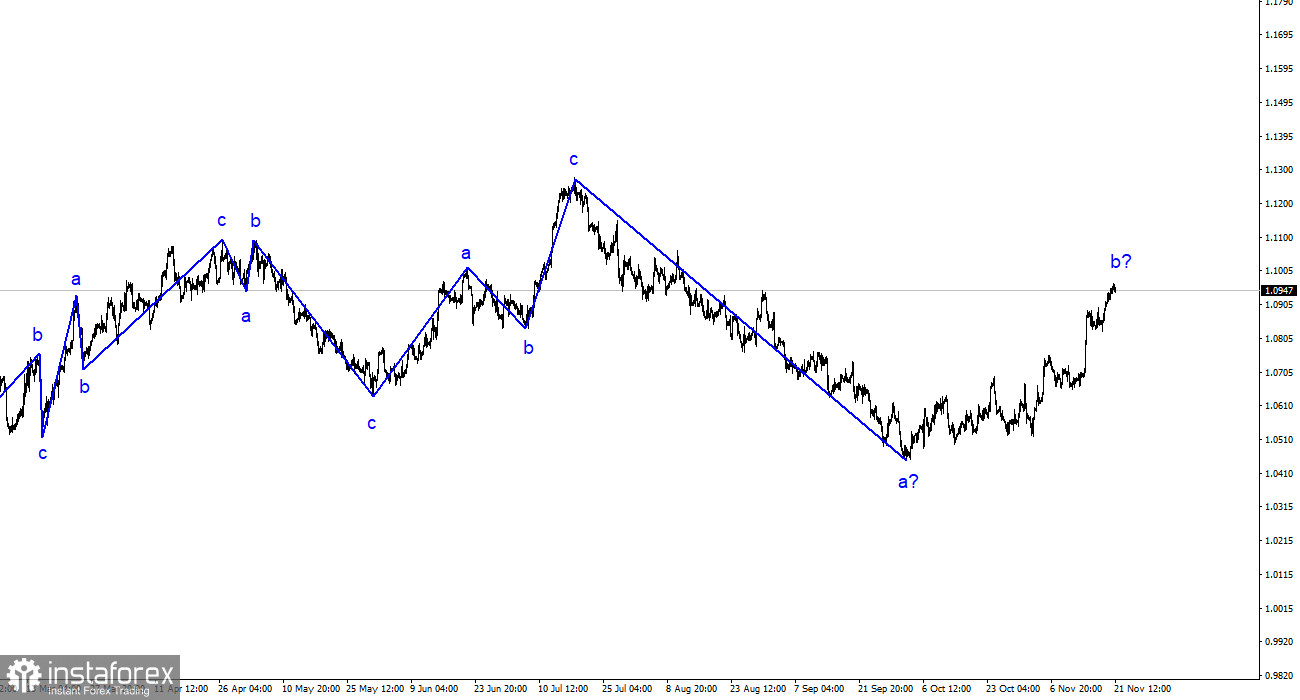

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Throughout 2023, I have consistently mentioned that I expect the pair to reach around the 5th figure, from where the construction of the last upward three-wave structure began. This target was achieved after the decline in July-October. After reaching this target, the construction of corrective wave 2 or b began, which has already taken a clear five-wave form. However, the US inflation report led to this wave becoming even more complex. Nevertheless, the working scenario remains the same – wave 3 or c construction.

Regardless of how wave 2 or b turns out in the end (I warned that it could be much more complex), the overall decline in the European currency will not be complete, as in any case, the construction of the third wave of the downtrend is still required. Now, wave e in 2 or b will take a five-wave form, after which the quote rise will be completed.

The news background must be stronger, but this does not bother buyers.

The euro/dollar pair's exchange rate practically did not change on Tuesday. The amplitude was again weak, and the current pullback of quotes from the reached highs is not enough to consider wave 2 or b completed. An unsuccessful attempt to break through the 1.0955 level may indicate the market's readiness to build a descending wave, but it is not yet there. Today, in the European Union and the United States, there was no interesting event explaining the almost zero amplitude of movements.

There was only a speech by the President of the Bank of France, Villeroy de Galhau, who stated that the ECB rates would remain unchanged for the next few quarters. He said that in the coming months, the issue of reducing rates would not be considered by the members of the Governing Council, as this action would be premature. Also, de Galhau stated that he does not consider the inflation target of 2% to be exact, without any hint of deviation, and regarding the economy, it is very important to achieve a "soft landing."

Later today, there will be another speech by Christine Lagarde, but the ECB's position is clear, and Lagarde is unlikely to report anything new. The market did not react in any way to de Galhau's speech because the President of the Bank of France did not report anything new. Members of the ECB Governing Council repeat the same statements from time to time, which is beginning to annoy the market.

General conclusions.

Based on the analysis conducted, the construction of a downward wave set continues. Targets around the 1.0463 level have been perfectly worked out, and an unsuccessful attempt to break this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so in the near future, I expect the construction of an impulsive downward wave 3 or c with a significant decrease in the pair. I still recommend selling with targets below the low of wave 1 or a. While wave 2 or b takes on a more prolonged form, sales should be cautious, or waiting for signals of the wave's completion is even better.

On the senior wave scale, the ascending trend section has taken on an extended form but is likely to be complete. We have seen five waves up, likely to be a structure a-b-c-d-e. Next, the pair built four three-wave structures: two down and two up. Now, it has entered the stage of building another extended descending three-wave structure.