reason for the euro and the pound to continue rising against the dollar. Of course, it is possible to assume everything is going according to plan, and we are just observing a slightly stronger upward correction than we would like. This is also possible. However, it is very difficult to buy an instrument if almost all factors speak in favor of its decline.

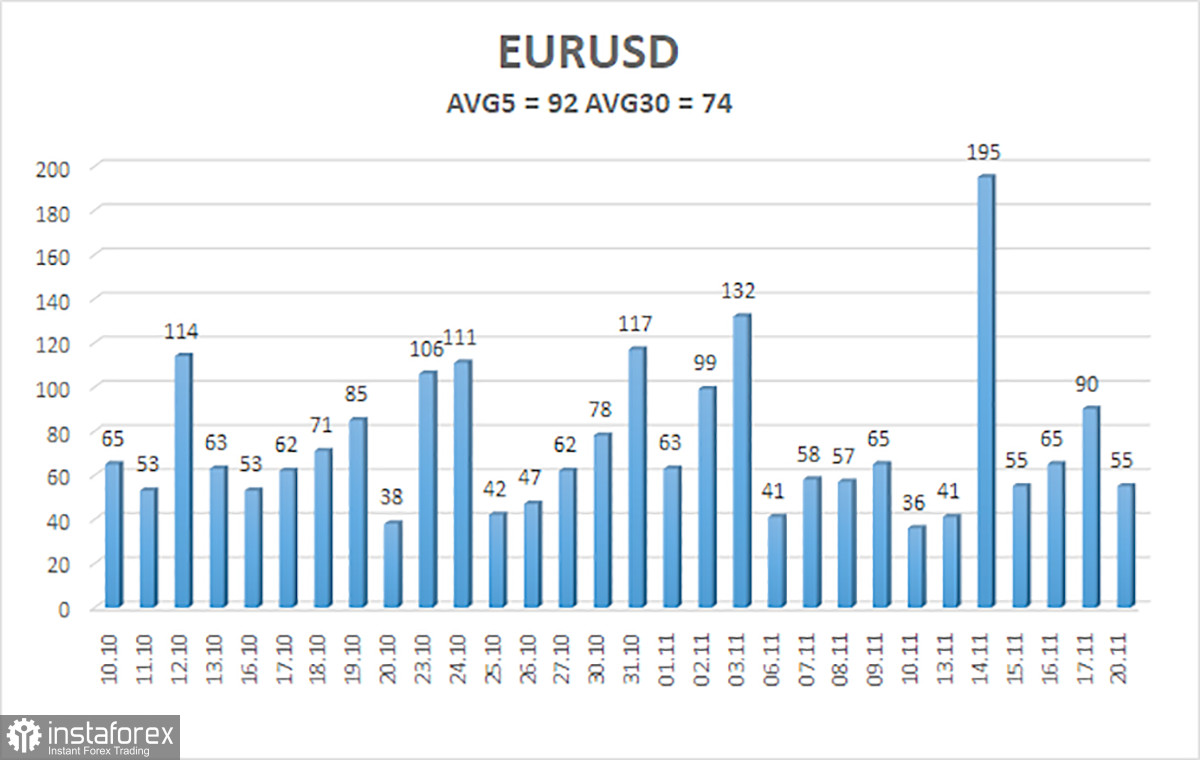

The average volatility of the euro/dollar currency pair for the last five trading days as of November 21 is 92 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0865 and 1.1051 on Tuesday. A downward reversal of the Heiken Ashi indicator will indicate a possible start of a downward correction.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

Trading recommendations:

The EUR/USD pair continues its new upward movement phase, exceeding the moving average. It is advisable to consider buying, but we still doubt that the pair's growth will continue, considering the triple overbought condition of the CCI indicator. Based on "bare" technicals, you can remain in long positions with targets at 1.0986 and 1.1051 until the Heiken Ashi indicator reverses, but be cautious. Selling the euro will become relevant after the price consolidates below the moving average with targets at 1.0742 and 1.0620.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which it is currently advisable to trade.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.