The EUR/USD currency pair continued to correct against the upward correction on Wednesday, but it immediately bounced back up when it reached the moving average line. Thus, the short-term upward trend remains intact, and the market does not see serious reasons to buy the US dollar. This is not surprising, considering the nature of the reports from America in November. Almost all of them failed, and even the positive inflation report was interpreted by traders as not favoring the US currency. Moreover, it was the inflation report, which, in essence, had no resonant significance, that triggered a sharp decline in the dollar. And now the dollar is still dealing with the consequences of that report.

From a macroeconomic point of view, the decline of the US dollar is quite logical. But only from a macroeconomic point of view because, from a fundamental point of view, the situation does not change. The ECB has practically guaranteed the completion of the tightening monetary policy cycle. The Fed is still contemplating the advisability of a new rate hike. But while both are thinking and assessing progress in slowing inflation, the Fed's rate is 5.5%, and the ECB's rate is 4.5%. The economy of the European Union has been balancing on the brink of negative values for five quarters, while the US economy is growing at a rate of 2-5% every quarter.

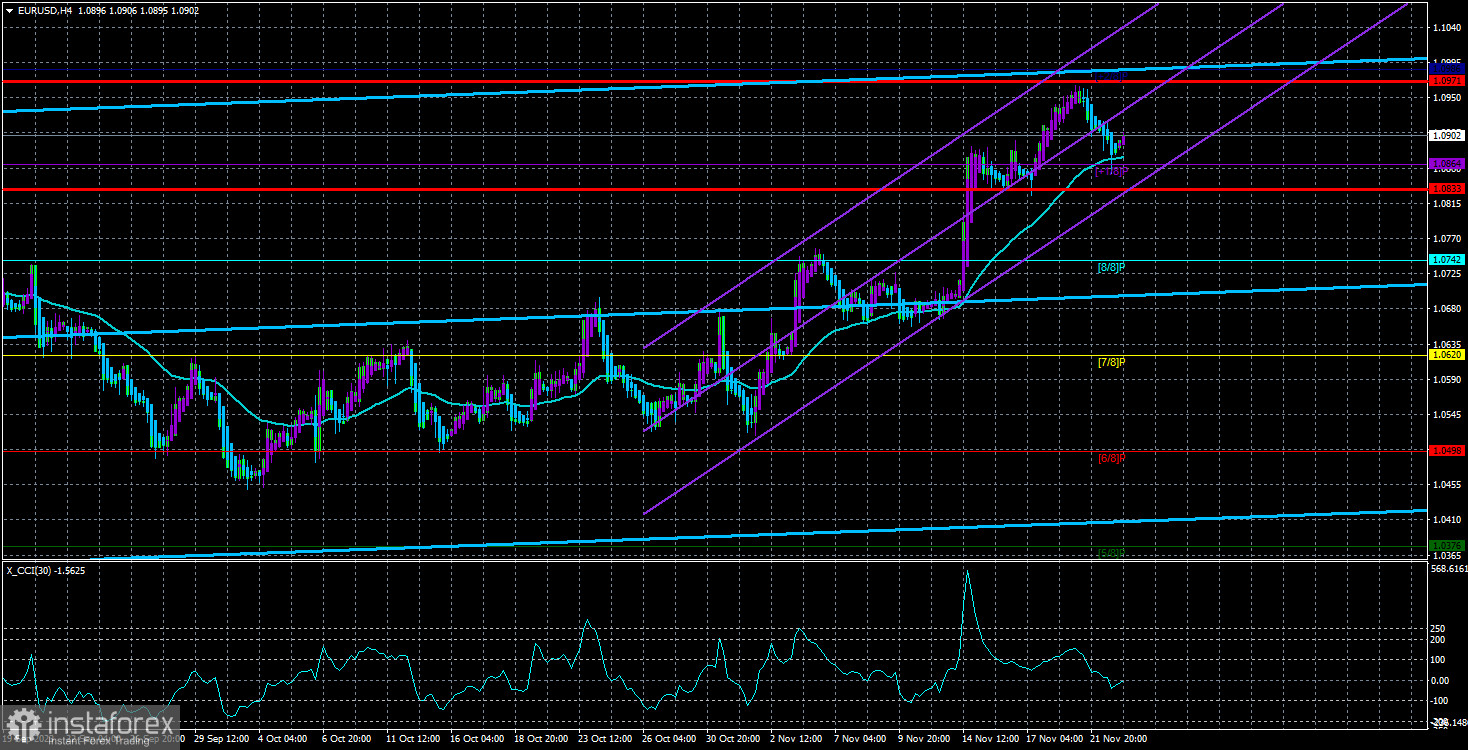

From a technical point of view, it is still more interesting. On the one hand, we have a trend on the 4-hour timeframe, and on the daily timeframe, the price has settled above the Ichimoku cloud. There is an obvious trend; why then think about selling? But, on the other hand, the CCI indicator has entered the overbought zone three times already, and there are no medium-term reasons for the growth of the European currency. What could the euro grow on further? The Fed is unlikely to consider reducing the rate soon. Only macroeconomic statistics from the United States can help the euro. If it declines occasionally, the European currency may continue to rise. But this is still only a corrective rise.

Why can the Fed decide on another tightening?

Yesterday, we talked about the next Fed protocol, which essentially did not contain any unknown information for the market. The only important message was, "The regulator is ready to resort to a new rate hike if necessary." However, at this time, the entire monetary policy committee is only "concerned about inflation" but is not ready to take radical measures. It is worth recalling that on November 1, when the last Fed meeting occurred, the last inflation report (according to which the CPI fell to 3.2%) was yet to be discovered. And if with inflation of 3.7%, the monetary policy committee of the Fed was not eager to raise the rate, then with inflation of 3.2%, it will not do this even more.

Thus, the Federal Reserve is now set for a long holding of the rate at its current value. During this time (2-3 quarters), another radical step may be possible if inflation does not start approaching 2%. The likelihood of another tightening is about 50% because the US economy is still strong, and economic activity is high. We believe that with such values, achieving the "cooling" of the economy and further slowing of inflation will be difficult. The market, however, does not believe in a rate hike in December and January, so the dollar currently has no advantages. Only the overbought status of the euro and the corrective nature of the current upward movement speak in favor of its growth.

However, as already mentioned, the euro also has a few trumps. Therefore, the pair may enter a long period of consolidation, which will continue until one of the central banks begins to hint at an impending rate cut.

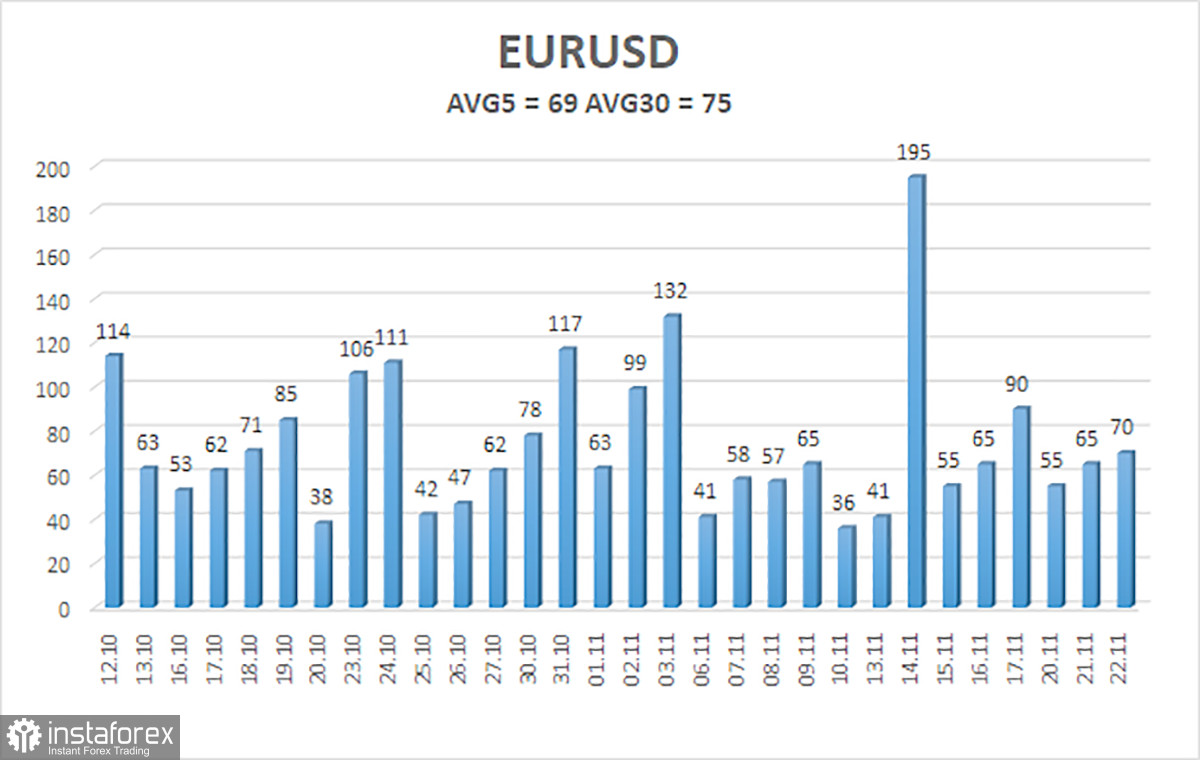

The average volatility of the euro/dollar currency pair for the last five trading days as of November 23 is 69 points and is characterized as "average." Thus, we expect movement between the levels of 1.0833 and 1.0971 on Thursday. The reversal of the Heiken Ashi indicator back upwards will indicate a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

Trading recommendations:

The EUR/USD pair continues a new upward movement phase and is above the moving average. At this time, one should consider buying, but we still strongly doubt that the pair's growth will continue, considering the triple overbought status of the CCI indicator. Based on the "bare" technique, open long positions with targets at 1.0971 and 1.0986 as the price bounced off the moving average. Sales of the euro will become relevant after the price consolidates below the moving average with targets at 1.0833 and 1.0742.

Explanations for the illustrations:

Linear Regression Channels – help determine the current trend. The trend is strong now if both are directed in the same direction.

Moving Average Line (settings 20.0, smoothed) – determines the short-term trend and direction in which it is currently advisable to trade.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the overbought zone (above -250) or oversold zone (below +250) indicates that a reversal of the trend in the opposite direction is approaching.