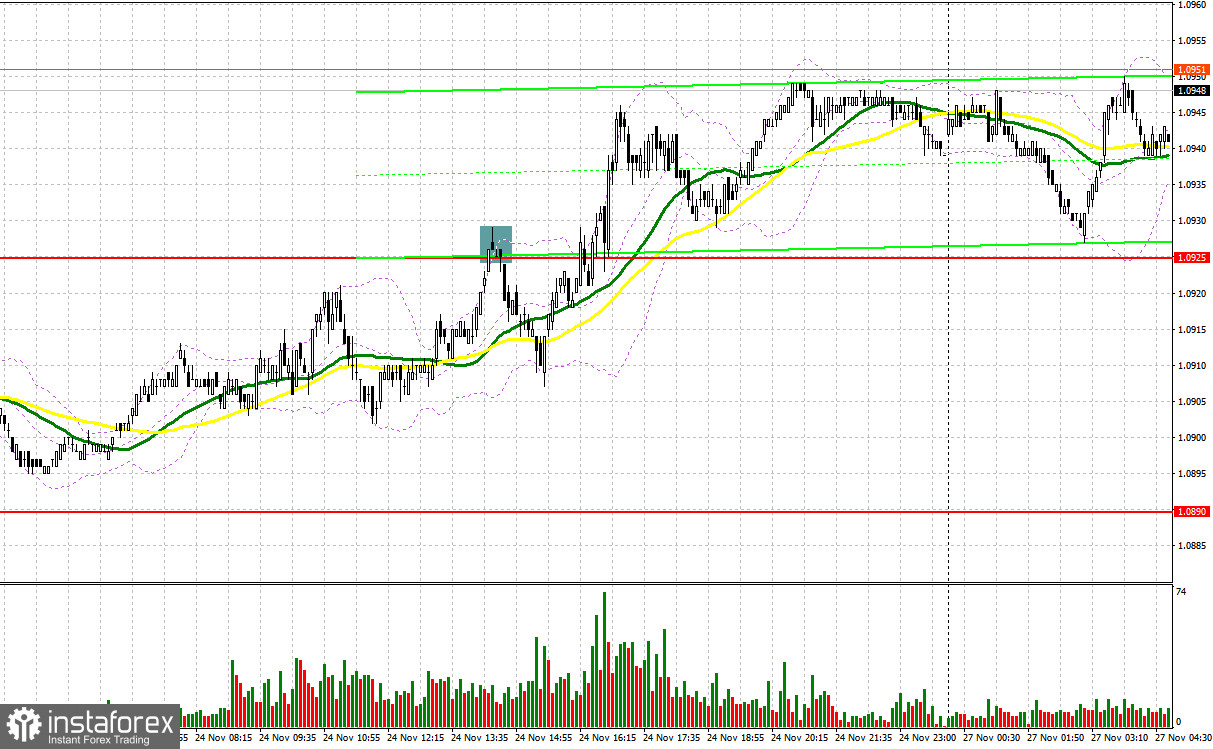

Last Friday, only one entry signal was generated. Let's look at the 5-minute chart and analyze what happened. Earlier, I asked traders to pay attention to 1.0925 and recommended making entry decisions based on it. The currency pair did rise, but it failed to test 1.0925 and form a false breakout there. This could be explained by extremely low market volatility. In the second half of the day, we saw a false breakout at 1.0925, which resulted in a sell signal and a slight decrease in the euro by 17 pips.

Conditions for opening long positions on EUR/USD:

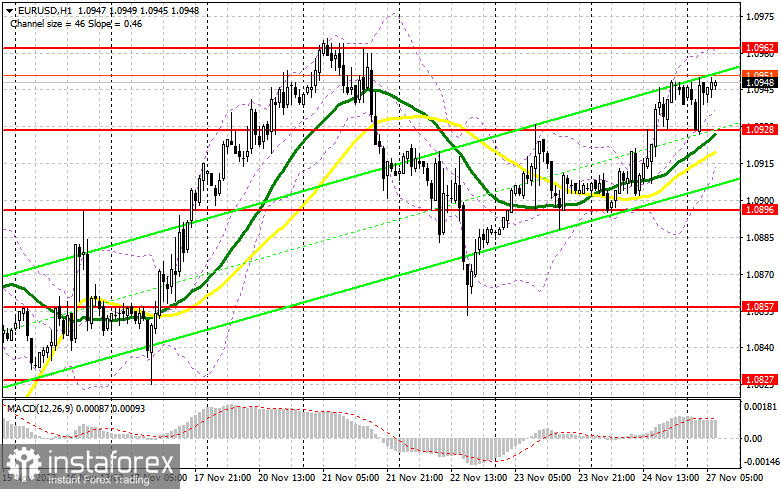

According to the data, the US manufacturing PMI dropped while the service PMI increased. Against the backdrop, traders continued selling the US dollar, thus boosting the euro in the second half of Friday. Today, apart from another speech by European Central Bank President Christine Lagarde, there is nothing else on the agenda. Therefore, her position on maintaining high interest rates could help the euro continue its upward trend. However, breaking above the monthly high will not be easy. It is best to enter the market on a decline after a false breakout of the 1.0928 level. This will confirm the presence of buyers in the market and provide a good entry point for long positions. In this case, the pair may rise and test its monthly high of 1.0962. A breakout and updating this range will provide another buy signal and a chance to reach a new high around 1.1004. The farthest target will be seen at 1.1033, where it is better to lock in profits. If the euro/dollar declines and bulls fail to be active near 1.0928 in the first half of the day, the pair may enter a sideways channel. In the event of this, traders could enter the market after a false breakout around the support level of 1.0896. I will consider opening long positions from 1.0857, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

Last Friday, sellers attempted to dominate, but the number of buyers jumped because of the euro's appealing prices amid weak US statistics. Today, bears could become active only after a false breakout around the monthly high of 1.0962. This will signal a sell-off in anticipation of another downward correction and a test of the 1.0928 support level. Below this level, the moving averages favor buyers. A breakthrough and settlement below this range, followed by an upward retest, should provide another sell signal with the target at 1.0896. The farthest target is located at the low of 1.0857, where it is better to lock in profits. Testing this level could significantly influence buyers' future prospects. If EUR/USD moves upwards during the European session and bears fail to be active at 1.0962, the bullish trend will continue, opening the path towards 1.1004. Here, traders may also go short only after an unsuccessful consolidation. It is possible to open short positions after a pullback from 1.1033, expecting a decline of 30–35 pips.

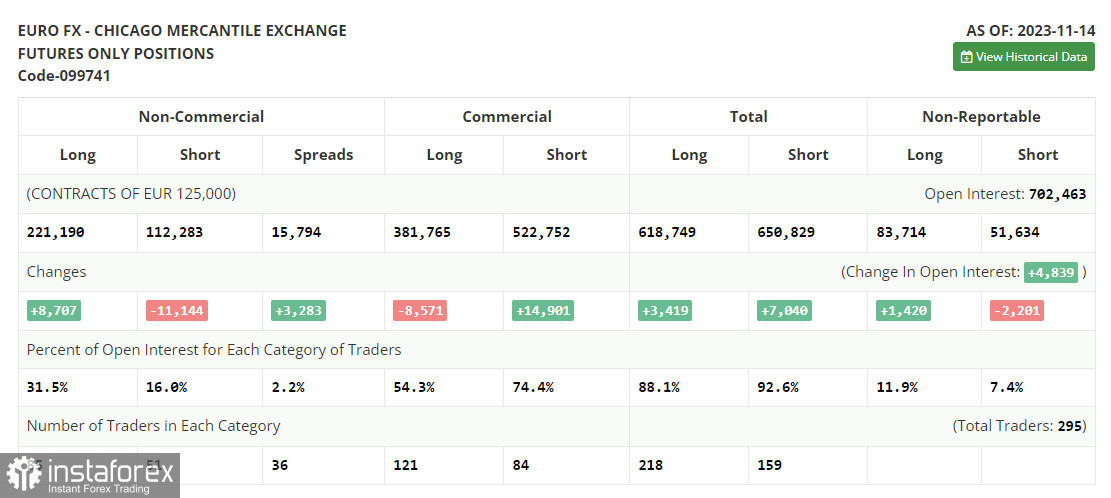

According to the COT report (Commitment of Traders) from November 14th, the number of long positions increased, whereas the number of short positions dropped. Notably, the recent inflation data clearly indicated that the US interest rate hikes in the current cycle are over, impacting the US dollar and reducing short positions on the euro, thus reviving its demand. The upcoming Federal Reserve's November meeting minutes are expected to clarify remaining questions, although it is evident that rates have peaked and are likely to decrease next year. The COT report revealed that non-commercial long positions increased by 8,707 to 221,190, while non-commercial short positions decreased by 11,144 to 112,283, widening the spread between long and short positions by 3,283. The closing price surged to 1.0902 from 1.0713.

Signals of indicators:

Moving Averages: Trading above the 30 and 50-day moving averages indicates a further rise in the euro. Note: The periods and prices of moving averages are considered by the author on the H1 hourly chart, differing from the classical daily moving averages on the D1 daily chart.

Bollinger Bands: In case of a decline, the lower band around 1.0928 will act as support.

Descriptions of indicators:

Moving average (a yellow line on the chart): identifies current trends by smoothing volatility and noise. Period: 50.Moving average (a green line on the chart): identifies current trends by smoothing volatility and noise. Period: 30.MACD Indicator (Moving Average Convergence/Divergence): Fast EMA: period 12. Slow EMA: period 26. SMA: period 9.Bollinger Bands: Period 20.Non-commercial traders: speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.Non-commercial long positions: the total long open position of non-commercial traders.Non-commercial short positions: the total number of short positions opened by non-commercial traders.Total non-commercial net position: the difference between the non-commercial traders' short and long positions.