Analysis of transactions and tips for trading USD/JPY

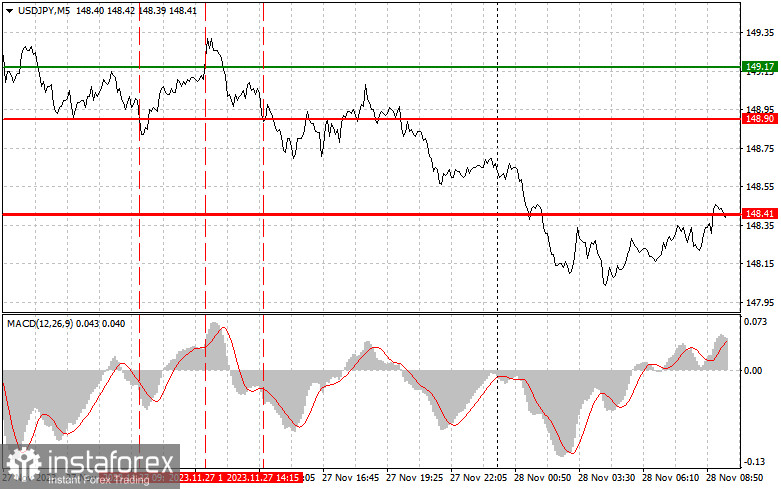

Further decline became limited because the test of 148.90 took place when the MACD line moved downward quite sharply from zero. A similar test occurred in the afternoon.

The core consumer price index surprisingly showed a slowdown, bringing back pressure on yen. This led to a spike in USD/JPY, which may continue after the release of a strong report on US consumer confidence. However, economists expect a decline in the indicator, so the lack of bullish activity at the local low will quickly return the pressure on the pair. Statements from FOMC members Lael Brainard and Christopher Waller will also affect market sentiment.

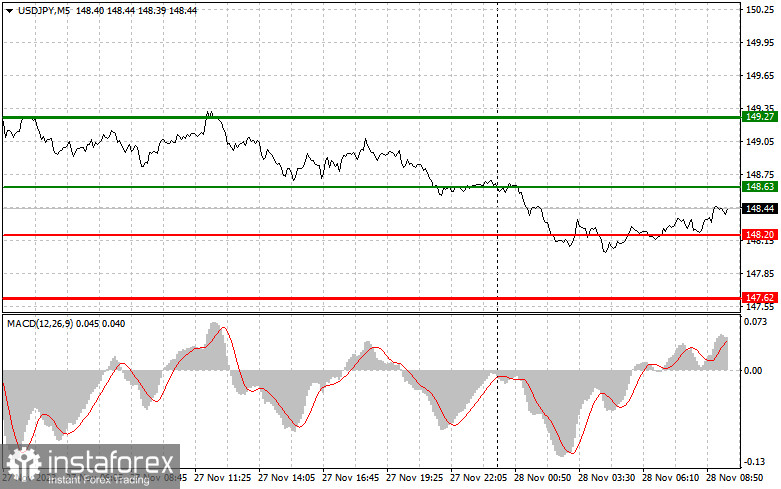

For long positions:

Buy when the price hits 148.63 (green line on the chart) and take profit at 149.27. Growth will occur after strong data from the US and hawkish positions from Fed representatives. However, when buying, ensure that the MACD line lies above zero or rises from it.

Also consider buying USD/JPY after two consecutive price tests of 148.20, but the MACD line should be in the oversold area as only by that will the market reverse to 148.63 and 149.27.

For short positions:

Sell when the price reaches 148.20 (red line on the chart) and take profit at 147.62. Pressure will increase in the case of unsuccessful consolidation around the local high. However, when selling, ensure that the MACD line lies below zero or drops down from it.

Also consider selling USD/JPY after two consecutive price tests of 148.63, but the MACD line should be in the overbought area as only by that will the market reverse to 148.20 and 147.62.

What's on the chart:

Thin green line - entry price at which you can buy USD/JPY

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell USD/JPY

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.