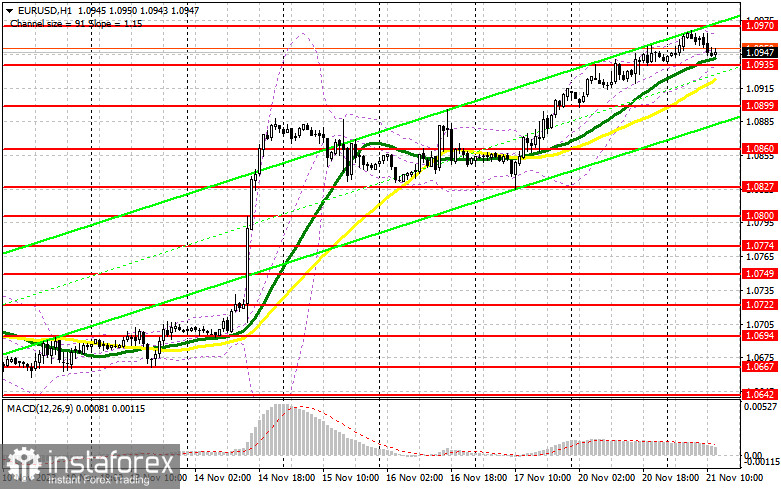

In my morning forecast, I drew attention to the level of 1.0970 and recommended making entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. The expected breakthrough of the monthly maximum did not occur in the first half of the day. Reaching the updated levels I specified was also unsuccessful against the backdrop of low market volatility of about 20 points. For this reason, I did not wait for entry points. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, it is required:

Considering that only data on existing home sales in the US secondary market is released during the American session, all market participants will likely focus on publishing the FOMC meeting minutes. The market volatility will depend on its content, as we will likely learn something new from the minutes. The chosen pause by the FOMC in early November is currently the most optimal scenario, which may lead to discussions about an earlier interest rate cut in the US next year. This would favor the euro and weaken the dollar. In case of further inactivity of buyers at monthly highs in the second half of the day, I prefer to wait for a decline in the pair and the formation of a false breakthrough near the nearest support at 1.0935, just below which the moving averages are located, playing on the buyers' side. This will confirm the correct entry point for long positions with the growth target towards the resistance at 1.0970. A breakthrough and a top-down test of this range will restore demand for the euro, giving a chance for further strengthening and a leap to 1.1004. The ultimate target will be the area of 1.1033, where I will take profit. In the case of a decline in EUR/USD and the absence of activity at 1.0935 in the second half of the day, bears will try to re-enter the market, but nothing catastrophic will happen to the trend. In this case, only the formation of a false breakthrough around 1.0899 will signal a buying opportunity for the euro. I will consider opening long positions immediately on a rebound from 1.0860 with the target of an upward correction within the day by 30-35 points.

To open short positions on EUR/USD, it is required:

Euro sellers have already shown themselves, bringing the pair to the day's minimum, but a major sell-off may only occur in the case of very hawkish FOMC meeting minutes. Considering the bullish market, I will only act on selling after protecting the nearest resistance at 1.0970. A false breakthrough there will provide an entry point with a downward movement to the support at 1.0935, formed by the results of yesterday's trading. Only after a breakthrough and consolidation below this range, as well as a reverse test from bottom to top, do I expect to get another selling signal with an exit to 1.0899. The ultimate target will be the area of 1.0860, where I will take profit. In the event of an upward movement in EUR/USD during the American session and the absence of bears at 1.0970, bulls will try to continue the upward trend. In such a scenario, I will postpone short positions until a new resistance at 1.1004. It can also be sold, but only after an unsuccessful consolidation. I will consider opening short positions immediately on a rebound from the maximum of 1.1033 with the target of a downward correction by 30-35 points.

Indicator Signals:

Moving Averages

Trading is carried out above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator, around 1.0935, will act as support.

Description of Indicators:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

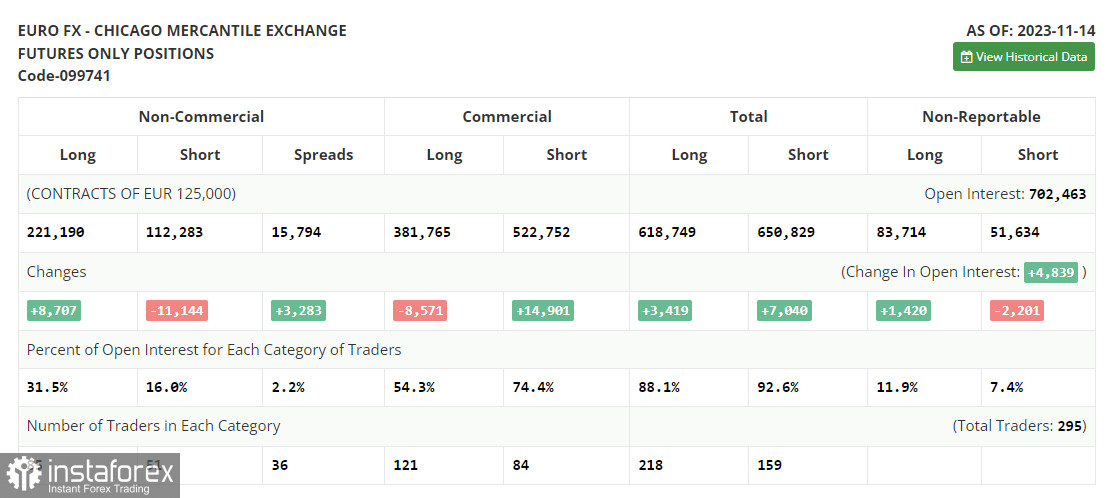

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.