Stock rally halted ahead of the release of the Fed's minutes and noticeably weaker sales data in the secondary housing market.

Certainly, the situation in the real estate market plays a significant role, as the construction sector of the US economy has always been considered its backbone. Since investors reacted negatively to the news, stock indices declined. Furthermore, in the face of a weakening US economy and easing inflation, the Fed may no longer raise interest rates. Although new verbal interventions may occur, it will no longer worry market players as massive changes can only happen if inflation resumes an upward trend.

Risk appetite will resume if the US releases more weak economic data. Company stocks, after a brief pause, will continue their growth, along with the decline in Treasury yields and dollar. If today's data on US jobless claims and core durable goods orders show higher-than-expected increases, the trend may intensify.

The topic of a possible start of interest rate cuts by the Fed may also take on new colors, reflecting the strengthening of expectations among market players.

Forecasts for today:

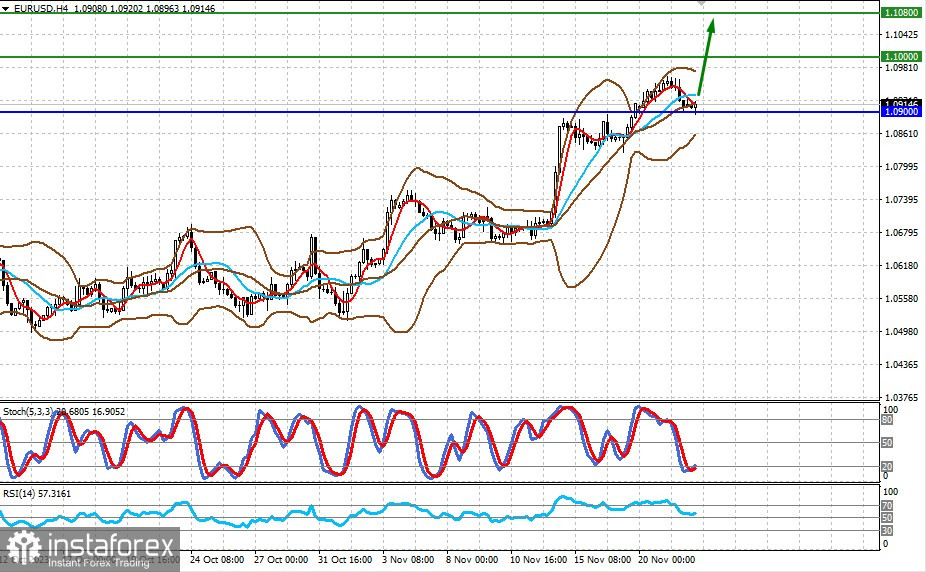

EUR/USD

The pair trades below 1.0900 due to the weakening of dollar. A consolidation above this level will likely lead to further growth towards 1.1000 and 1.1080.

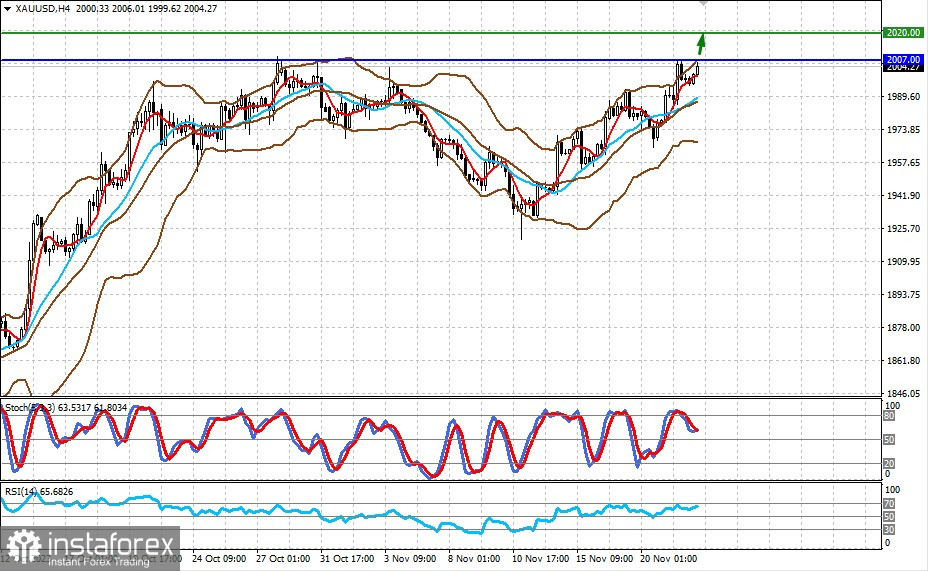

XAU/USD

Gold trades slightly above $2000.00. Further weakening of dollar and surpassing $2007.00 could lead to a rise to $2020.00.