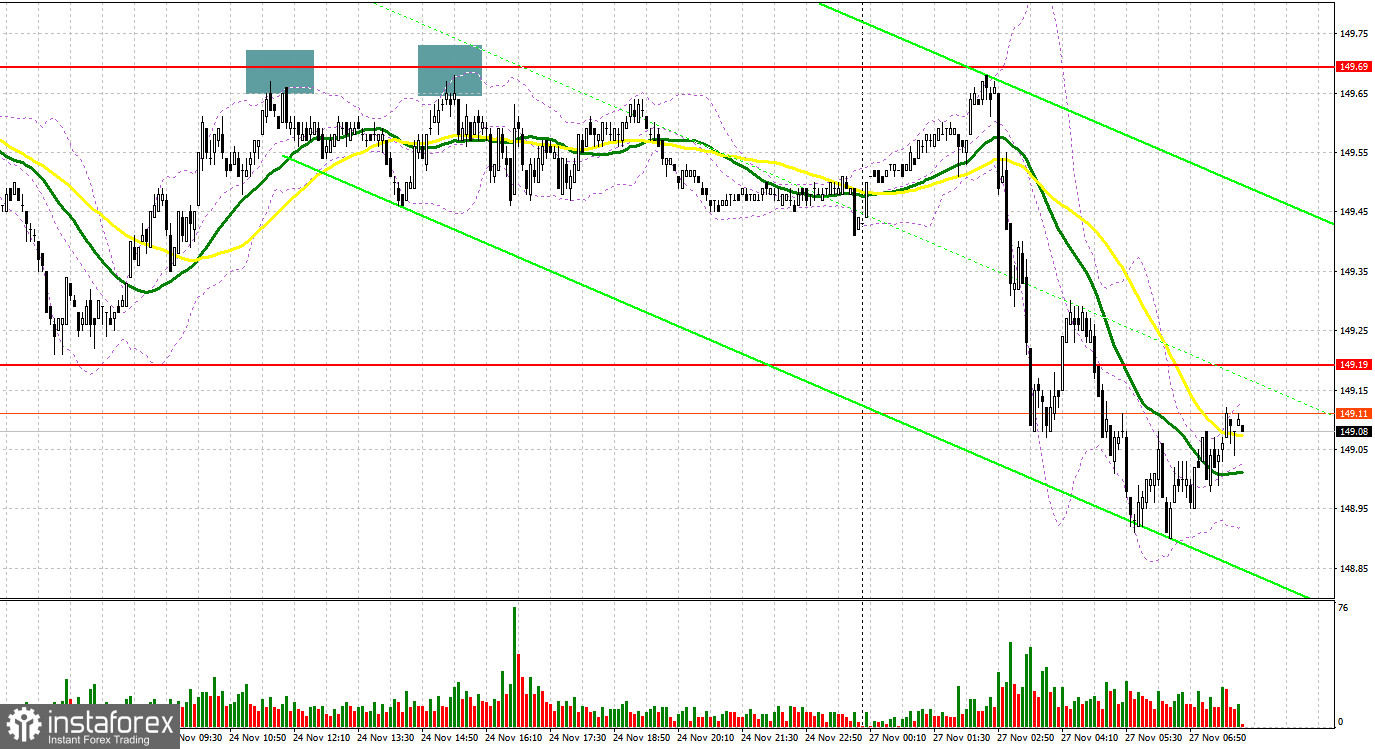

Several market entry signals were formed last Friday. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around the resistance level of 149.69 in the first and second halves of the day allowed for sell signals, resulting in a pair's drop by 25 points. However, the significant sell-off only occurred today during the Asian session.

To open long positions on USD/JPY, it is required:

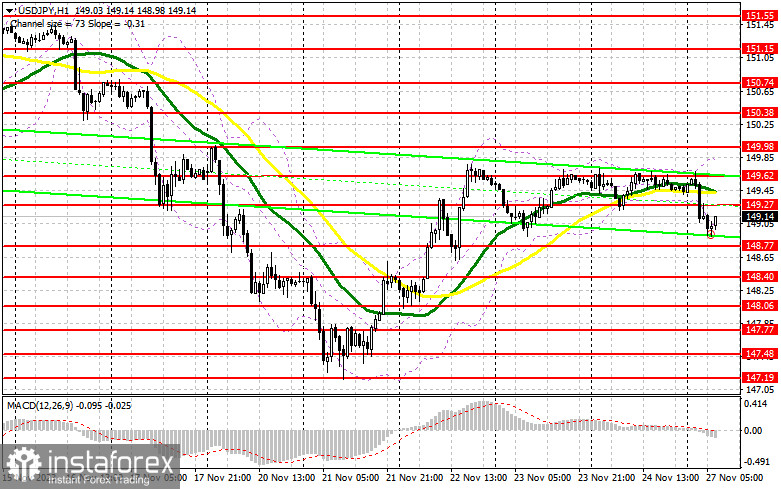

Buyers' failure to overcome the 149.70 resistance on Friday for the third attempt affected their positions, leading to a significant dollar sell-off. This would not have happened without the intervention of the Bank of Japan. The pair may continue to decline because weak data on US new home sales are expected today. Therefore, buying in the current conditions needs to be extremely cautious. A bounce and the formation of a false breakout around the new support of 148.77 will provide an entry point for long positions to recover and update the resistance of 149.27, formed today during the Asian session. Breaking and consolidating above this range will allow buyers to regain market control, signaling a buy at 149.62, where the moving averages are, favoring sellers. The ultimate target will be around 149.98, where profits will be taken. In the case of a pair's decline and no activity at 148.77 from buyers, bears will regain market control. In this case, I will postpone purchases until the minimum of 148.40 is tested. Only a false breakout there will signal long positions. I plan to buy USD/JPY immediately on a rebound only from 148.06, aiming for a correction within the day by 30-35 points.

To open short positions on USD/JPY, it is required:

Sellers have regained control, and now they need to develop their advantage. Given that the US dollar has been facing challenges lately, it is time to take advantage of it. It will be most convenient to sell the dollar after a rise and the formation of a false breakout around the new resistance of 149.27, just above the moving averages, favoring sellers. Only this will confirm the presence of large players in the market, strengthening pressure on the pair and providing a chance to break through and consolidate below 148.77 closer to the second half of the day. Taking control of this level and testing it from bottom to top will deal a more serious blow to the buyers' positions, triggering stop orders and opening the way to the minimum of 148.40. The more distant target will be around 148.06, where profits will be taken. With USD/JPY growth and no activity at 149.27, buyers will return the pair to a sideways channel, stopping the approaching bearish market. In this case, I will postpone sales until a false breakout at 149.62. In the absence of downward movement there, I will sell USD/JPY immediately on a rebound from 149.98, but only with the expectation of a pair's correction down by 30-35 points within the day.

Indicator signals:

Moving Averages

Trading is carried out below the 30 and 50-day moving averages, indicating the likelihood of a dollar decline.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In the case of a decline, the lower boundary of the indicator, around 149.01, will act as support.

Indicator Descriptions:

- Moving Average (MA) (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (MA) (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- Moving Average Convergence/Divergence (MACD) Indicator (Fast EMA period 12, Slow EMA period 26, SMA period 9).

- Bollinger Bands Indicator (period 20).

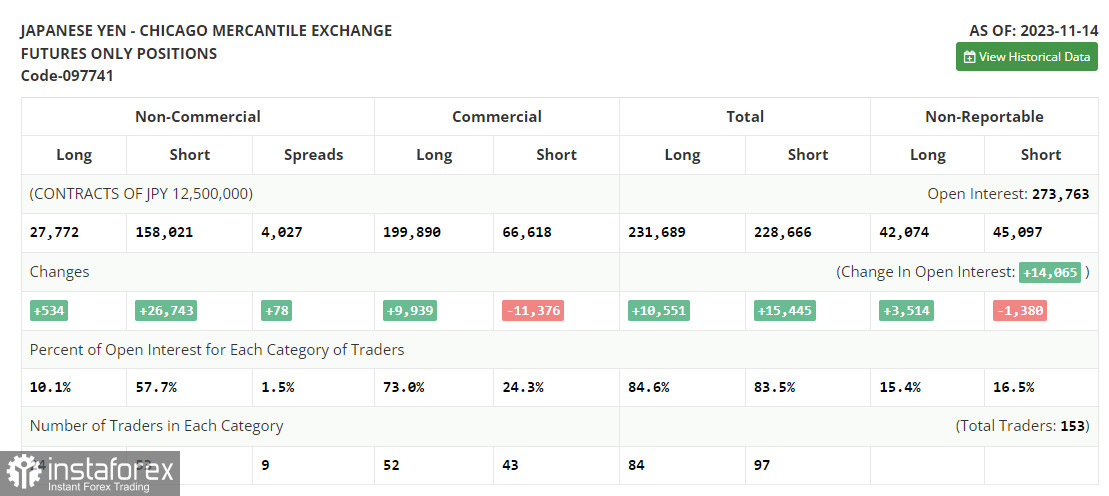

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.