The first growth in business activity in the service sector and the composite purchasing managers' index for the UK in the last four months, rising above the psychologically important 50 mark, added fuel to the GBP/USD rally. Previously, investors bet that the UK economy could not avoid a recession, and the pair rose solely due to the weakness of the U.S. dollar. Now, the pound has its own trump cards.

Before the release of the November UK PMI data, the upward movement in GBP/USD was based on an improvement in global risk appetite and expectations of an earlier start to the tightening cycle of the Federal Reserve compared to the Bank of England. While U.S. stock indices have been rising for four consecutive weeks and are ready to end the last month of autumn with the best result since November 2020, safe-haven assets, primarily the U.S. dollar, are under pressure.

At the same time, the futures market predicted the first act of the Federal Reserve's monetary expansion in May and the Bank of England's in June of the next year. Derivatives signaled that the federal funds rate would decrease by 100 basis points to 4.5% in 2024, and the repo rate would also fall by 75 basis points to 4.5%. After the release of strong business activity statistics for the UK in November, there is talk of a sharp increase in borrowing costs by 60 basis points. In other words, instead of three acts of monetary easing, investors are counting on two. And this process can only begin in September. It's no wonder that GBP/USD shot up.

Dynamics of market expectations for the Bank of England repo rate

Considering the different pace of the expected monetary expansions of the Federal Reserve and the Bank of England and the improvement in global risk appetite, the GBP/USD rally has excellent chances of continuation. Perhaps the main risk for the bulls is the potential hawkish rhetoric of both central banks. Although U.S. and British inflation is slowing down, they are still above the 2% targets. Therefore, both the Federal Reserve and the BoE intend to keep rates on hold for a long time to see how events unfold.

The markets are tuned to a different scenario. They expect a reduction in borrowing costs, which fuels stock indices, improves global risk appetite, and creates a tailwind for GBP/USD. However, if the U.S. economy suddenly stops cooling down, and inflation rises, the situation will turn upside down. During the current cycle of monetary restriction, investors have already gone against the Federal Reserve six times. And each time, they got burned. Will they succeed in imposing their will on the central bank the seventh time?

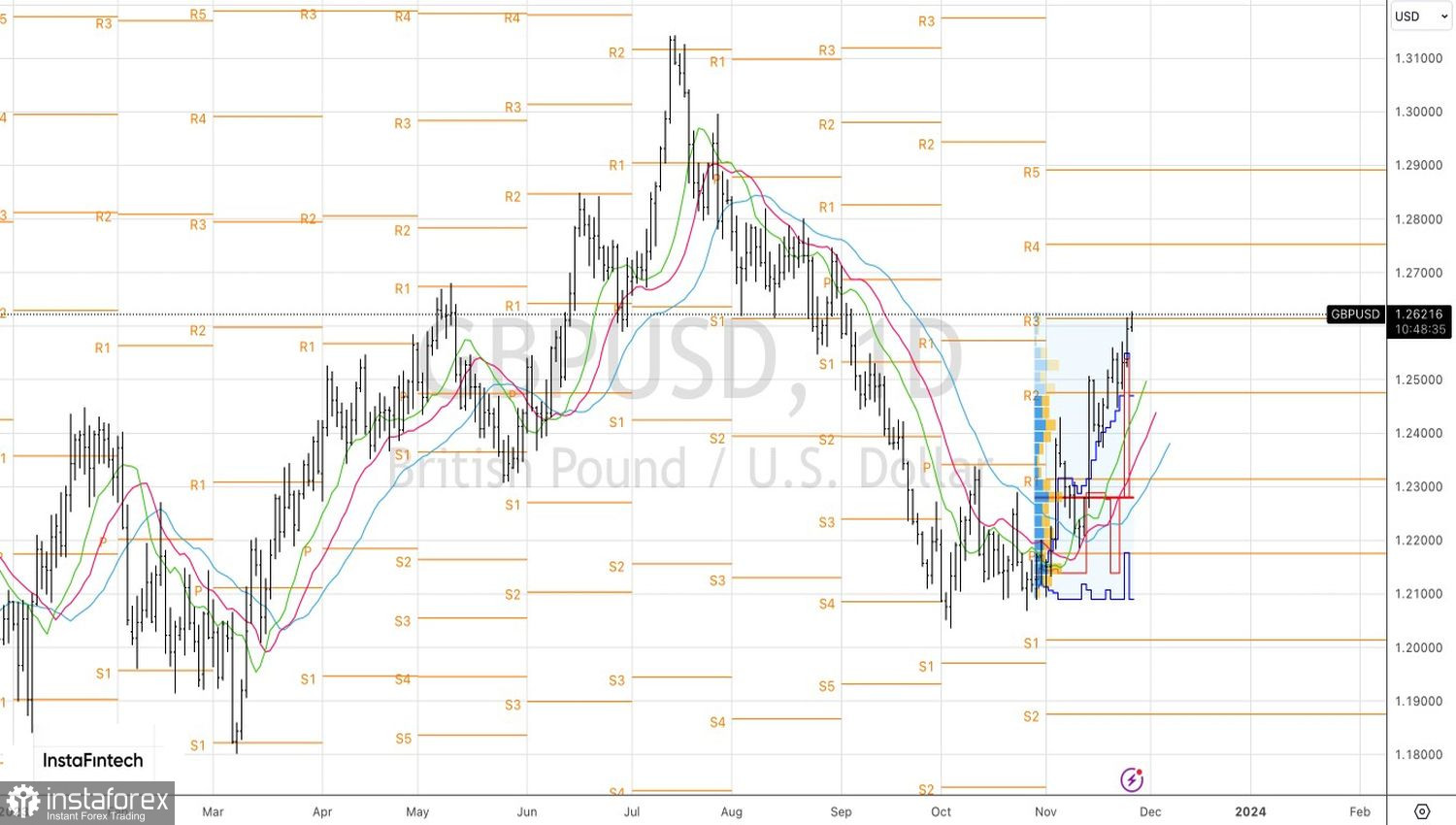

Technically, on the daily chart, there is no doubt about the strength of the upward movement in GBP/USD. Quotes are increasingly moving away from moving averages, indicating that the bulls are gaining strength. If they manage to establish themselves above the pivot level of 1.2615, the pound rally against the U.S. dollar is likely to continue towards 1.275 and 1.29. The recommendation is to buy.