Last week, gold surpassed the $2,000 per ounce mark several times. Today, gold opened above this level and continues to rise.

The weekly gold survey indicates that retail investors remain as optimistic as before, with the majority of analysts joining their outlook. However, a significant minority maintains a neutral stance.

According to Mark Leibovit, publisher of the VR Metals/Resource Letter, the only risk lies in the potential resumption of a broad market sell-off, which could trigger metal sales as the need for fundraising is put on hold due to the planned year-end stock rally. Leibovit predicts new historical highs for gold in 2024.

Sean Lusk, co-director of commercial hedging at Walsh Trading, believes that markets are mistaken if they think a rate cut is imminent. Nevertheless, he anticipates gold will continue to rise as the market has adapted to the current rates, and the Federal Reserve is aware of it. He sees strong resistance around $2,060. Lusk also believes that precious metals will rise alongside energy prices and seasonal support.

Frank McGhee, head precious metals dealer at Alliance Financial, thinks gold is overbought, and markets are misjudging several crucial factors. In his view, seasonal factors that usually support gold prices this time of year play a lesser role now, as geopolitics currently dominates.

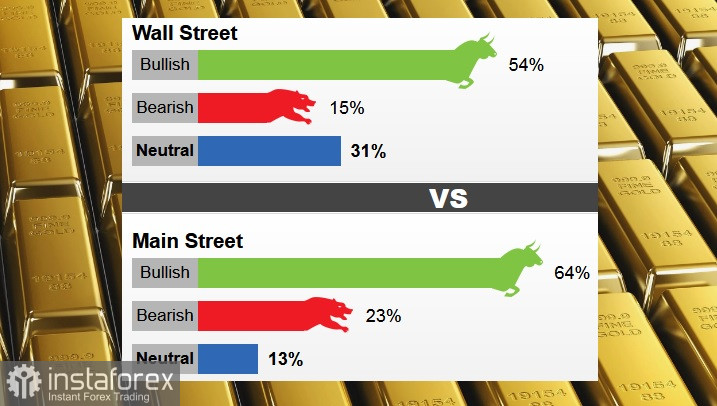

This week, 13 Wall Street analysts participated in a gold survey. Seven of them, or 54%, anticipate price growth this week, two analysts, representing 15%, predict a decline, and four, or 31%, are neutral.

In an online poll with 672 votes, market participants were as optimistic as in the previous week's survey. 431 retail investors, or 64%, expect price growth, 156 investors, or 23%, anticipate a decline, and 85 people, or 13%, are neutral.

Following the shortened Thanksgiving week, the current week will return to normal for data publication and market activity. On Monday, data on new home sales will be released; Consumer confidence index on Tuesday; U.S. GDP data for the third quarter on Wednesday; Personal income and spending for October on Thursday; and ISM Manufacturing PMI for November on Friday.