No matter how challenging the macro environment may be, one can get used to everything. Adapt and deliver a positive result. In less than 11 months of 2023, the S&P 500 grew by 18%, even amid the Federal Reserve's tightening monetary policy. Meanwhile, Bank of America predicts that the broad stock index will reach a record 5000 in 2024, which is 10% higher than current levels. The reason is not that the Federal Reserve will lower the federal funds rate. The stock market has simply adapted to both geopolitical and macroeconomic negativity.

Bank of America analysts are not alone. RBC Capital Markets holds a similar forecast of 5000 based on the analysis of investor sentiment, corporate earnings estimates, the state of the economy, political risks, and the relationship between stocks and bonds. According to the company, the S&P 500 could grow even to 5300 in 2024 if inflation returns to the 2% target, the Federal Reserve achieves a soft landing and starts lowering borrowing costs.

S&P 500 Dynamics and Bank of America Forecast

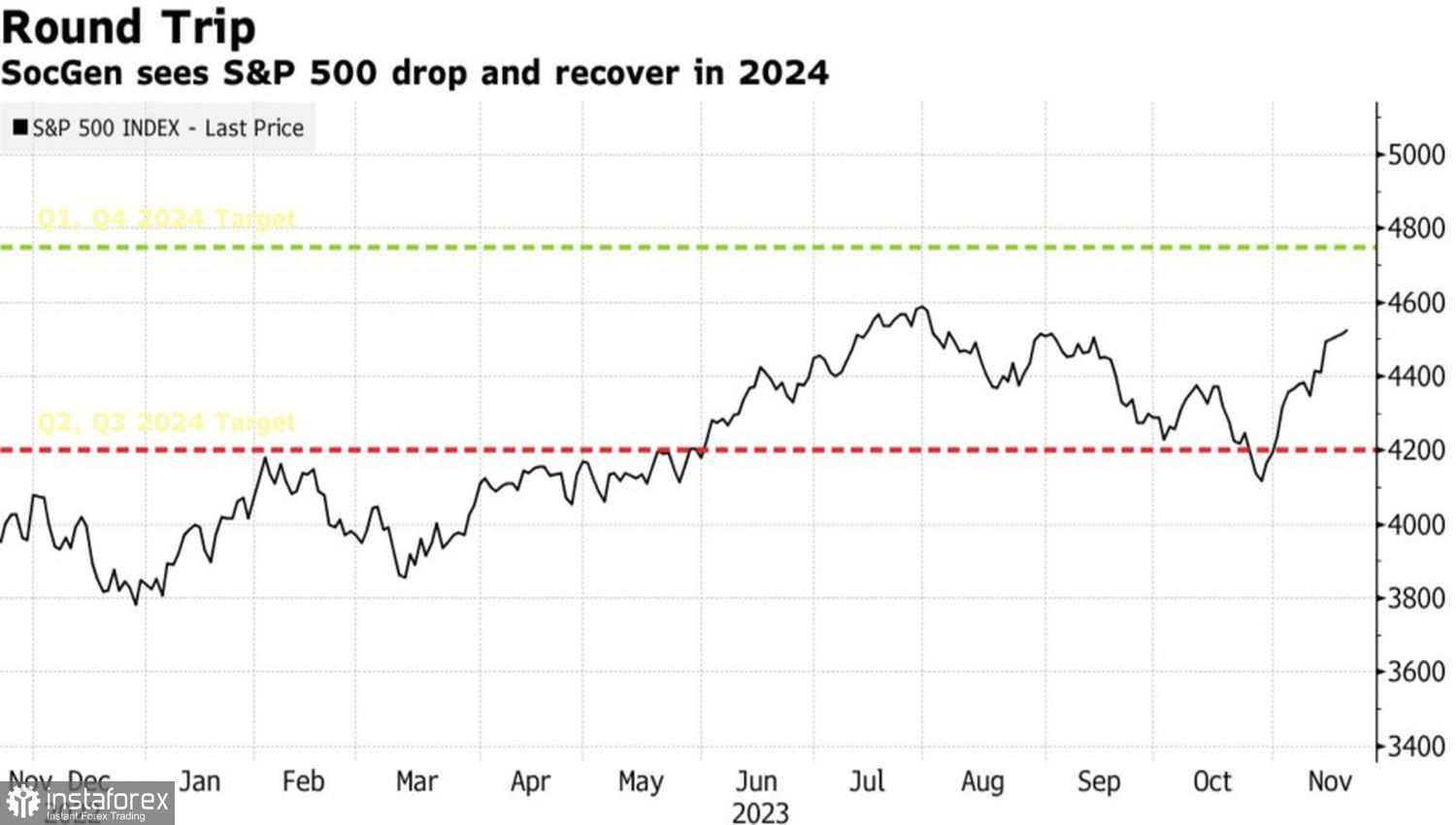

Other banks and investment companies also speak of a record level of the broad stock index in 2024. In particular, Societe Generale forecasts a rise to 4750 by the end of the first quarter, followed by a 12% decline to 4200 due to a recession in the U.S. economy. For the rest of the year, the S&P 500 will recover lost positions, returning to the 4750 level.

Consensus forecasts from 33 Reuters experts also indicate a volatile stock market in the coming year. They anticipate the broad stock index closing at 4700, which is 3.4% higher than the current level. Moreover, 9 out of 13 strategists responded positively to the question: will the S&P 500 reach a record high level within the next six months?

S&P 500 Dynamics and Societe Generale Forecast

In summary, optimism prevails in the market. Despite the index trading at the 19th excess of the forward price-to-earnings ratio compared to the 17th at the end of 2022 and the 16th historical average, indicating its high valuation. There is no need to be surprised when the S&P 500 adds 10.5% to its value since the end of October and closes in the green for 15 out of 16 trading sessions, the bullish momentum grows rapidly.

Buyers are betting on the easing of the Federal Reserve's monetary policy in 2024 and on the Goldilocks scenario, where inflation sharply decreases, the economy loses steam but continues to grow.

Not everyone is so certain. PIMCO believes that the slowdown in consumer prices next year will be based not on the recovery of supply chains and the exhaustion of fiscal stimulus but on a decrease in demand. This is bad news for stocks.

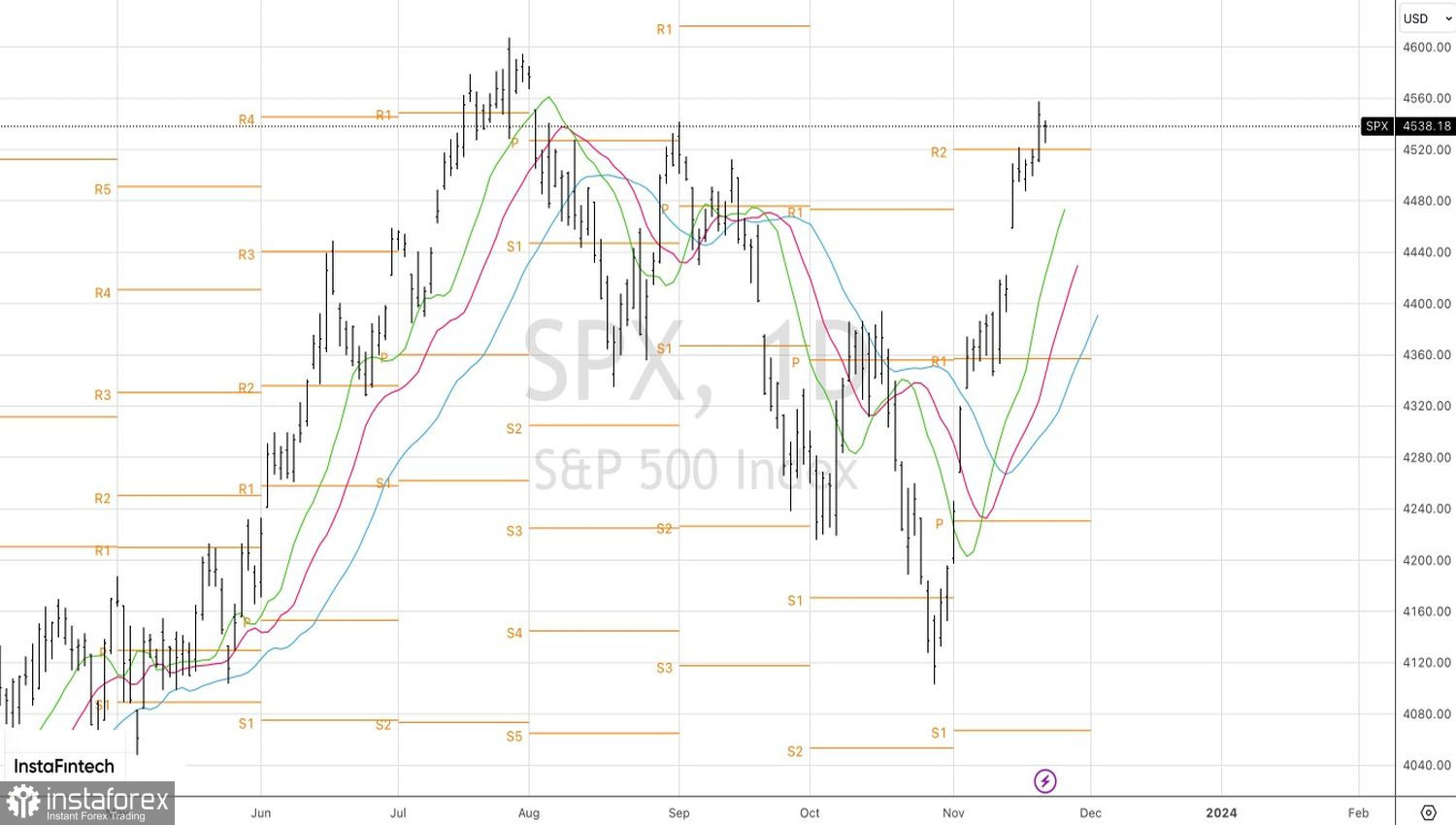

Technically, on the daily chart of the S&P 500, an inside bar has formed. Breaking its lower boundary near 4525 with the subsequent successful storming of the pivot level at 4520 will signal the start of a corrective movement after the rapid rally of the stock index. This will allow for the formation of short-term short positions. However, it is not advisable to go overboard with sales. The bullish trend looks too strong.