Market remained stagnant over an empty macroeconomic calendar. The small-scale fluctuations did not lead to any significant changes, especially since the day ended at the same values as it began.

Today, housing price data in the US will come out, and it will likely prompt a further weakening in dollar as the growth rate may slow down from 5.6% to 5.3%. That indicates a gradual easing of inflation, which will consequently convince investors that the Fed will soon begin to loosen its monetary policy.

EUR/USD returned to the local high. A stabilization of the price above 1.0950 will lead to a further rise towards 1.1000-1.1050.

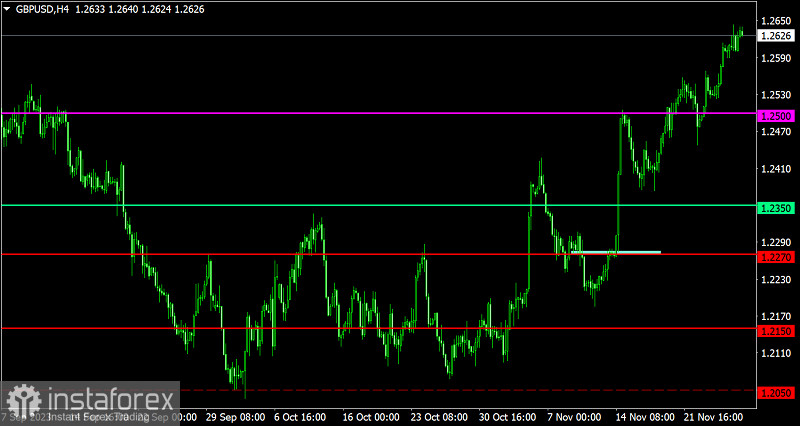

GBP/USD shows a similar picture. A further rise will bring the pair to 1.2700. However, indicators point to pound becoming overbought, so the volume of long positions may be affected.