The EUR/USD currency pair continued its upward movement on Friday in a calm mode. It cannot be said that there was no reason for the new rise of the European currency, but the events and reports on Friday that were present in the calendar were not terrible enough for the dollar to continue its decline. However, this is nothing new: we are already accustomed to the fact that the dollar is falling again for various reasons or without any reason.

Let's briefly discuss what was interesting on Friday. Germany published the GDP for the third quarter in the final estimate. This estimate did not differ from forecasts, and the indicator amounted to -0.1% q/q. The S&P business activity indices for the services and manufacturing sectors were published in the United States. It is worth noting that these indicators in the United States are secondary, as there are similar ISM reports. But in any case, they were not the reason for the new decline of the US dollar.

The business activity index in the services sector increased from 50.6 to 50.8, with a lower forecast. The business activity index in the manufacturing sector decreased from 50.0 to 49.4 points with a higher forecast. Thus, one report was better, and the other was worse than traders' expectations. Accordingly, there were no reasons for a new decline in the American currency. Christine Lagarde spoke again on Friday but provided no important or interesting information.

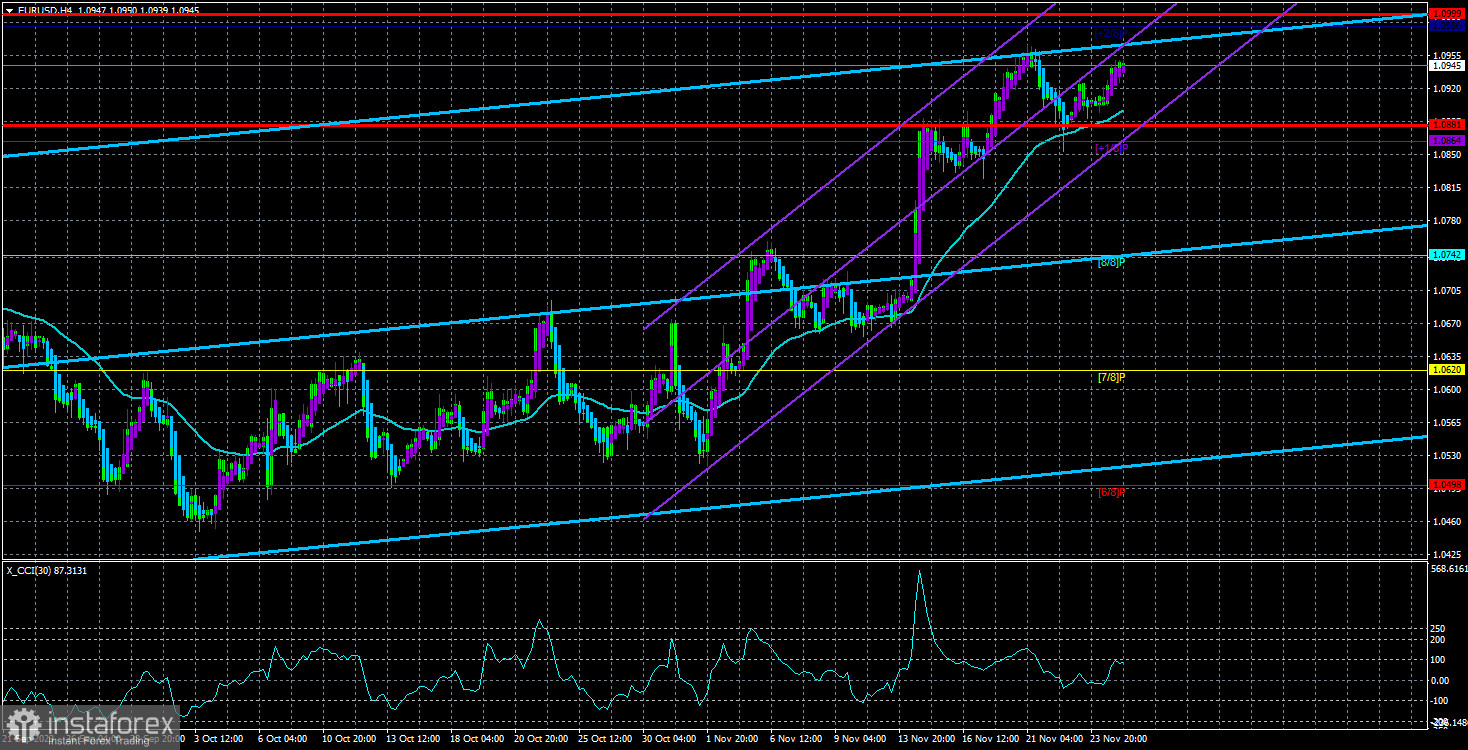

So, what do we have in summary? This week's price corrected toward the moving average line, bounced off it, and resumed its movement to the north. There were hardly any substantial reasons for such a movement. Yes, last week there was a significant drop in the important report on orders for long-term goods in the United States, but this is just one report in five days. Christine Lagarde again did not report anything important despite speaking several times. The oversold condition of the CCI indicator was discharged again, although the pair did not even move down a bit. In general, the movement remains as strange and illogical as ever. There were no substantial reasons for the euro to appreciate, just as there are none now. But this is the foreign exchange market. Major players may buy or sell a particular currency not for speculation or profit.

On Monday, there is only one significant event.

Monday began with the European currency rising slightly again. No significant events over the weekend could push the pair up. And during the Asian trading session, either. Therefore, we continue to insist on the inertial status of the current upward movement. Today, traders may only pay attention to Christine Lagarde's speech. Although the ECB head will speak before the European Parliament's Committee on Economic and Monetary Affairs, we are still determining if she will provide new and important information. It should be understood that Lagarde will only provide a report. She is unlikely to discuss the need for another rate hike or announce any other plans.

Thus, important information may be received today, but we remind you that all recent speeches by ECB representatives have confused the market more than clarified the situation. The European regulator has not raised the rate for several meetings, and we need clear signals about the upcoming new tightening. Therefore, the euro is growing based on something other than strengthening the ECB's position. The euro is growing despite everything and against all odds.

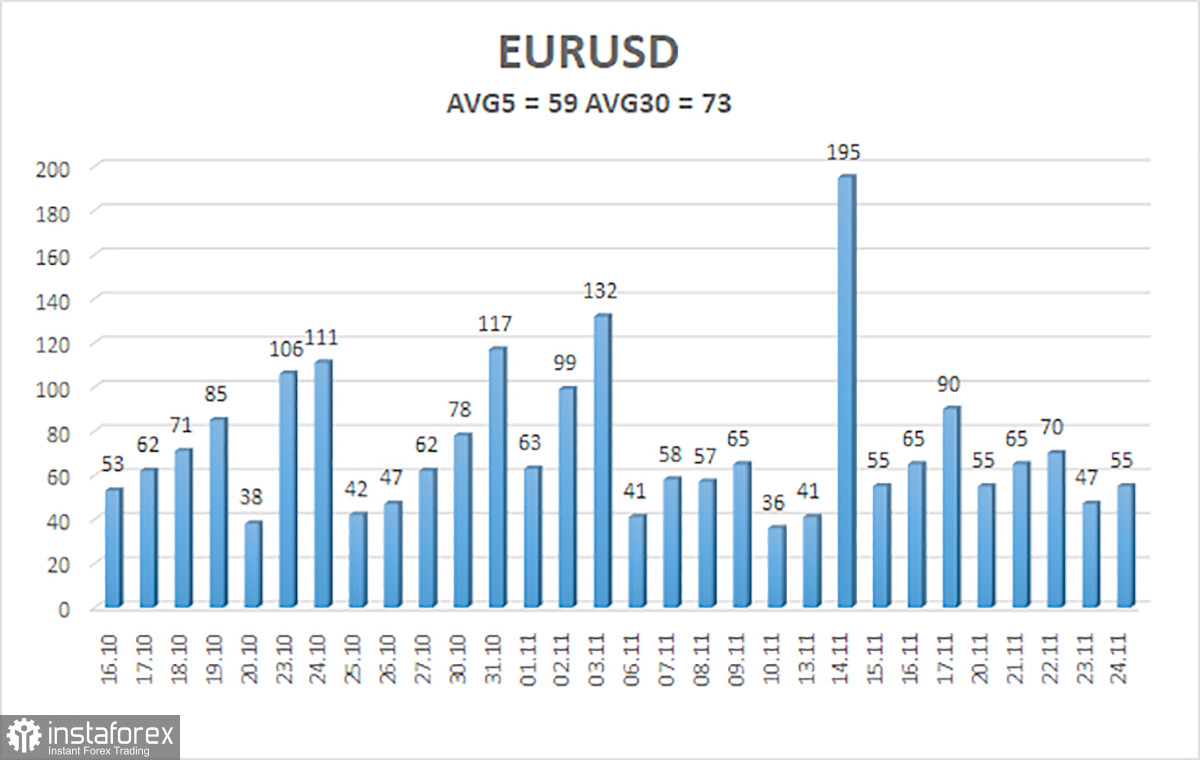

The average volatility of the euro/dollar currency pair for the last five trading days as of November 26 is 59 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0881 and 1.0999 on Monday. The reversal of the Heiken Ashi indicator back down will indicate a possible new phase of the downward correction.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

Trading recommendations:

The EUR/USD pair continues a new upward movement phase above the moving average. It is advisable to consider buying now, but we still need to be convinced that the pair's growth will continue, given the triple overbought condition of the CCI indicator and the lack of growth factors. Based on "bare" technicals, it is possible to remain in long positions with targets at 1.0973 and 1.0999, as the price has bounced off the moving average. Selling the euro will become relevant after the price consolidates below the moving average with a target of 1.0742.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.