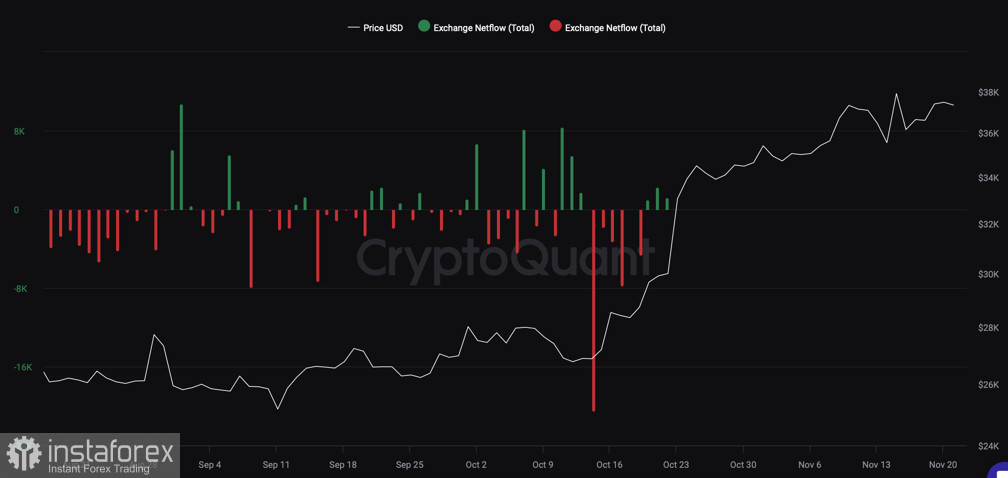

As of November 21, Bitcoin confidently holds its position near the $37k level, where there is local consolidation of the asset's price. Over the past two weeks, we have observed a slowdown in the cryptocurrency's growth, and sellers' reaction to the price approaching $38k leaves no chance for bulls to continue the upward movement. At the same time, the asset is not heading for a correction, indicating high short-term market expectations.

Bitcoin manages to maintain the structure of the upward channel largely due to a fundamentally positive background. One of the key factors for the sustainable upward movement of the cryptocurrency is the anticipation of the approval of a spot Bitcoin (BTC) ETF, which analysts estimate will significantly increase Bitcoin's market capitalization. However, there is a high probability of a cryptocurrency price collapse upon the approval of the spot ETF product.

Why could BTC collapse after ETF approval?

The key reason and starting point for the upward movement of the cryptocurrency was the publication of fake news about the approval of a spot BTC ETF. Since then, news related to the filing of new applications for spot ETF products constantly appears in the information field. The market reacts positively to any event related to the potential approval of a spot BTC ETF. According to Bloomberg Intelligence, the BTC-ETF market could grow to $100 billion in the coming years.

At the same time, the approval of such a product may have a negative short-term effect. JPMorgan analysts believe that the topic of spot BTC-ETF has long been discussed in the market, and the actual approval of the product could be a "sell the news" event. In other words, the potential approval of the ETF is already priced into the Bitcoin price beyond what the market will receive initially, and this could lead to a spike in volatility and a collapse of BTC/USD quotes.

Investors are prepared for a BTC collapse

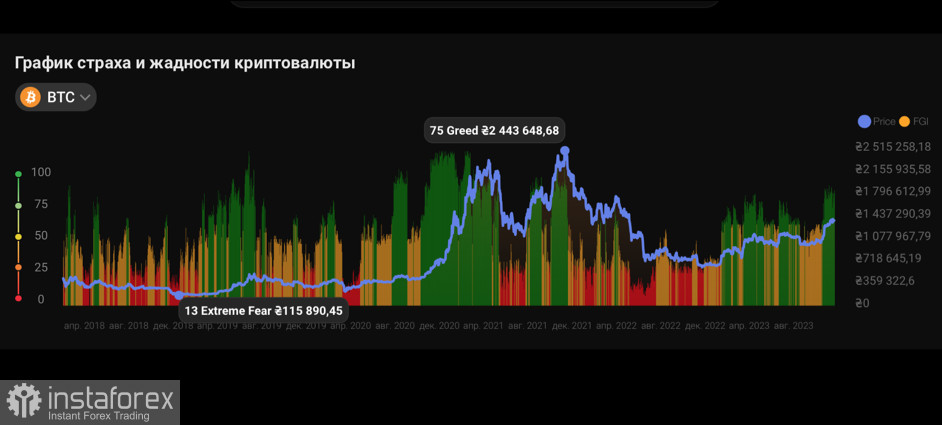

Despite the potentially negative effect of approving a spot BTC ETF, overall sentiments in the cryptocurrency market remain positive. Investors continue to actively accumulate BTC, gradually reducing the supply in the market and helping to maintain the price in key support zones. As of November 21, the annual active supply of BTC reached a minimum since July 2010, near the 29.7% level.

At the same time, there are still about 2.04 million BTC on cryptocurrency exchanges, which is 32% lower than the 2020 levels. This indicates a high level of interest in Bitcoin, as well as confident absorption of BTC volumes entering the market after profit-taking by various categories of investors. This once again confirms the higher short-term goals of investors within the current BTC price rally.

BTC/USD Analysis

The price of Bitcoin has changed by only 0.68% over the past 24 hours, indicating a decrease in active trading activity and the continuation of a gradual capital reallocation. Bitcoin is trading at $37.4k, with daily trading volumes dropping to $20.7 billion. Considering the absence of significant fundamental news and the quietude regarding the SEC decision on BTC ETF, the price will continue consolidation near this level.

At the same time, technical indicators point to clear overbought conditions. However, at this stage, the market is guided by emotions and expectations rather than facts. Therefore, we observe a confident unwinding of positions by bulls within the $36k–$38k range. There is a slight decrease in trading volumes from buyers, making a retest and breakout of $38k impossible. It is precisely for this reason that we observe a consolidating price movement for BTC/USD.

Conclusion

In the short term, there is no doubt that Bitcoin will undergo a correction. However, as of November 21, divergences in key technical metrics are insufficient for breaking through crucial support levels at $35.5k and $36k. The main phase of the Bitcoin price decline will likely start before important and volatile events, such as the Federal Reserve meeting, inflation data, or an escalation of geopolitical tensions. Until then, the cryptocurrency will continue to move within the $36k–$38k range.