When the Bank of Japan twice conducted currency interventions in the fall of 2022 to halt the yen's decline, the upward trend in USD/JPY broke for a completely different reason. Investors bet on the slowdown of the Federal Reserve's monetary policy tightening process, which favorably affected global risk appetite and weakened the U.S. dollar. Does it sound familiar?

This time, the Bank of Japan didn't even have to dirty its hands with currency interventions. Yes, there was a sharp one-day drop in USD/JPY in early October, but bulls are to blame for this. They were so scared of potential BoJ intervention in the Forex market that they raised the white flag.

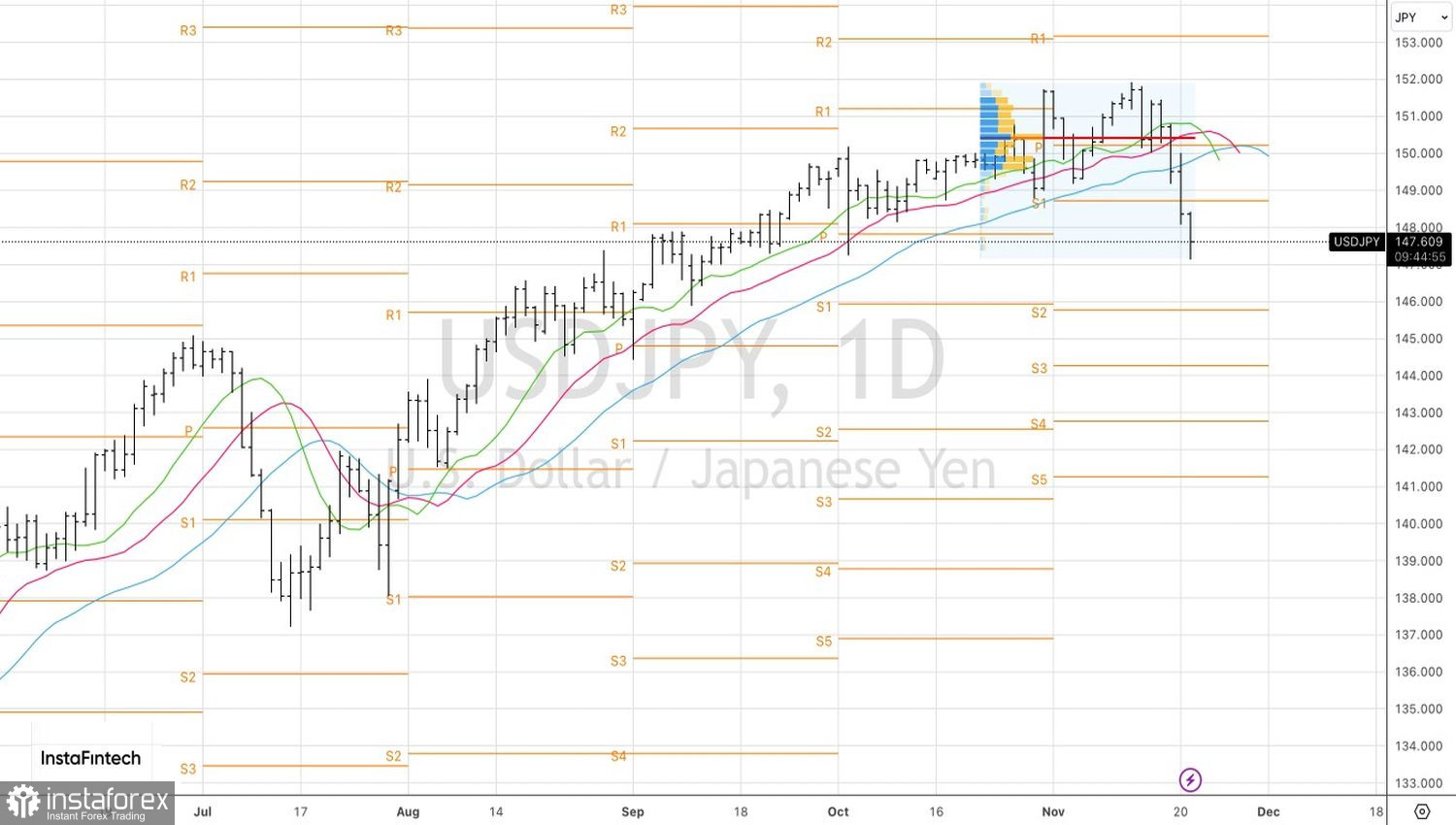

A month and a half later, the upward trend in the analyzed pair is breaking again, thanks to the Federal Reserve. The slowdown in U.S. inflation to 3.2% allowed the futures market to bet on the dovish pivot of the Federal Reserve. It is expected to cut rates by 100 basis points in 2024, leading to a decline in U.S. Treasury yields, narrowing the spread with their Japanese counterparts, and a peak in USD/JPY.

Dynamics of USD/JPY and US-Japan Bond Yield Spread

Excessively inflated speculative shorts on the yen exacerbate the correction. By the week ending November 14, hedge funds had increased net short positions on the yen to 65,490 contracts, the highest level since April 2022. Unwinding these positions gives the necessary impetus to the decline in USD/JPY quotes.

However, history shows that last year's market campaign against the Federal Reserve failed. The decline in the USD/JPY pair lasted about 2.5 months, after which the upward trend resumed, and the Japanese yen became a clear outsider in the G10. Even though the BoJ made two adjustments to its yield curve targeting policy: first, it expanded the range to 1% and then announced its flexible regulation. Will history repeat itself?

Dynamics of Speculative Positions on the Yen

Most likely not. The upward trend in USD/JPY will be broken once and for all. And there are two reasons for this. First, the Federal Reserve has indeed completed its cycle of tightening monetary policy and will lower borrowing costs in 2024. Second, the Bank of Japan has no choice but to normalize monetary policy.

Inflation in Japan has been above the 2% target for 18 months. Reuters experts predict that consumer prices will accelerate from 2.8% to 3% in October. And if the BoJ previously referred to the reduction in real wages, this spring, many corporations plan to increase them. There will be no more excuses for not normalizing monetary policy.

Technically, on the daily chart, USD/JPY is experiencing a decline in quotes below the combination of moving averages. This indicates a correction and is the first sign of breaking the upward trend. The recommendation is to sell towards 146 and 142.5.