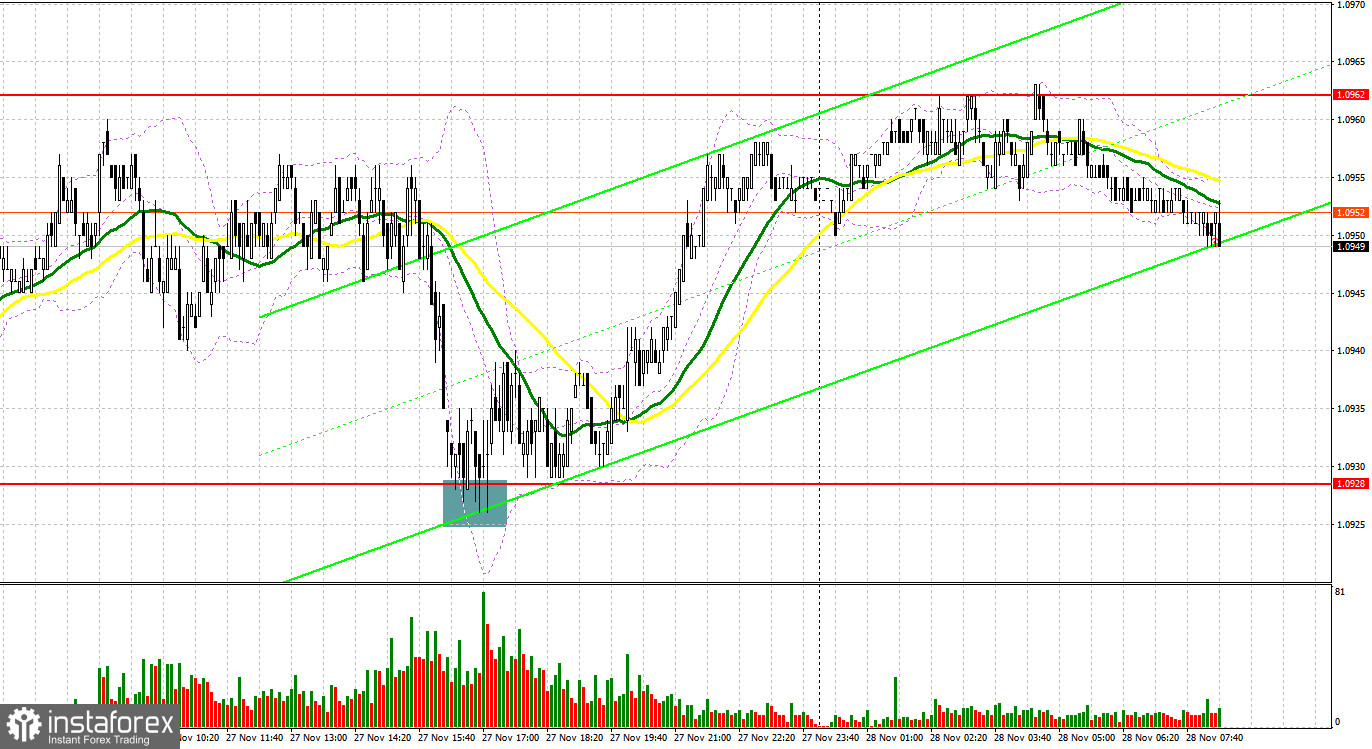

Yesterday, there was only one signal for market entry. Let's take a look at the 5-minute chart and discuss what happened. In my previous forecast, I focused on the level of 1.0962 and recommended making market entry decisions based on it. The price actually went up, but it did not test and did not make a false breakout at 1.0962. The reason for this was low market volatility. In the second half of the day, a decrease and defense of the support at 1.0928 led to an excellent entry point for buying euros. As a result, EUR/USD made an upward movement of 25 pips.

What is needed to open long positions on EUR/USD

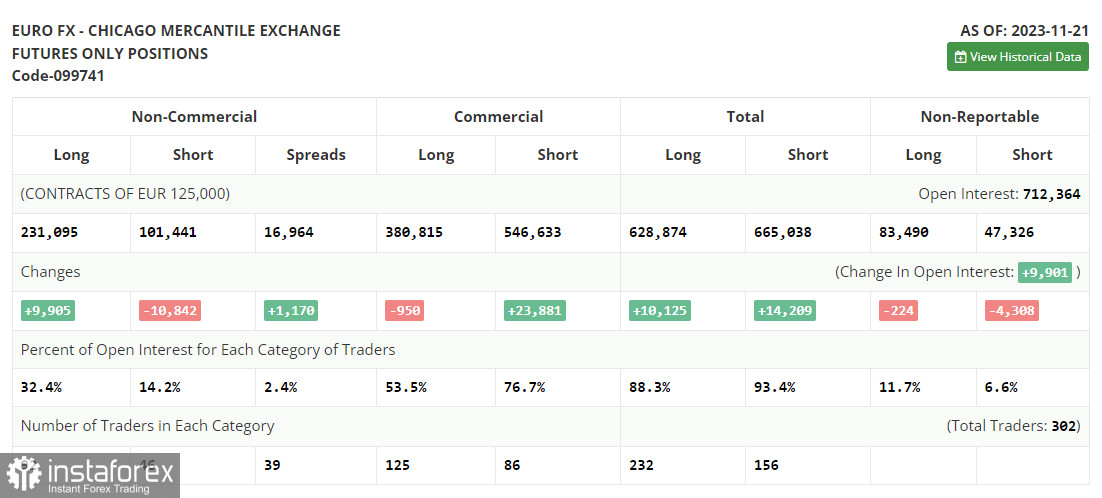

Before discussing the outlook for EUR/USD, let's see what happened in the futures market and how the Commitment of Traders positions changed. In the COT report (Commitment of Traders) for November 21, there was an increase in long positions and another significant decline in short positions. Statements by ECB policymakers and their commitment to high interest rates encouraged traders to add long positions on EUR/USD last week. Besides, a series of PMI reports also demonstrated a slight recovery in some eurozone countries, leaving a chance to avoid a recession in Q4 of this year. The minutes of the Federal Reserve's November meeting slightly dampened the zeal of the buyers of risky assets but did not particularly affect the development of the bullish trend. Soon, a lot of important fundamental statistics on inflation and consumer confidence will be released, which will definitely affect the market direction. The COT report indicated that long non-commercial positions grew by 9,905 to 231,095, while short non-commercial positions decreased by 10,842 to 101,441. As a result, the spread between long and short positions increased by 1,170. EUR/USD closed on Friday higher at 1.0927 compared to 1.0902 a week ago.

What is needed to open short positions on EUR/USD

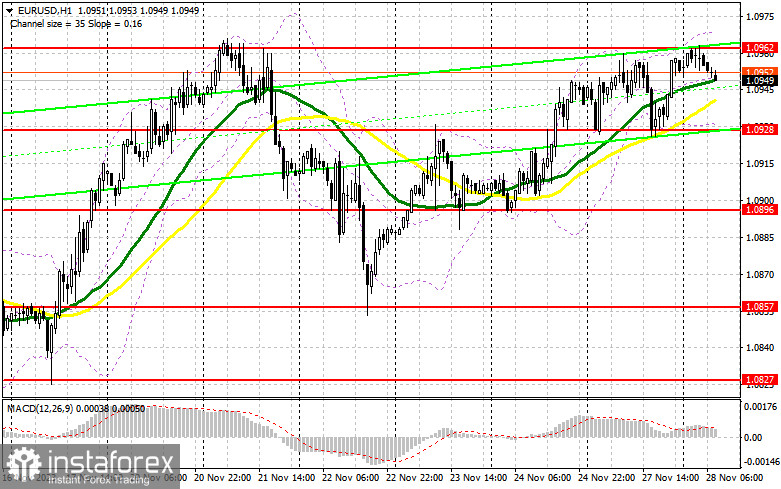

Yesterday, the sellers did not allow the price to exceed 1.0962, maintaining their chances of building a larger downward correction. In case of a positive reaction to the eurozone's statistics, I expect the bears to show up only after a false breakout around a one-month high of 1.0962, which would produce a sell signal in anticipation of another downward correction and a test of the support at 1.0928, just above which the moving averages are passing, favoring the buyers. After breaking and securing below this range, as well as after a reverse test from bottom to top, I anticipate receiving another sell signal targeting 1.0896. The lowest target will be the minimum of 1.0857, where I will fix profits. Testing this level could significantly impact the future prospects of the buyers. In case of an upward movement of EUR/USD during the European session amidst hawkish comments from ECB representatives, and in the absence of the bears at 1.0962, the bullish market will develop further. This will open the way for the buyers to the high of 1.1004. There, selling is also possible but only after a failed consolidation. I will open short positions immediately on a rebound from 1.1033 aiming for a downward correction of 30-35 pips.

Regarding the first half of the day, Germany's forward-looking consumer sentiment index is due today, which could negatively impact the growth of the European currency, as well as a series of data on changes in the eurozone's M3 money supply aggregate and private sector lending volume. However, the speeches by ECB President Christine Lagarde and ECB Board members Joachim Nagel and Philip Lane deserve much more attention. Yesterday's tone of the policymakers limited the upward potential, so let's see what happens today. I will act, as yesterday, on a decline in EUR/USD after a false breakout at 1.0928, which has proven itself well. This will allow us to reconfirm the presence of buyers in the market and provide a good entry point for long positions in anticipation of the instrument's growth and a test of a one-month high of 1.0962. A breakout and update from top to bottom of this area will give another signal for buying and a chance to update the high around 1.1004. The highest target will be the area of 1.1033, where I will fix profits. In the scenario of a decrease in EUR/USD and the absence of activity at 1.0928 in the second half of the day, the instrument will remain trading sideways. In such a case, it will be possible to enter the market after forming a false breakout around the support area of 1.0896. I will open long positions immediately on a dip from 1.0857, bearing in mind an upward correction of 30-35 pips within the day.

Indicators' signals

Moving averages

The instrument is trading above the 30 and 50-day moving averages. It indicates further growth in EUR/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD goes down, the indicator's lower border at about 1.0928 will act as support. In case the instrument trades higher, the indicator's upper border at 1.0965 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.